filmov

tv

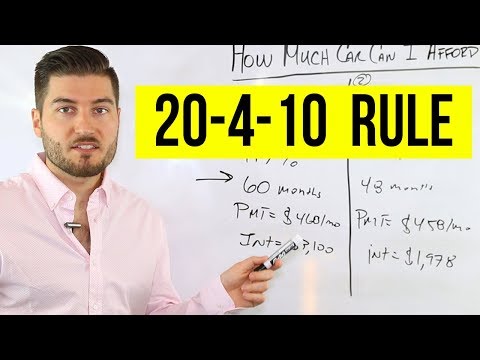

How Much Car Can YOU Afford? Why the 20/4/10 Rule is BAD ADVICE!

Показать описание

Have you asked “How much car can I afford” or “How much should I spend on a car?” while you’ve been searching for a car to buy? In this video we discuss why the common 20/4/10 rule is not the best financial advice to follow when buying a car. In simple terms the 20/4/10 rule which states that you should put at least 20% down, finance the vehicle for no more than 4 years, and have the total monthly car expenses (car insurance & car payments) add up to no more than 10% of your monthly income. If you incorrectly follow the 20/4/10 rule you can end up in some serious financial trouble and not be able to make the necessary car payments.

We will show you the hidden step to do before applying the 20/4/10 rule and how much money you should use to pay for a car. Once you learn these steps you’ll never ask “how much should I pay for a car”. Thanks to Next Level Life (How to Buy a car | The 20/4/10 rule explained) and Marko-whiteboard finance (How much car can I afford [20/4/10 rule]) for the inspiration in making this video. They did an awesome job. As a previous dealer I wanted to go a step further and show you how to better use the 20/4/10 rule in conjunction with the 50/30/20 money plan to get a more accurate figure as to how much you can really afford.

📕📗📘LINK TO THE BOOK: 📕📗📘

All Your Worth: The Ultimate Lifetime Money Plan

🔔SUBSCRIBE🔔

🔴How Car Dealerships Rip You Off (REAL Truth from an Actual DEALER)

🎬Watch our latest videos :🎬

🔴How to Invest your first $1,000 the Smart Strategy

🔴 How To Start PAYING OFF DEBT and GET OUT of DEBT? Super FAST Strategy in just MONTHS!

🔴How to Double your money in the Stock Market

🔴Highest Paying Savings Account

🔴Take Control of your Finances

#whiteboardfinance #howmuchcarcaniafford #20/4/10rule #canyouaffordacar #howmuchcarcanyouafford

DISCLAIMER: All the information contained within our YouTube channel is SOLELY for INFORMATIONAL PURPOSES. We make no representations as to the accuracy, completeness, suitability or validity of any information contained on this channel. Use this information at your own RISK. ALL responsibility is assigned to YOU. Any links to other websites are provided as a convenience and M.G.A encourages you to read the privacy statements of any third-party websites. The information on this channel is based on our own personal opinions and should not be taken as professional financial investment advice. The processes, ideas, and strategies presented in this channel should only be used after consulting with a professional financial advisor.

COPYRIGHT: All Money Growth Academy content is copyright (c) Money Growth Academy, LLC.

We will show you the hidden step to do before applying the 20/4/10 rule and how much money you should use to pay for a car. Once you learn these steps you’ll never ask “how much should I pay for a car”. Thanks to Next Level Life (How to Buy a car | The 20/4/10 rule explained) and Marko-whiteboard finance (How much car can I afford [20/4/10 rule]) for the inspiration in making this video. They did an awesome job. As a previous dealer I wanted to go a step further and show you how to better use the 20/4/10 rule in conjunction with the 50/30/20 money plan to get a more accurate figure as to how much you can really afford.

📕📗📘LINK TO THE BOOK: 📕📗📘

All Your Worth: The Ultimate Lifetime Money Plan

🔔SUBSCRIBE🔔

🔴How Car Dealerships Rip You Off (REAL Truth from an Actual DEALER)

🎬Watch our latest videos :🎬

🔴How to Invest your first $1,000 the Smart Strategy

🔴 How To Start PAYING OFF DEBT and GET OUT of DEBT? Super FAST Strategy in just MONTHS!

🔴How to Double your money in the Stock Market

🔴Highest Paying Savings Account

🔴Take Control of your Finances

#whiteboardfinance #howmuchcarcaniafford #20/4/10rule #canyouaffordacar #howmuchcarcanyouafford

DISCLAIMER: All the information contained within our YouTube channel is SOLELY for INFORMATIONAL PURPOSES. We make no representations as to the accuracy, completeness, suitability or validity of any information contained on this channel. Use this information at your own RISK. ALL responsibility is assigned to YOU. Any links to other websites are provided as a convenience and M.G.A encourages you to read the privacy statements of any third-party websites. The information on this channel is based on our own personal opinions and should not be taken as professional financial investment advice. The processes, ideas, and strategies presented in this channel should only be used after consulting with a professional financial advisor.

COPYRIGHT: All Money Growth Academy content is copyright (c) Money Growth Academy, LLC.

Комментарии