filmov

tv

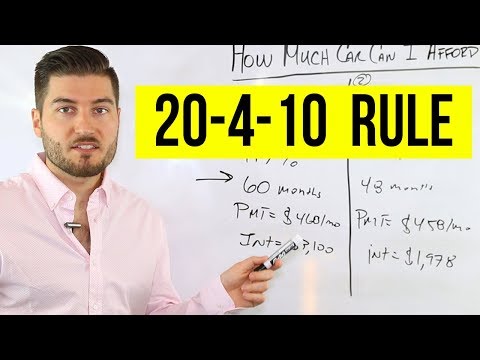

How Much Car Can I Afford?

Показать описание

Find cars that fit your budget:

Car Trade in Tactics for Success (YAA Article):

🚗 Get educated on buying a car with YAA's NEW & IMPROVED Deal School 3.0:

💰 Save money on repairs and maintenance with a YAA+ membership:

🚗 Join the YAA Community:

🚗 Search for new and used cars:

🚗 Save thousands on a YAA extended warranty:

YAA Podcast: Daily News You Can Use

Ray and Zach dive into the process of figuring out just how much car you can buy with a pre-determined monthly payment. There's more variables at play here than you may realize, so grab a comfy chair, sit back, and soak in the knowledge!

Car Trade in Tactics for Success (YAA Article):

🚗 Get educated on buying a car with YAA's NEW & IMPROVED Deal School 3.0:

💰 Save money on repairs and maintenance with a YAA+ membership:

🚗 Join the YAA Community:

🚗 Search for new and used cars:

🚗 Save thousands on a YAA extended warranty:

YAA Podcast: Daily News You Can Use

Ray and Zach dive into the process of figuring out just how much car you can buy with a pre-determined monthly payment. There's more variables at play here than you may realize, so grab a comfy chair, sit back, and soak in the knowledge!

How Much Car Can I Afford (20/4/10 Rule)

How Much Car Can You Really Afford? (By Salary)

How Much Car Can I Afford: Use This Rule to Avoid Trouble!

How Much Car You Can ACTUALLY Afford (By Salary)

ACCOUNTANT EXPLAINS: How much car can you REALLY afford (By Salary)

How Much Car Can You Afford: $30K vs $75K vs $265K Supercar

ACCOUNTANT EXPLAINS How Much Car Can You Afford | Avoid becoming CAR POOR

How Much Car Can I Afford?

How Much Car You Can REALISTICALLY Afford! (By Income Level)

How much car can I afford? Here's how to calculate | Explainomics

How Much Car Can You ACTUALLY Afford? (According To A Car Dealer)

How Much Car Can You Really Afford? (By Salary)

How Much Should We Spend on a Car?

How Much Car Can YOU Afford? Why the 20/4/10 Rule is BAD ADVICE!

How Much Should I Spend On A Car?

How Much Car Is Too Much?

How Much Car Can I Afford (3 Methods)

How Much Car Can You Really Afford? (Car Loan Basics)

How Much Car You Can TRULY Afford (By Salary)

How Much Car Can You ACTUALLY Afford

I'm $100,000 In Debt. How Much Car Can I Afford?

How Much Car Can I Afford? (20/4/10 Rule)

How Much Car Can I Afford? (20/4/10 Rule Examples)

How much car can you truly afford?

Комментарии

0:07:38

0:07:38

0:12:39

0:12:39

0:08:21

0:08:21

0:14:10

0:14:10

0:08:04

0:08:04

0:19:21

0:19:21

0:13:19

0:13:19

0:10:37

0:10:37

0:12:24

0:12:24

0:05:07

0:05:07

0:18:27

0:18:27

0:08:04

0:08:04

0:08:55

0:08:55

0:09:45

0:09:45

0:05:38

0:05:38

0:06:51

0:06:51

0:12:29

0:12:29

0:06:33

0:06:33

0:07:45

0:07:45

0:10:15

0:10:15

0:03:54

0:03:54

0:11:53

0:11:53

0:05:08

0:05:08

0:01:06

0:01:06