filmov

tv

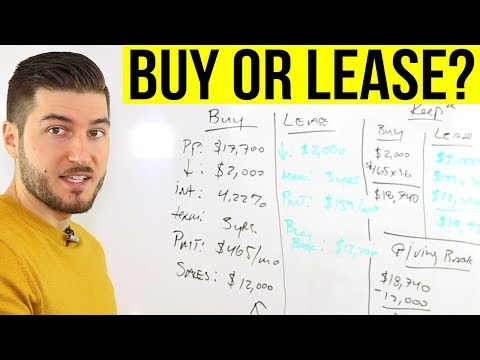

Buying vs Leasing A Car: Which Is Better? (2020).

Показать описание

Should you lease or buy a car? This video compares the two using a simple example of a 2020 Honda Civic with a MSRP of $20650. I also go over the Pros and Cons of both Leasing and Buying a Car.

Resources:

Leasing vs buying a car comes down to a few situational differences. In today's interest rate climate (low interest rates), there are many lease deals and specials on loans going on, so with the scenario in the video, leasing is technically the same cost after 3 years in the example. However, typically ownership is slightly favored over leasing in most 3 year scenarios.

Leasing makes sense if you are looking to drive a new car every 3 years or so. If this is the case, you're better off leasing, compared to buying and trading the overwhelming majority of the time!

The best advantages of leasing is that you don't have to worry about the resale value of the car, you know your ownership costs, and your responsibility is to just not trash the car and to keep it maintained and serviceable. Also you need to know how many miles you're going to use during your lease.

Buying a 3 year old used car with low mileage is probably the best optimization for your wallet. If you can achieve this, most of the depreciation has been chipped away and now you can get a pretty good deal.

Pros for Leasing Include the following:

- Low Down Payment (or none)

- Low Monthly Payments

- Warranty Coverage

- Can write off lease payments in certain situations (business owners)

Some Cons Include:

- Mileage limits

- Not your own car

- Wear and tear fees

Pros for Buying Include:

- It's yours

- Drive as much as you want

- Ability to customize

- Ability to sell it at anytime

Cons for Buying Include:

- Maintenance, you'll be on your own

- Large down payment

- Larger finance payments - might be difficult if your income isn't high enough

WATCH NEXT:

My name is Humphrey Yang, I make personal finance videos on YouTube, and TikTok where I have 550k+ followers! Make sure to sub to me on YouTube for two videos a week.

---------------------------------------------------

GEAR & BOOKS

---------------------------------------------------

---------------------------------------------------

MY SOCIAL MEDIA

---------------------------------------------------

Disclaimer: I am not a financial advisor, any investment commentary are my opinions only. Some of the products and services that appear on this channel are from companies that I have an affiliate relationship with, such as Robinhood, for which I recieve a small percentage made via those links, but it doesn’t cost you anything extra!

Resources:

Leasing vs buying a car comes down to a few situational differences. In today's interest rate climate (low interest rates), there are many lease deals and specials on loans going on, so with the scenario in the video, leasing is technically the same cost after 3 years in the example. However, typically ownership is slightly favored over leasing in most 3 year scenarios.

Leasing makes sense if you are looking to drive a new car every 3 years or so. If this is the case, you're better off leasing, compared to buying and trading the overwhelming majority of the time!

The best advantages of leasing is that you don't have to worry about the resale value of the car, you know your ownership costs, and your responsibility is to just not trash the car and to keep it maintained and serviceable. Also you need to know how many miles you're going to use during your lease.

Buying a 3 year old used car with low mileage is probably the best optimization for your wallet. If you can achieve this, most of the depreciation has been chipped away and now you can get a pretty good deal.

Pros for Leasing Include the following:

- Low Down Payment (or none)

- Low Monthly Payments

- Warranty Coverage

- Can write off lease payments in certain situations (business owners)

Some Cons Include:

- Mileage limits

- Not your own car

- Wear and tear fees

Pros for Buying Include:

- It's yours

- Drive as much as you want

- Ability to customize

- Ability to sell it at anytime

Cons for Buying Include:

- Maintenance, you'll be on your own

- Large down payment

- Larger finance payments - might be difficult if your income isn't high enough

WATCH NEXT:

My name is Humphrey Yang, I make personal finance videos on YouTube, and TikTok where I have 550k+ followers! Make sure to sub to me on YouTube for two videos a week.

---------------------------------------------------

GEAR & BOOKS

---------------------------------------------------

---------------------------------------------------

MY SOCIAL MEDIA

---------------------------------------------------

Disclaimer: I am not a financial advisor, any investment commentary are my opinions only. Some of the products and services that appear on this channel are from companies that I have an affiliate relationship with, such as Robinhood, for which I recieve a small percentage made via those links, but it doesn’t cost you anything extra!

Комментарии

0:14:15

0:14:15

0:05:51

0:05:51

0:12:32

0:12:32

0:14:24

0:14:24

0:12:48

0:12:48

0:08:23

0:08:23

0:12:53

0:12:53

0:07:22

0:07:22

0:09:32

0:09:32

0:09:27

0:09:27

0:11:34

0:11:34

0:12:14

0:12:14

0:08:32

0:08:32

0:15:23

0:15:23

0:08:23

0:08:23

0:08:59

0:08:59

0:17:30

0:17:30

0:06:59

0:06:59

0:12:58

0:12:58

0:02:42

0:02:42

0:10:18

0:10:18

0:04:13

0:04:13

0:10:53

0:10:53

0:05:44

0:05:44