filmov

tv

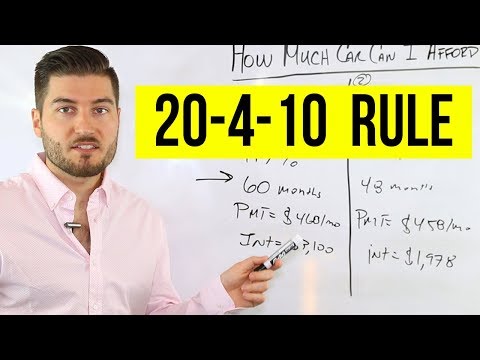

How Much Car Can I Afford? Calculate Your Car Affordability like a Pro!

Показать описание

Learn how to calculate your car affordability like a pro with my easy-to-follow tutorial. Discover the 20/4/10 rule, understand car leases, explore the 3 secrets to successful car shopping, and gain insights into optimizing your budget for a stress-free car buying experience. Join the community of savvy millennial shoppers and subscribe to the channel for more financial tips and tricks!

--------

My favorite FREE car insurance quote comparison tool:

EXPERIAN®, FOR AUTO INSURANCE

--------

--------

--------

📝CHECK OUT THE HOW TO CONTROL YOUR SPENDING WORKBOOK

--------

💌 READY TO BUDGET?

--------

💻 SIGN UP FOR BUDGET BOOTCAMP

--------

🌟 My favorite money-saving app: FETCH REWARDS

--------

--------

Disclosure: Links contain affiliates. When you buy through one of my links, I will receive a commission. This is at no cost to you and helps support my channel!

--------

My favorite FREE car insurance quote comparison tool:

EXPERIAN®, FOR AUTO INSURANCE

--------

--------

--------

📝CHECK OUT THE HOW TO CONTROL YOUR SPENDING WORKBOOK

--------

💌 READY TO BUDGET?

--------

💻 SIGN UP FOR BUDGET BOOTCAMP

--------

🌟 My favorite money-saving app: FETCH REWARDS

--------

--------

Disclosure: Links contain affiliates. When you buy through one of my links, I will receive a commission. This is at no cost to you and helps support my channel!

How Much Car Can I Afford (20/4/10 Rule)

How Much Car Can You Really Afford? (By Salary)

How Much Car Can I Afford: Use This Rule to Avoid Trouble!

How Much Car You Can ACTUALLY Afford (By Salary)

ACCOUNTANT EXPLAINS: How much car can you REALLY afford (By Salary)

How Much Car Can You Afford: $30K vs $75K vs $265K Supercar

ACCOUNTANT EXPLAINS How Much Car Can You Afford | Avoid becoming CAR POOR

How Much Car Can I Afford?

How Much Car You Can REALISTICALLY Afford! (By Income Level)

How Much Car Can You ACTUALLY Afford? (According To A Car Dealer)

How much car can I afford? Here's how to calculate | Explainomics

How Much Car Can You Really Afford? (By Salary)

How Much Car Can YOU Afford? Why the 20/4/10 Rule is BAD ADVICE!

How Much Should We Spend on a Car?

How Much Should I Spend On A Car?

How Much Car Is Too Much?

How Much Car Can I Afford (3 Methods)

I'm $100,000 In Debt. How Much Car Can I Afford?

How Much Car Can You Really Afford? (Car Loan Basics)

How Much Car You Can TRULY Afford (By Salary)

How Much Car Can You ACTUALLY Afford

How Much Car Can I Afford? (20/4/10 Rule Examples)

How much car can you truly afford?

How Much Car Can You Afford - 20/4/10 Rule vs 50/30/20 Rule

Комментарии

0:07:38

0:07:38

0:12:39

0:12:39

0:08:21

0:08:21

0:14:10

0:14:10

0:08:04

0:08:04

0:19:21

0:19:21

0:13:19

0:13:19

0:10:37

0:10:37

0:12:24

0:12:24

0:18:27

0:18:27

0:05:07

0:05:07

0:08:04

0:08:04

0:09:45

0:09:45

0:08:55

0:08:55

0:05:38

0:05:38

0:06:51

0:06:51

0:12:29

0:12:29

0:03:54

0:03:54

0:06:33

0:06:33

0:07:45

0:07:45

0:10:15

0:10:15

0:05:08

0:05:08

0:01:06

0:01:06

0:11:52

0:11:52