filmov

tv

Geometric average annual return

Показать описание

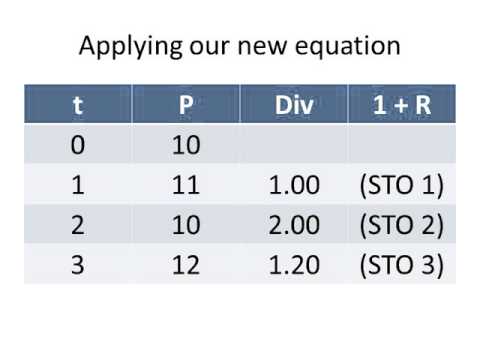

There are two ways one can calculate the Average Annual Return on, say, a stock investment: (1) the arithmetic average, and (2) the geometric average. While the arithmetic average is nothing but the "simple average", the geometric average is calculated very differently, and it also has a slightly different interpretation.

Watch this video to see how the Geometric Average Annual Return can be calculated using a FORMULA, as well as the trick to find it using a FINANCIAL CALCULATOR (I used "Texas Instruments BA ii plus" calculator).

Enjoy! :-)

Watch this video to see how the Geometric Average Annual Return can be calculated using a FORMULA, as well as the trick to find it using a FINANCIAL CALCULATOR (I used "Texas Instruments BA ii plus" calculator).

Enjoy! :-)

Geometric average annual return

(Ch. 12 lecture) Arithmetic vs Geometric Average Annual Return

(6 of 12) Ch.12 - Arithmetic & geometric average return: 2 examples

Geometric Mean Return

Geometric vs. Arithmetic Returns | Explained with an Investing Example

Example Geometric Average Returns

Your 'Average Annual Return' is a Lie

Geometric Mean: Annual Rate of Return on an Investment

Geometric Mean: Calculating the Geometric Mean Rate of Return Example 2 - Part 1

Average Annual Rate of Return Using Geometric Mean || Measures of Central Tendency || Statistics

(5 of 12) Ch.12 - Geometric average return calculation

Geometric Mean Annual Return Practice Problem with Formula

The Geometric Mean and Average Growth Rates

Time-Weighted Rate of Return Example Problem (Geometric Mean Return)

When would we use the geometric mean instead of the arithmetic mean in real life?

Geometric Mean Return Formula: How to Calculate the Geometric Mean

How To Calculate The Geometric Mean

Arithmetic Average Returns v Geometric Average Returns

Geometric average return definition for investment modeling

Geometric Mean calculation by Dr. Caleb Chan

Geometric Mean - CFA Level1 practice question

TI BA II Plus Geometric Mean

Excel Finance Class 97: Using Geometric Mean & Arithmetic Mean to Estimate Future Returns

Geometric mean rate of return calculation

Комментарии

0:11:17

0:11:17

0:31:33

0:31:33

0:02:36

0:02:36

0:01:39

0:01:39

0:03:14

0:03:14

0:09:15

0:09:15

0:11:58

0:11:58

0:11:31

0:11:31

0:04:27

0:04:27

0:06:26

0:06:26

0:17:28

0:17:28

0:02:05

0:02:05

0:07:03

0:07:03

0:01:34

0:01:34

0:01:23

0:01:23

0:05:15

0:05:15

0:05:56

0:05:56

0:10:04

0:10:04

0:04:53

0:04:53

0:02:56

0:02:56

0:01:59

0:01:59

0:01:44

0:01:44

0:03:52

0:03:52

0:04:54

0:04:54