filmov

tv

What is WACC - Weighted Average Cost of Capital

Показать описание

Weighted average cost of capital (WACC) is a way to measure the required rate of return of a company. Companies can use it to measure the profitability of a project. Investors can use it in something like discounted cash flow.

★☆★ Subscribe: ★☆★

Investing Basics Playlist

Investing Books I like:

Equipment I Use:

DISCLAIMER: I am not a financial advisor. These videos are for educational purposes only. Investing of any kind involves risk. Your investments are solely your responsibility. It is crucial that you conduct your own research. I am merely sharing my opinion with no guarantee of gains or losses on investments. Please consult your financial or tax professional prior to making an investment.

#LearnToInvest #StocksToWatch #StockMarket

★☆★ Subscribe: ★☆★

Investing Basics Playlist

Investing Books I like:

Equipment I Use:

DISCLAIMER: I am not a financial advisor. These videos are for educational purposes only. Investing of any kind involves risk. Your investments are solely your responsibility. It is crucial that you conduct your own research. I am merely sharing my opinion with no guarantee of gains or losses on investments. Please consult your financial or tax professional prior to making an investment.

#LearnToInvest #StocksToWatch #StockMarket

🔴 Weighted Average Cost of Capital or WACC Explained (Quickest Overview)

What is WACC - Weighted Average Cost of Capital

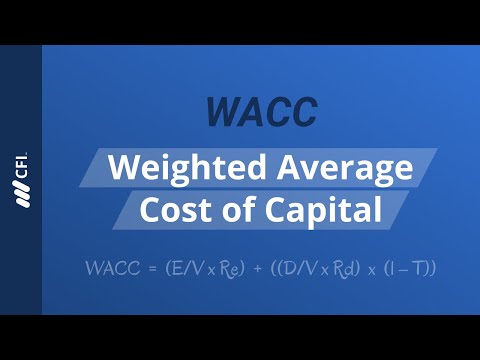

WACC - Weighted Average Cost of Capital

WACC | Was sind die Weighted Average Cost of Capital | einfach erklärt

WACC explained

Weighted Average Cost of Capital (WACC) Explained

WACC (Weighted Average Cost of Capital) Formula and Definition | Learn With Finance Strategists

WACC Weighted Average Cost of Capital | Explained with Example

WACC - Weighted Average Cost of Capital, WACC formula and Cost of Capital explained in detail

Know more about #WACC

What is WACC?

Weighted-Average Cost of Capital or WACC

What is WACC | Weighted Average Cost of Capital | Finance |

WACC (Weighted Average Cost of Capital) - Explained in Hindi |# 41 Master Investor

Weighted Average Cost of Capital (WACC)

WACC (Weighted Average Cost of Capital)

Cost of Capital (WACC)

WACC-explained in short.

WEIGHTED AVERAGE COST OF CAPITAL (WACC) - FINANCIAL MANAGEMENT.

How to Calculate Weighted Average Cost of Capital in Excel! (WACC in Excel)

Understanding the Weighted Average Cost of Capital (WACC) is key!

How to Calculate WACC (Weighted Average Cost of Capital) | DCF Valuation Part 2

The weighted average cost of capital (WACC) - ACCA Financial Management (FM)

W.A.C.C/How to calculate Weighted Average Cost of Capital/W.A.C.C explained with Example

Комментарии

0:02:16

0:02:16

0:06:40

0:06:40

0:06:28

0:06:28

0:05:11

0:05:11

0:13:57

0:13:57

0:03:43

0:03:43

0:03:10

0:03:10

0:17:01

0:17:01

0:29:35

0:29:35

0:00:50

0:00:50

0:00:06

0:00:06

0:03:24

0:03:24

0:05:08

0:05:08

0:17:13

0:17:13

0:07:42

0:07:42

0:13:10

0:13:10

0:29:17

0:29:17

0:00:47

0:00:47

0:27:55

0:27:55

0:08:26

0:08:26

0:00:33

0:00:33

0:02:00

0:02:00

0:23:59

0:23:59

0:10:59

0:10:59