filmov

tv

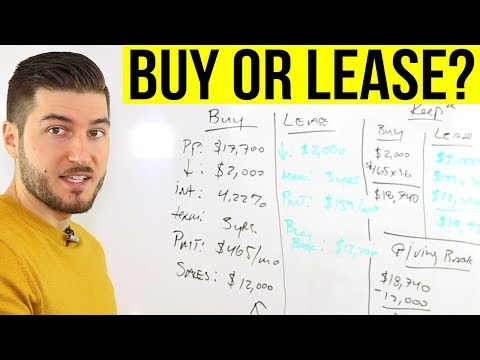

Leasing vs Buying a Car: Which is ACTUALLY Cheaper in 2024?

Показать описание

Leasing vs Buying a Car: Which is ACTUALLY Cheaper? We discuss this in today's video with a full scenario based on a Rav 4 Hybrid. We also talk about who buying a car is better for, versus who leasing a car is better for. Please note around 6:40 I do say the number "11,595", but that is ME not reading the number correctly, the text on screen is correct (11,195). If you enjoy this type of content, make sure to SubbbbbBSCRIBE!!!

Timestamps:

0:00 - Start Here

0:45 - Leasing

4:02 - Buying

7:06 - Comparing Apples to Apples

8:00 - Returning the Car Scenario

11:15 - When to Lease vs Buy

13:05 - When Buying is Better

13:28 - Who Leasing Is Good For

FREE STOCKS:

Follow me on social media:

RESOURCES:

PS: I am not a current Financial Advisor, any investment commentary are my opinions only. Some of the links in this description are affiliate links that I do receive a commission for & they help support the channel!

Timestamps:

0:00 - Start Here

0:45 - Leasing

4:02 - Buying

7:06 - Comparing Apples to Apples

8:00 - Returning the Car Scenario

11:15 - When to Lease vs Buy

13:05 - When Buying is Better

13:28 - Who Leasing Is Good For

FREE STOCKS:

Follow me on social media:

RESOURCES:

PS: I am not a current Financial Advisor, any investment commentary are my opinions only. Some of the links in this description are affiliate links that I do receive a commission for & they help support the channel!

Leasing vs Buying a Car: Which is ACTUALLY Cheaper in 2024?

Leasing Vs Buying A Car - Dave Ramsey

Leasing VS. Financing A Car | Is It Better To Buy Or Lease A New Car?

Leasing vs. Buying a Car - Dave Ramsey Rant

Buying vs. Leasing a Car (Pros and Cons)

Should I Lease a Car?

ACCOUNTANT EXPLAINS Should You Buy, Finance or Lease a New Car

Is Leasing CHEAPER Than Buying? 2023 Data REVEALED!

Understanding Car Leasing vs Buying

🚗 Leasing vs. Buying a Car: Which is the Better Option for YOU? 🚗 | Your Rich BFF

Auto Broker Explains: Should you Lease, Finance, or Buy a New Car?

Which is better for you? Leasing vs. buying your vehicle

ACCOUNTANT EXPLAINS: Should You Buy, Lease or Finance a New Car

Buying vs Leasing a Car in 2024 (Pros & Cons)

Leasing vs Buying a Car, Which is Worse

Buying vs Leasing a Car 101: How to pick the BEST choice

Here’s Why Leasing a Car is Stupid

Leasing vs. Buying a Car: Which is Cheaper in 2024?

Do I Buy, Finance, Lease or Rent My Cars and What Should You Do?

Buying vs Leasing A Car: Which Is Better? (2020).

Don't Get SCREWED on a Car Lease | 3 GOLDEN RULES to Negotiate a Car Lease

DON'T BE CONNED BUYING A CAR - PCP VS LEASE VS HP VS CASH EXPLAINED.

How To Lease A Car In 2024 (Step By Step)

Should You Pay Cash, Finance or Lease A New Car? Expert Explains Which Is Best

Комментарии

0:14:15

0:14:15

0:05:51

0:05:51

0:08:23

0:08:23

0:08:59

0:08:59

0:12:32

0:12:32

0:07:22

0:07:22

0:14:24

0:14:24

0:12:53

0:12:53

0:00:37

0:00:37

0:05:44

0:05:44

0:08:32

0:08:32

0:02:42

0:02:42

0:09:27

0:09:27

0:12:48

0:12:48

0:06:59

0:06:59

0:11:34

0:11:34

0:10:18

0:10:18

0:09:00

0:09:00

0:17:30

0:17:30

0:12:14

0:12:14

0:10:00

0:10:00

0:08:23

0:08:23

0:12:58

0:12:58

0:11:34

0:11:34