filmov

tv

Buying vs. Leasing a Car (Pros and Cons)

Показать описание

There are 3 ways to buy a car, finance it, lease it, or buy it in cash. But leasing a car is one of the most expensive ways to own a car.

1. Buying vs Leasing

- We have to understand what goes into both of these ways to drive a car

- I'm going to compare leasing and finances a car, I’ll talk about buying cash at the end of this video

- As you probably already know, when you lease a vehicle you are renting and paying for the depreciation of the asset and rent fee, and few other fees; but when you finance your borrowing money to own he vehicle.

Leasing a Car: Pros

- When you lease a car you get a few benefits

- You get to have lower monthly payments

- You get drive a new vehicle

- And it takes the hassle out of car ownership in a way

However, leasing does come with Cons

- Drive off the lot fee ( return fee sometimes also)

- Restrictions on miles you can go

- You don’t own the car ( but you can buy it, at market price when you return it)

Now when you Buy a car and you finance it: Pros

- You're on your way to own the car

- No restrictions, it's your car

- Buying is cheaper

However the Cons with buying a Car:

- Higher monthly payment

- Depreciating asset

- It does come repair cost every now and then which could be hassle

Obviously: if we just look at this from this perspective it looks like leasing is more convenient, but its going to be more expensive because of that. And that’s why leasing is luxury.

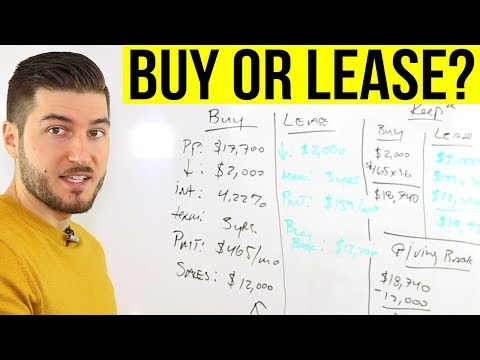

2. Let's break down the Math of leasing vs Owning

- Now every time I say leasing has a lower monthly payment

- Your brain probably starts to say then it's cheaper

- But in reality, the monthly payment does not equal value and price

Here is an Example: Karen and Mary: they both want the same car, but one of them will buy and the other one will lease

Karen wants to drive a new vehicle

- But she can't afford those monthly payments

- So she opts in for the lease and thinks she's getting a better deal because of the lower monthly payments

- So the car both Karen and Mary want cost $30,000 dollars

Math for Karen: she is going to lease for 6 years, in those 6 years she will get 2 new cars. So basically two lease cycles: Payments are $300 a month

First 3 years: ( 36 months x 300 + $1200 drive off fee ) total cost of $12,000

Second Lease Year 3: ( 36 months x 300 + 1200 drive off fee) total cost $12,000

Total Cost of the Lease for Karen is: $24,000 in 6 years, and shes already getting ready to get her third lease.

Math for Mary:

She bought a 30k car and put down $8k and financed 22k at 3.11% over 5 years: total monthly payment of $396

First 5 years: ( 60 months x 369 + 8000 Down Payment) = $31,760 bucks

Obviously a lot more than Karen, and she drove the same car for 5 years, but in year 5 she no longer had any payments.

But her is the Truth:

- Karen doesn’t own anything, so that 24k is gone, and she’ll probably again for another 3 years and pay another 12k but mary doesn’t have to make payments anymore

- Also, mary owns an asset, so over the first 5-6 years, it lost around 50% of the value, but she can always sell it

- In this case, it looks like the lease is $7,760 bucks cheaper buck mary has 15k in value, which makes buying $7240 cheaper than leasing.

The point: when you buy a car you build equity and you can always sell it and get some money. Mary can drive for another 10 years without any payments. Karen will always have payments and never have any equity, and that’s why leasing is a luxury and that’s why it's 22% more expensive in this example in the first 6years. But after that, it'll get more and more expensive.

3. The best way to buy a car:

- Is to buy it around Year 5, and get a 50% discount

- And that slows down the depreciation

- And pay for it in cash, so make a savings goal

* PRO TIP*

INFORMATION IS EVERYTHING

💲1 on 1 Talk + My Budget + Stock Investments💲

👕Merch👕

✅2 FREE AUDIOBOOKS✅

🎁ACORN FREE $5🎁

⚡FREE KINDLE UNLIMITED⚡ (traditional reading)

👨🏽💻DISCORD PRIVATE GROUP👨🏽💻

😎All My Social Media😎

*Some of the links and other products that appear on this video are from companies in which Tommy Bryson will earn an affiliate commission or referral bonus. Tommy Bryson is part of an affiliate network and receives compensation for sending traffic to partner sites. The content in this video is accurate as of the posting date. Some of the offers mentioned may no longer be available. I'm an Accountant but I'm not your Accountant, always review information with your Accountant/CPA and your Financial Advisor.

1. Buying vs Leasing

- We have to understand what goes into both of these ways to drive a car

- I'm going to compare leasing and finances a car, I’ll talk about buying cash at the end of this video

- As you probably already know, when you lease a vehicle you are renting and paying for the depreciation of the asset and rent fee, and few other fees; but when you finance your borrowing money to own he vehicle.

Leasing a Car: Pros

- When you lease a car you get a few benefits

- You get to have lower monthly payments

- You get drive a new vehicle

- And it takes the hassle out of car ownership in a way

However, leasing does come with Cons

- Drive off the lot fee ( return fee sometimes also)

- Restrictions on miles you can go

- You don’t own the car ( but you can buy it, at market price when you return it)

Now when you Buy a car and you finance it: Pros

- You're on your way to own the car

- No restrictions, it's your car

- Buying is cheaper

However the Cons with buying a Car:

- Higher monthly payment

- Depreciating asset

- It does come repair cost every now and then which could be hassle

Obviously: if we just look at this from this perspective it looks like leasing is more convenient, but its going to be more expensive because of that. And that’s why leasing is luxury.

2. Let's break down the Math of leasing vs Owning

- Now every time I say leasing has a lower monthly payment

- Your brain probably starts to say then it's cheaper

- But in reality, the monthly payment does not equal value and price

Here is an Example: Karen and Mary: they both want the same car, but one of them will buy and the other one will lease

Karen wants to drive a new vehicle

- But she can't afford those monthly payments

- So she opts in for the lease and thinks she's getting a better deal because of the lower monthly payments

- So the car both Karen and Mary want cost $30,000 dollars

Math for Karen: she is going to lease for 6 years, in those 6 years she will get 2 new cars. So basically two lease cycles: Payments are $300 a month

First 3 years: ( 36 months x 300 + $1200 drive off fee ) total cost of $12,000

Second Lease Year 3: ( 36 months x 300 + 1200 drive off fee) total cost $12,000

Total Cost of the Lease for Karen is: $24,000 in 6 years, and shes already getting ready to get her third lease.

Math for Mary:

She bought a 30k car and put down $8k and financed 22k at 3.11% over 5 years: total monthly payment of $396

First 5 years: ( 60 months x 369 + 8000 Down Payment) = $31,760 bucks

Obviously a lot more than Karen, and she drove the same car for 5 years, but in year 5 she no longer had any payments.

But her is the Truth:

- Karen doesn’t own anything, so that 24k is gone, and she’ll probably again for another 3 years and pay another 12k but mary doesn’t have to make payments anymore

- Also, mary owns an asset, so over the first 5-6 years, it lost around 50% of the value, but she can always sell it

- In this case, it looks like the lease is $7,760 bucks cheaper buck mary has 15k in value, which makes buying $7240 cheaper than leasing.

The point: when you buy a car you build equity and you can always sell it and get some money. Mary can drive for another 10 years without any payments. Karen will always have payments and never have any equity, and that’s why leasing is a luxury and that’s why it's 22% more expensive in this example in the first 6years. But after that, it'll get more and more expensive.

3. The best way to buy a car:

- Is to buy it around Year 5, and get a 50% discount

- And that slows down the depreciation

- And pay for it in cash, so make a savings goal

* PRO TIP*

INFORMATION IS EVERYTHING

💲1 on 1 Talk + My Budget + Stock Investments💲

👕Merch👕

✅2 FREE AUDIOBOOKS✅

🎁ACORN FREE $5🎁

⚡FREE KINDLE UNLIMITED⚡ (traditional reading)

👨🏽💻DISCORD PRIVATE GROUP👨🏽💻

😎All My Social Media😎

*Some of the links and other products that appear on this video are from companies in which Tommy Bryson will earn an affiliate commission or referral bonus. Tommy Bryson is part of an affiliate network and receives compensation for sending traffic to partner sites. The content in this video is accurate as of the posting date. Some of the offers mentioned may no longer be available. I'm an Accountant but I'm not your Accountant, always review information with your Accountant/CPA and your Financial Advisor.

Комментарии

0:14:15

0:14:15

0:05:51

0:05:51

0:12:32

0:12:32

0:12:48

0:12:48

0:14:24

0:14:24

0:12:53

0:12:53

0:05:21

0:05:21

0:05:44

0:05:44

0:08:23

0:08:23

0:11:34

0:11:34

0:09:27

0:09:27

0:16:50

0:16:50

0:08:32

0:08:32

0:08:59

0:08:59

0:07:22

0:07:22

0:02:42

0:02:42

0:10:00

0:10:00

0:06:59

0:06:59

0:00:45

0:00:45

0:17:30

0:17:30

0:10:18

0:10:18

0:10:06

0:10:06

0:00:56

0:00:56

0:12:58

0:12:58