filmov

tv

Cost of Capital (WACC)

Показать описание

** This is a remade version of our Cost of Capital Masterclass **

In this masterclass, expert Tutor Andrew Mower explains the Cost of Capital, otherwise known as the weighted average cost of capital (WACC) . Andrew explains what the cost of capital means, the three main costs: the cost of equity, the cost of debt and the cost of preference shares. Andrew then talks through some practice questions.

MORE ACCOUNTANCY REVISION:

00:00 - 01:14 Intro

01:14 - 06:29 Overview

06:29 - 10:42 Calculating Ke

10:42 - 13:38 Calculating Kd

13:38 - 14:49 Calculating Kp

14:49 - 29:17 Practice Questions

In this masterclass, expert Tutor Andrew Mower explains the Cost of Capital, otherwise known as the weighted average cost of capital (WACC) . Andrew explains what the cost of capital means, the three main costs: the cost of equity, the cost of debt and the cost of preference shares. Andrew then talks through some practice questions.

MORE ACCOUNTANCY REVISION:

00:00 - 01:14 Intro

01:14 - 06:29 Overview

06:29 - 10:42 Calculating Ke

10:42 - 13:38 Calculating Kd

13:38 - 14:49 Calculating Kp

14:49 - 29:17 Practice Questions

🔴 Weighted Average Cost of Capital or WACC Explained (Quickest Overview)

Cost of Capital (WACC)

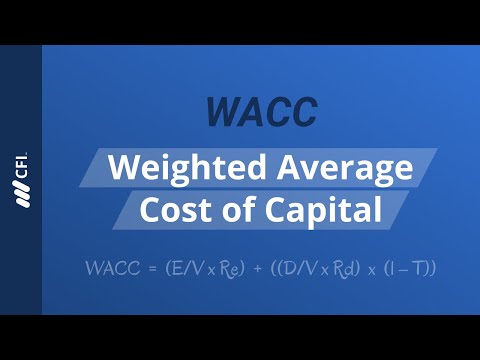

WACC - Weighted Average Cost of Capital

What is WACC - Weighted Average Cost of Capital

WACC Weighted Average Cost of Capital | Explained with Example

Weighted Average Cost of Capital (WACC) Explained

WACC explained

WEIGHTED AVERAGE COST OF CAPITAL (WACC) - FINANCIAL MANAGEMENT.

WACC - Weighted Average Cost of Capital, WACC formula and Cost of Capital explained in detail

The weighted average cost of capital (WACC) - ACCA Financial Management (FM)

WACC, Cost of Equity, and Cost of Debt in a DCF

How to Calculate Weighted Average Cost of Capital in Excel! (WACC in Excel)

Weighted Average cost of Capital (WACC) under Book Value Approach ~ Financial Management

ACCA F9 - Cost of Capital - WACC | @financeskul

FREE Webinar on Weighted Average Cost of Capital (WACC)

How to calculate Cost of Capital(WACC)

WACC (Weighted Average Cost of Capital) Formula and Definition | Learn With Finance Strategists

Understanding Cost of Debt and Calculating WACC with an example

7/10 Cost of Capital | WACC [Solution] University Question 2022 Nov |FM| kauserwise

FINANCIAL MANAGEMENT - COSTS OF CAPITAL INCLUDING WACC

W.A.C.C/How to calculate Weighted Average Cost of Capital/W.A.C.C explained with Example

Weighted Average Cost of Capital (WACC) Breakdown

FM Topic Explainer: Weighted Average Cost of Capital

Weighted Average Cost of Capital | WACC | How to Calculate WACC | ACCA | CMA | Commerce Specialist

Комментарии

0:02:16

0:02:16

0:29:17

0:29:17

0:06:28

0:06:28

0:06:40

0:06:40

0:17:01

0:17:01

0:03:43

0:03:43

0:13:57

0:13:57

0:27:55

0:27:55

0:29:35

0:29:35

0:23:59

0:23:59

0:17:56

0:17:56

0:08:26

0:08:26

0:10:02

0:10:02

0:09:27

0:09:27

0:50:38

0:50:38

0:43:40

0:43:40

0:03:10

0:03:10

0:05:55

0:05:55

0:03:39

0:03:39

0:35:29

0:35:29

0:10:59

0:10:59

0:22:03

0:22:03

0:20:04

0:20:04

0:15:54

0:15:54