filmov

tv

Understanding Cost of Debt and Calculating WACC with an example

Показать описание

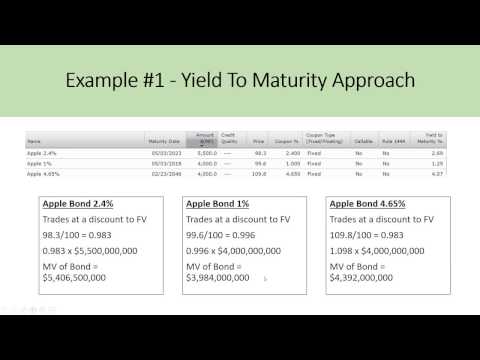

Cost of Debt is important to understand the yield to maturity (interest rate) on the current debt that the company owes. Understand it as the interest rate on your debt is the Cost of Debt. This formula is part of WACC (weighted average cost of capital. At the end of the video, we showcase an example using Cost of Equity, Cost of Debt including the tax shield to calculate the WACC.

This is the 9th of 11 videos that teach Business Finance in Section 6 and is a good starting point if you are new to Finance or need a refresher.

New videos will be posted once a week, so subscribe to keep up to date!

Make sure to subscribe and leave a comment down below saying that "I've subscribed" and we'll try to your comment. We would like to hear from you!

#businesseducation #corporatefinance #wacc #costofdebt

This is the 9th of 11 videos that teach Business Finance in Section 6 and is a good starting point if you are new to Finance or need a refresher.

New videos will be posted once a week, so subscribe to keep up to date!

Make sure to subscribe and leave a comment down below saying that "I've subscribed" and we'll try to your comment. We would like to hear from you!

#businesseducation #corporatefinance #wacc #costofdebt

Understanding Cost of Debt and Calculating WACC with an example

Equity and Debt Investors

Session 11: Costs of debt and capital

🔴 Weighted Average Cost of Capital or WACC Explained (Quickest Overview)

What is the Cost of Capital

Can you briefly describe what the after-tax cost of debt is? By Tom Anderson

Cost of Debt (Talking Head)

Cost of debt - YTM approach

FIN 401 - WACC (Cost of Debt) - Ryerson University

How to Calculate Your Debt to Income Ratios (DTI) First Time Home Buyer Know this!

Equity vs Debt Financing | Meaning, benefits & drawbacks, choosing the most suitable

WACC explained

What Everyone Gets Wrong About Global Debt | Economics Explained

COST OF CAPITAL: Cost Of Debt (ICAN SFM)

Empower yourself by simply understanding the cost of debt

Session 7: Costs of Debt and Capital

Why (1-t) tax deducted while arriving at Cost of Debt Formula? | CA Raja Classes

Cost of Capital and Cost of Equity | Business Finance

Introduction to Debt and Equity Financing

Session 11: Costs of Debt & Capital

Cost of capital | cost of debt capital | management accounting

WACC, Cost of Equity, and Cost of Debt in a DCF

Estimating The Cost Of Debt For WACC - DCF Model Insights

Cost of Equity

Комментарии

0:05:55

0:05:55

0:00:51

0:00:51

1:20:08

1:20:08

0:02:16

0:02:16

0:03:53

0:03:53

0:01:01

0:01:01

0:03:39

0:03:39

0:08:52

0:08:52

0:07:33

0:07:33

0:08:02

0:08:02

0:04:06

0:04:06

0:13:57

0:13:57

0:16:41

0:16:41

0:14:45

0:14:45

0:00:44

0:00:44

1:46:52

1:46:52

0:04:42

0:04:42

0:13:16

0:13:16

0:04:52

0:04:52

1:28:05

1:28:05

0:01:00

0:01:00

0:17:56

0:17:56

0:17:12

0:17:12

0:01:47

0:01:47