filmov

tv

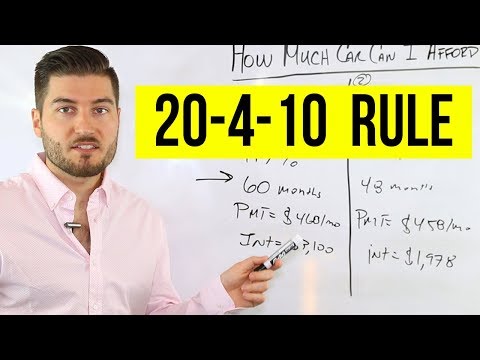

How Much Car Can You Afford? (#1 Rule to Know)

Показать описание

How much car can I afford is a question many car buyers Google before making their next vehicle purchase. In this video I teach you the most you can afford to pay for your next vehicle.

More car buyers than ever are trading in vehicles that are worth less than they owe on the loan. This means they've purchased a car they can't afford, they're under water, and they're bringing negative equity with them to their next deal.

There's one simple way to stop this from happening.

This topic is covered in more detail at:

I recommend the following videos to best negotiate your next vehicle purchase.

#notwaitingtolive #howtonegotiateacardeal #caraffordability

More car buyers than ever are trading in vehicles that are worth less than they owe on the loan. This means they've purchased a car they can't afford, they're under water, and they're bringing negative equity with them to their next deal.

There's one simple way to stop this from happening.

This topic is covered in more detail at:

I recommend the following videos to best negotiate your next vehicle purchase.

#notwaitingtolive #howtonegotiateacardeal #caraffordability

How Much Car Can You Really Afford? (By Salary)

How Much Car You Can ACTUALLY Afford (By Salary)

ACCOUNTANT EXPLAINS: How much car can you REALLY afford (By Salary)

How Much Car Can You Afford: $30K vs $75K vs $265K Supercar

How Much Car Can I Afford (20/4/10 Rule)

How Much Car You Can REALISTICALLY Afford! (By Income Level)

How Much Car Can I Afford: Use This Rule to Avoid Trouble!

ACCOUNTANT EXPLAINS How Much Car Can You Afford | Avoid becoming CAR POOR

How Much Car Can You ACTUALLY Afford? (According To A Car Dealer)

How Much Car Can I Afford?

How Much Car Can YOU Afford? Why the 20/4/10 Rule is BAD ADVICE!

How Much Car Can You Really Afford? (Car Loan Basics)

How much car can you truly afford?

QUICK TIP: How much car can you afford?

How Much Car Can You Afford? Do NOT be Car Poor!

Can I Afford a $90,000 Sports Car? (My Wife Isn't Convinced)

Ramit Sethi: Can You Afford A New Car?

How Much Car Can I Afford? Calculate Your Car Affordability like a Pro!

CAR FINANCES! | What Car can you Afford? | Ankur Warikoo Hindi

How Much Car Can You Afford? Use This Simple Calculation!

WCI Podcast #218 - How Much Car Can You Afford?

How many parts can you take off a car?

How Much Value Can You Add To A Car With Just A Detail?

What Salary Can Afford A $100K Car? Is It Ever Financially OK To Buy A $100k Vehicle?

Комментарии

0:12:39

0:12:39

0:14:10

0:14:10

0:08:04

0:08:04

0:19:21

0:19:21

0:07:38

0:07:38

0:12:24

0:12:24

0:08:21

0:08:21

0:13:19

0:13:19

0:18:27

0:18:27

0:10:37

0:10:37

0:09:45

0:09:45

0:06:33

0:06:33

0:01:06

0:01:06

0:00:46

0:00:46

0:05:08

0:05:08

0:07:33

0:07:33

0:01:53

0:01:53

0:12:58

0:12:58

0:15:15

0:15:15

0:14:37

0:14:37

0:47:11

0:47:11

0:15:43

0:15:43

0:07:25

0:07:25

0:16:30

0:16:30