filmov

tv

FinShiksha - Calculating Annualized Standard Deviation from Stock Prices

Показать описание

This video shows how to calculate annualized volatility (Standard Deviation) for any asset class using the example of L&T as a stock.

-------------------------------------------------------------------------------

Follow us on

---------------------------------------

FinShiksha is an IIM Calcutta alumnus venture and specializes in education in the financial services domain.

But we are more than just education providers; we help you build a career – and work with you during the process. Our programs help a candidate evaluate his/her strengths and hone them, at the same time spotting weaknesses and eliminate them. We teach, we hand-hold and we guide.

-------------------------------------------------------------------------------

Follow us on

---------------------------------------

FinShiksha is an IIM Calcutta alumnus venture and specializes in education in the financial services domain.

But we are more than just education providers; we help you build a career – and work with you during the process. Our programs help a candidate evaluate his/her strengths and hone them, at the same time spotting weaknesses and eliminate them. We teach, we hand-hold and we guide.

FinShiksha - Calculating Annualized Standard Deviation from Stock Prices

Stock Annual Return & Standard Deviation in Excel | FREE FILE

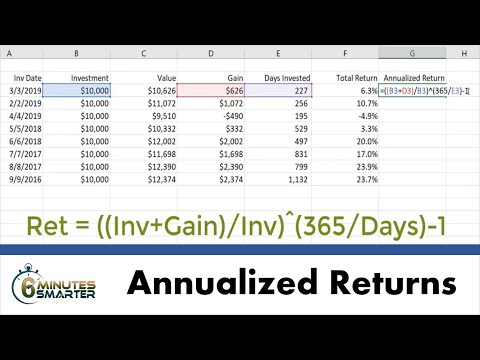

Calculate Annualized Returns for Investments in Excel

How to calculate annualized returns from monthly returns in Excel

How to Calculate Annualised Rate of Return

Calculating Annualized Rate of Return - Microsoft 2004

Finding annual returns from monthly returns

FinShiksha - How to calculate Stock Beta

Annualized return and standard deviation

FinShiksha - Finance Concepts - Quant Finance - Frequency Distribution

Standard Deviation Annualized (3 Solutions!!)

FinShiksha - Finance Concepts - Quant Finance - Introduction to Normal Distribution

Weibull distribution using the fatigue test as an example (survival/failure/reliability analysis)

FinShiksha - Finance Concepts - Fixed Income - Calculating Full Price & Clean Price for a Bond

Calculating Stock Returns with Excel!

Mastering Multi-Asset Portfolio Analysis: Standard Deviation & Returns in Excel

How to calculate stock returns using real data

Annualized daily returns

What is Standard Deviation?

FinShiksha - Finance Functions in Excel and Applications

How to Calculate Expected Return, Variance, Standard Deviation in Excel from Stocks/Shares

How to Calculate Standard Deviation Stock Returns

FinShiksha - Finance Concepts - Economics - Real vs Nominal Growth Rates

Evaluating Investment Products

Комментарии

0:02:55

0:02:55

0:05:38

0:05:38

0:05:15

0:05:15

0:01:56

0:01:56

0:14:35

0:14:35

0:07:37

0:07:37

0:07:17

0:07:17

0:10:14

0:10:14

0:03:36

0:03:36

0:01:38

0:01:38

0:02:39

0:02:39

0:42:15

0:42:15

0:38:09

0:38:09

0:04:37

0:04:37

0:00:36

0:00:36

0:14:34

0:14:34

0:11:41

0:11:41

0:09:32

0:09:32

0:04:38

0:04:38

0:41:39

0:41:39

0:03:21

0:03:21

0:04:56

0:04:56

0:07:07

0:07:07

0:13:06

0:13:06