filmov

tv

Buying vs. Leasing a Car (Pros and Cons)

Показать описание

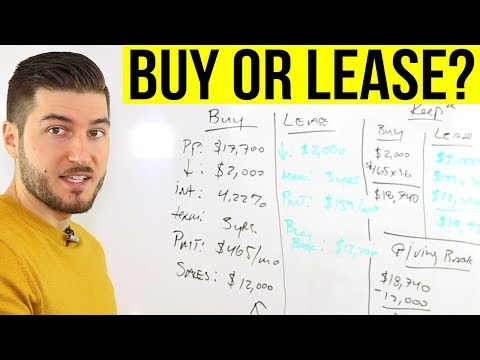

In this video I discuss whether you should buy or lease a car. So which is the better option? The truth is that there are two aspects to this decision.

There is the mathematical decision, and the personal situation decision. Some people like to drive new cars every three years, so they think it's better to lease a car. Some people like to drive cars longer than those three years and take care of their vehicle, so buying a car may be a better option for them.

Leasing a car is generally better if you're the type of person who likes new cars every three years. There are pros and cons to leasing a car vs buying a car. Some of those Pros is that you know you'll have a modern vehicle with all the updated amenities. However there are also some restrictions when leasing a car that you should be aware of.

Buying a car is generally the better option if you were someone who likes to hold on to their vehicles and likes the repair and work on them yourself. if you hold on to your vehicles for five or more years, it usually makes all the sense in the world to buy it and drive it into the ground. The person who owns their car can also sell their car at the end of ownership allowing them to recover some value of the vehicle. You can't do this if you lease your car.

Watch the entire video to find out if you should buy or lease your car!

Sources:

It was easiest to use the numbers from the Khan Academy video below because there are SO many different situations when it comes to Buying vs. Leasing a car that CANNOT be covered in one video. There are so many different makes, models, and manufacturer incentives that change over time. I decided to stick to a general overview for this video, along with my personal opinion at the end. For the original numbers please see the link below. Thanks again for watching! :)

WBF UNIVERSITY - JOIN MY SCHOOL HERE

LIMITED TIME - Get 1 FREE STOCK ON ROBINHOOD

FUNDRISE - INVEST IN REAL ESTATE FOR ONLY $500

M1 FINANCE - INVEST FOR FREE (Yes, Really)

My FREE M1 Finance Training Video

My FREE Stock Market For Beginners Guide

GET MY HOME AFFORDABILITY SPREADSHEET HERE

SCHEDULE A COACHING CALL WITH ME

HOW TO BUY & STORE BITCOIN

THE BEST CREDIT CARDS TO USE RIGHT NOW

CHECK OUT MY BLOG:

FOLLOW ME ON INSTAGRAM

Instrumental Produced By Chuki:

ABOUT ME 👇

My mission is to provide my viewers with actionable content that enables them to create financial wealth. My videos are a reflection of my real-world experience as a real estate investor, stock market investor, student of finance, and entrepreneur.

This channel allows me to share my passion for personal finance, stock market investing, real estate investing, and entrepreneurship. I produce content that I would want to watch, and because of that, I give 100% effort in every video that I make. I also believe in complete transparency and open communication with my audience.

Subscribe if you are interested in:

#Investing

#PersonalFinance

#Entrepreneurship

#StockMarket

DISCLAIMER: I am not a financial adviser. These videos are for educational purposes only. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. It is imperative that you conduct your own research. I am merely sharing my opinion with no guarantee of gains or losses on investments.

AFFILIATE DISCLOSURE: Some of the links on this channel are affiliate links, meaning, at NO additional cost to you, I may earn a commission if you click through and make a purchase and/or subscribe. However, this does not impact my opinion.

There is the mathematical decision, and the personal situation decision. Some people like to drive new cars every three years, so they think it's better to lease a car. Some people like to drive cars longer than those three years and take care of their vehicle, so buying a car may be a better option for them.

Leasing a car is generally better if you're the type of person who likes new cars every three years. There are pros and cons to leasing a car vs buying a car. Some of those Pros is that you know you'll have a modern vehicle with all the updated amenities. However there are also some restrictions when leasing a car that you should be aware of.

Buying a car is generally the better option if you were someone who likes to hold on to their vehicles and likes the repair and work on them yourself. if you hold on to your vehicles for five or more years, it usually makes all the sense in the world to buy it and drive it into the ground. The person who owns their car can also sell their car at the end of ownership allowing them to recover some value of the vehicle. You can't do this if you lease your car.

Watch the entire video to find out if you should buy or lease your car!

Sources:

It was easiest to use the numbers from the Khan Academy video below because there are SO many different situations when it comes to Buying vs. Leasing a car that CANNOT be covered in one video. There are so many different makes, models, and manufacturer incentives that change over time. I decided to stick to a general overview for this video, along with my personal opinion at the end. For the original numbers please see the link below. Thanks again for watching! :)

WBF UNIVERSITY - JOIN MY SCHOOL HERE

LIMITED TIME - Get 1 FREE STOCK ON ROBINHOOD

FUNDRISE - INVEST IN REAL ESTATE FOR ONLY $500

M1 FINANCE - INVEST FOR FREE (Yes, Really)

My FREE M1 Finance Training Video

My FREE Stock Market For Beginners Guide

GET MY HOME AFFORDABILITY SPREADSHEET HERE

SCHEDULE A COACHING CALL WITH ME

HOW TO BUY & STORE BITCOIN

THE BEST CREDIT CARDS TO USE RIGHT NOW

CHECK OUT MY BLOG:

FOLLOW ME ON INSTAGRAM

Instrumental Produced By Chuki:

ABOUT ME 👇

My mission is to provide my viewers with actionable content that enables them to create financial wealth. My videos are a reflection of my real-world experience as a real estate investor, stock market investor, student of finance, and entrepreneur.

This channel allows me to share my passion for personal finance, stock market investing, real estate investing, and entrepreneurship. I produce content that I would want to watch, and because of that, I give 100% effort in every video that I make. I also believe in complete transparency and open communication with my audience.

Subscribe if you are interested in:

#Investing

#PersonalFinance

#Entrepreneurship

#StockMarket

DISCLAIMER: I am not a financial adviser. These videos are for educational purposes only. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. It is imperative that you conduct your own research. I am merely sharing my opinion with no guarantee of gains or losses on investments.

AFFILIATE DISCLOSURE: Some of the links on this channel are affiliate links, meaning, at NO additional cost to you, I may earn a commission if you click through and make a purchase and/or subscribe. However, this does not impact my opinion.

Комментарии

0:14:15

0:14:15

0:05:51

0:05:51

0:12:48

0:12:48

0:12:32

0:12:32

0:14:24

0:14:24

0:12:53

0:12:53

0:11:34

0:11:34

0:09:00

0:09:00

0:12:12

0:12:12

0:08:32

0:08:32

0:02:42

0:02:42

0:08:59

0:08:59

0:08:23

0:08:23

0:07:22

0:07:22

0:09:27

0:09:27

0:05:44

0:05:44

0:17:30

0:17:30

0:06:59

0:06:59

0:10:18

0:10:18

0:15:23

0:15:23

0:12:14

0:12:14

0:10:00

0:10:00

0:12:58

0:12:58

0:10:53

0:10:53