filmov

tv

How to perform a Discounted Cash Flow Model Step by Step! (Intrinsic Value for Beginners)

Показать описание

Get 50% off of Seeking Alpha Premium!

In this video, I take you step by step on how to perform a discounted cash flow analysis. Let me know if you have any questions in the comments below!

Terminal Value formula: =J14*(1+K18)/(K19-K18)

I am not a Financial advisor or licensed professional. Nothing I say or produce on YouTube, or anywhere else, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk. Some of the links in the description may be affiliate links.

How to perform a Discounted Cash Flow Model Step by Step! (Intrinsic Value for Beginners)

How to Make a Cheap Camera Cinematic

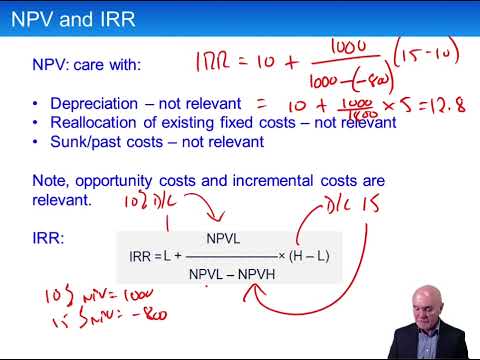

Discounted Cash Flow Techniques - ACCA Advanced Performance Management (APM)

“I’ve never seen Warren do discounted cashflows!” Warren & Charlie on Applying Huge Margin of Sa...

How To Make Cheap Speakers Sound Unbelievable.

How Much Is Microsoft Stock Really Worth? | Microsoft Stock Discounted Cash Flow Valuation | MSFT

5 Cheap Performance Mods!

DIY HOW TO Make Distilled Water at Home (Cheap, Quick & Easy) #shorts

How to make a door closer from cheap materials! #shorts

Make Your CHEAP Guitar Play Like a MILLION Bucks!

Cheap Mods That Make a BIG Difference!

A Discounted Cash Flow Valuation of Amazon Stock | #amznstock #amzn #amazonstock #growthstockstobuy

Discounted Cash Flow Techniques - ACCA Advanced Performance Management (APM)

25 Bill HACKS that Make Life CHEAP

Cheap cars that will make you look rich...#shorts #car #automobile #youtube #porsche

Bilbo Baggins Do not take me for a conjurer of cheap tricks #shorts

How To Make a Cheap Fog Machine 10 Times More Powerful

How To Make Your Cheap Drum-Set Sound Amazing

How to make CHEAP bandit signs : Real Estate Wholesaling

HOW to MAKE the SMALLEST ROBLOX AVATAR *CHEAP* 2024

There is only one king of cheap performance cars…

EZ and cheap mod to make your spacebar less hollow

How to Make Easy and Cheap Trellis

this is so cheap to make! (Halloween DIY) #halloween #diy #halloweendecorations

Комментарии

0:12:22

0:12:22

0:05:17

0:05:17

0:11:46

0:11:46

0:01:00

0:01:00

0:14:06

0:14:06

0:09:17

0:09:17

0:06:33

0:06:33

0:00:53

0:00:53

0:00:45

0:00:45

0:23:08

0:23:08

0:00:57

0:00:57

0:00:46

0:00:46

0:11:39

0:11:39

0:13:11

0:13:11

0:00:14

0:00:14

0:00:13

0:00:13

0:12:47

0:12:47

0:14:22

0:14:22

0:01:23

0:01:23

0:00:32

0:00:32

0:00:52

0:00:52

0:00:54

0:00:54

0:04:03

0:04:03

0:01:00

0:01:00