filmov

tv

Stock Annual Return & Standard Deviation in Excel | FREE FILE

Показать описание

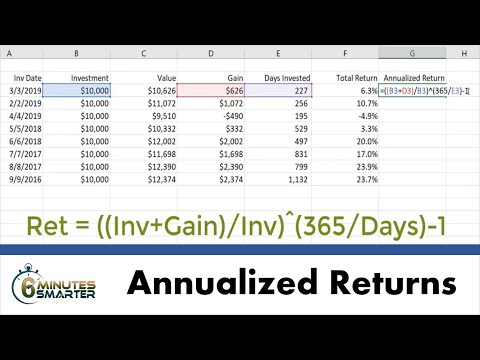

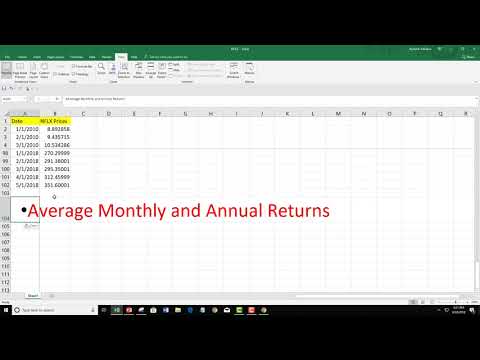

Join Ryan O'Connell, CFA, FRM, in this informative tutorial as he guides you through the process of calculating stock annual return and standard deviation using Excel. Starting with how to obtain stock price data from Yahoo Finance, Ryan will teach you step-by-step how to calculate daily returns, annual returns, and finally, the annual standard deviation to assess investment risk and performance efficiently. Perfect for investors and finance students, this video is packed with practical tips and Excel formulas to enhance your financial analysis skills. Whether you're a beginner or looking to refine your expertise, this guide offers valuable insights into making informed investment decisions.

💾 Download Free Excel File:

🎓 Tutor With Me: 1-On-1 Video Call Sessions Available

👨💼 My Freelance Financial Modeling Services:

Chapters:

0:00 - Get Stock Price Data from Yahoo Finance

1:07 - Calculate Daily Returns

2:30 - Calculate Annual Return

3:54 - Calculate Annual Standard Deviation

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC. Some of the links above are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase.

💾 Download Free Excel File:

🎓 Tutor With Me: 1-On-1 Video Call Sessions Available

👨💼 My Freelance Financial Modeling Services:

Chapters:

0:00 - Get Stock Price Data from Yahoo Finance

1:07 - Calculate Daily Returns

2:30 - Calculate Annual Return

3:54 - Calculate Annual Standard Deviation

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC. Some of the links above are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase.

Комментарии

0:05:38

0:05:38

0:11:58

0:11:58

0:05:15

0:05:15

0:02:48

0:02:48

0:02:55

0:02:55

0:08:46

0:08:46

0:01:56

0:01:56

0:02:42

0:02:42

0:57:23

0:57:23

0:02:15

0:02:15

0:03:51

0:03:51

0:04:13

0:04:13

0:12:50

0:12:50

0:09:37

0:09:37

0:14:34

0:14:34

0:14:52

0:14:52

0:00:36

0:00:36

0:08:26

0:08:26

0:05:03

0:05:03

0:02:09

0:02:09

0:08:51

0:08:51

0:00:50

0:00:50

0:04:56

0:04:56

0:06:10

0:06:10