filmov

tv

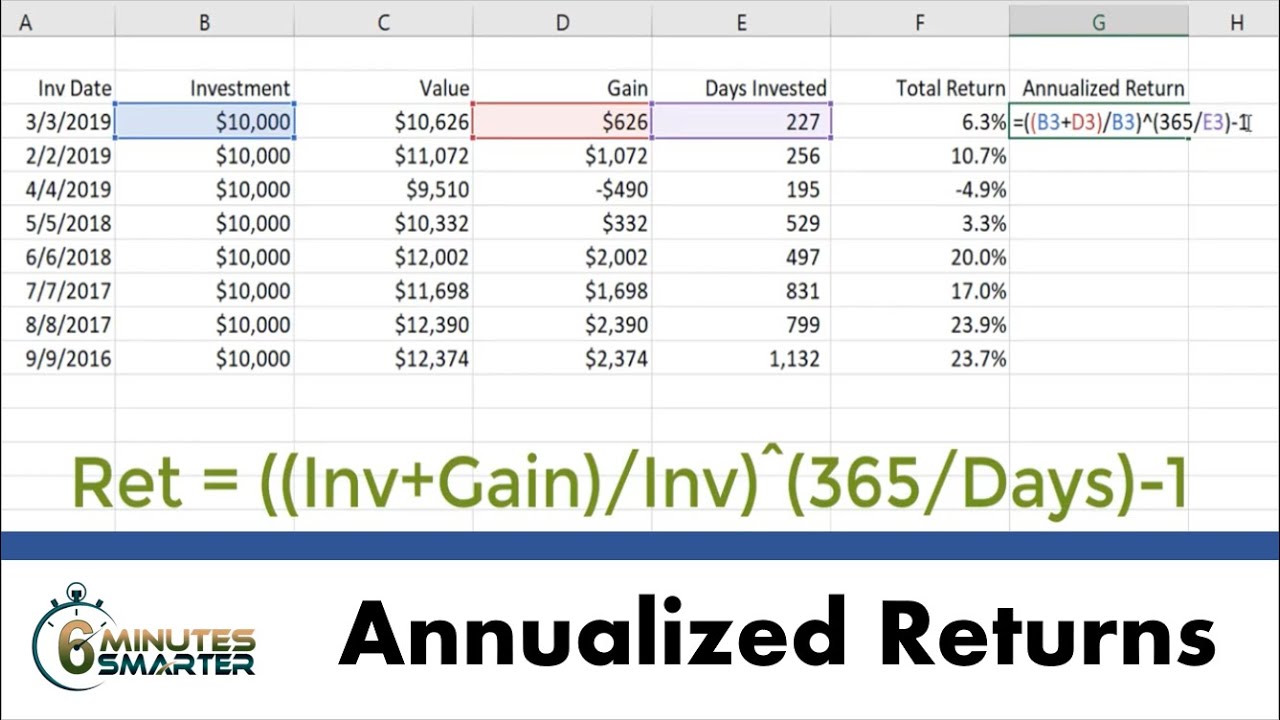

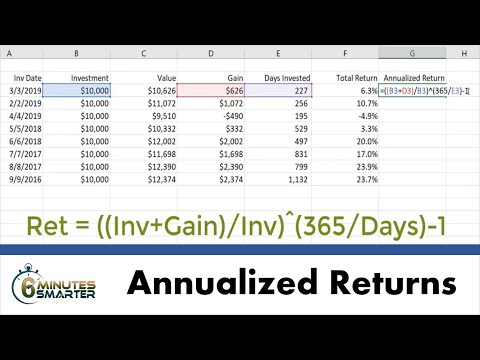

Calculate Annualized Returns for Investments in Excel

Показать описание

Use Excel to determine the compounded annual returns for investments held less than or greater than 1 year. #excel #investments #annualizedreturn

Calculate Annualized Returns for Investments in Excel

How to calculate annualized returns from monthly returns in Excel

Use Excel 365 to Calculate Simple Annualized Returns for a Series of Investments

Stock Annual Return & Standard Deviation in Excel | FREE FILE

Annualized Rate of Return Formula in Excel

Your 'Average Annual Return' is a Lie

Annualized return on investment

Calculate Annualized Stock Returns Using Python

My Simple Solution for Total Financial Management | Money Mastery Pro | Notion

FinShiksha - Calculating Annualized Standard Deviation from Stock Prices

CAGR vs XIRR (annualized return: simple explanation)

Annual Rate of Return

Annualized daily returns

S&P 500 Annual Returns | You Won't Believe How Much!!

What is Annualized Return? | Annualized Return Explained | by Anuj Vohra

Annual Rate of Return Need for Loss Recover and Additional Return on Investment

Annual return calculations in SIP MUTUAL FUNDS

Geometric average annual return

Annual vs Trailing vs Rolling Returns Explained | ET Money

Absolute return vs Annual Return

Holding Period Return | Holding Period Yield - Annual HPR | Annual HPY | Concepts and Calculations

Use the OFFSET Function in Excel to Calculate Average Annual Returns for S&P 500 Over 50 Years

Calculate Annual Return on Investment in Excel by learning center in Urdu/hindi

Calculating Returns On a Rental Property (ROI with Excel Template)

Комментарии

0:05:15

0:05:15

0:01:56

0:01:56

0:05:00

0:05:00

0:05:38

0:05:38

0:02:14

0:02:14

0:11:58

0:11:58

0:05:53

0:05:53

0:12:50

0:12:50

0:12:03

0:12:03

0:02:55

0:02:55

0:07:15

0:07:15

0:06:06

0:06:06

0:09:32

0:09:32

0:08:26

0:08:26

0:03:45

0:03:45

0:06:33

0:06:33

0:02:23

0:02:23

0:11:17

0:11:17

0:12:57

0:12:57

0:02:16

0:02:16

0:08:45

0:08:45

0:07:37

0:07:37

0:03:11

0:03:11

0:15:44

0:15:44