filmov

tv

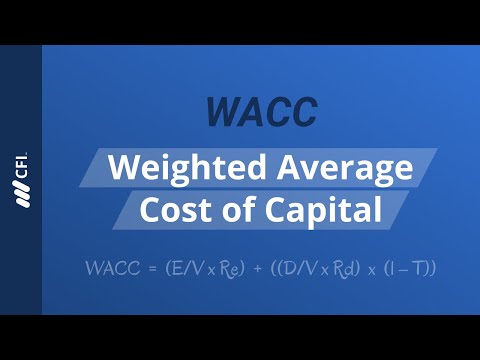

Weighted Average Cost of Capital (WACC) Explained

Показать описание

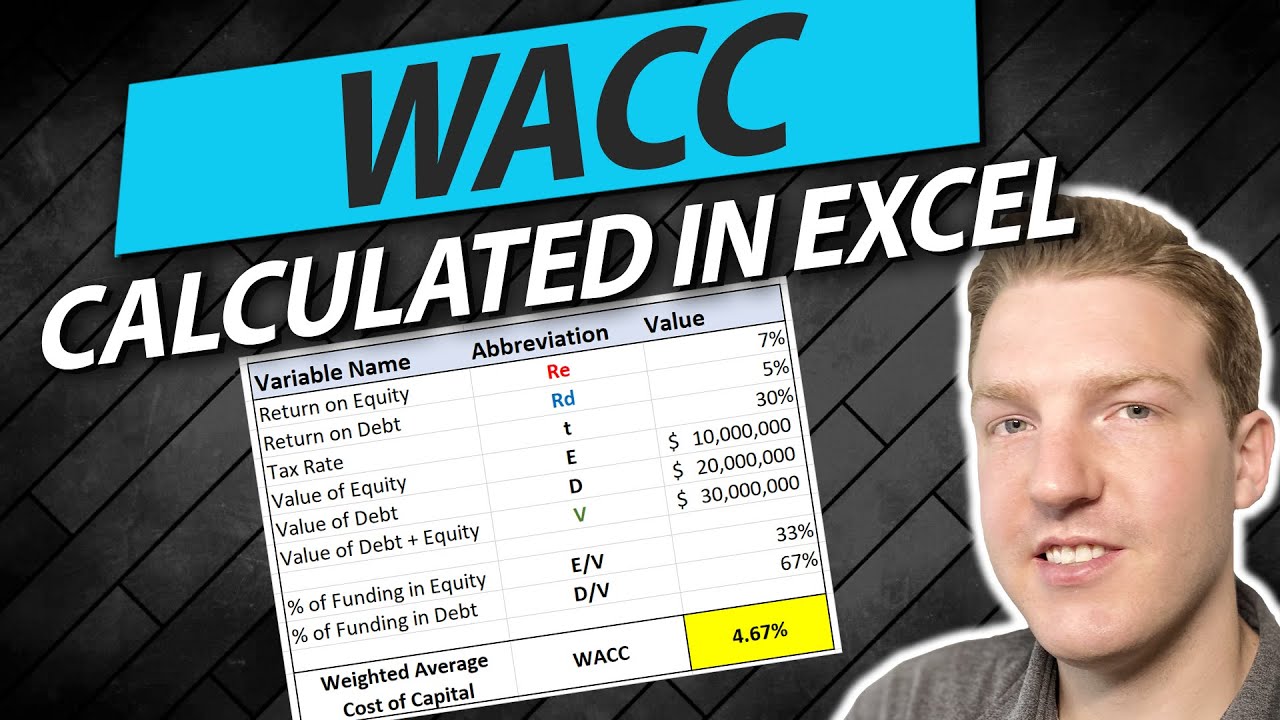

Ryan O'Connell, CFA, FRM explains how to calculate Weighted Average Cost of Capital (WACC) using Excel.

💾 Download Free Excel File:

🎓 Tutor With Me: 1-On-1 Video Call Sessions Available

Chapters:

0:00 - Debt Funding and Equity Funding Explained

0:57 - Making Debt and Equity Assumptions

2:24 - Calculate Weighted Average Cost of Capital (WACC)

Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC. Some of the links above are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase.

💾 Download Free Excel File:

🎓 Tutor With Me: 1-On-1 Video Call Sessions Available

Chapters:

0:00 - Debt Funding and Equity Funding Explained

0:57 - Making Debt and Equity Assumptions

2:24 - Calculate Weighted Average Cost of Capital (WACC)

Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC. Some of the links above are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase.

🔴 Weighted Average Cost of Capital or WACC Explained (Quickest Overview)

WACC - Weighted Average Cost of Capital

What is WACC - Weighted Average Cost of Capital

Weighted Average Cost of Capital (WACC) Explained

WACC | Was sind die Weighted Average Cost of Capital | einfach erklärt

How to Calculate Weighted Average Cost of Capital in Excel! (WACC in Excel)

WACC Weighted Average Cost of Capital | Explained with Example

WACC explained

Summary of Valuation: Measuring and Managing the Value of Companies – A NotebookLM Podcast

The weighted average cost of capital (WACC) - ACCA Financial Management (FM)

Cost of Capital (WACC)

WACC - Weighted Average Cost of Capital, WACC formula and Cost of Capital explained in detail

WEIGHTED AVERAGE COST OF CAPITAL (WACC) - FINANCIAL MANAGEMENT.

WACC (Weighted Average Cost of Capital) Formula and Definition | Learn With Finance Strategists

Weighted Average Cost of Capital (WACC) Overview

Weighted Average Cost of Capital (WACC) Breakdown

FM Topic Explainer: Weighted Average Cost of Capital

Weighted Average Cost of Capital | WACC | How to Calculate WACC | ACCA | CMA | Commerce Specialist

W.A.C.C/How to calculate Weighted Average Cost of Capital/W.A.C.C explained with Example

FREE Webinar on Weighted Average Cost of Capital (WACC)

30. Calculation of Weighted Average Cost Of Capital from Financial Management Subject

Weighted Average Cost Of Capital(WACC)

[11/12] WACC | Weighted Average Cost of Capital | Financial Management | Kauserwise

CIMA F2 Weighted Average Cost of Capital WACC - Introduction

Комментарии

0:02:16

0:02:16

0:06:28

0:06:28

0:06:40

0:06:40

0:03:43

0:03:43

0:05:11

0:05:11

0:08:26

0:08:26

0:17:01

0:17:01

0:13:57

0:13:57

0:24:45

0:24:45

0:23:59

0:23:59

0:29:17

0:29:17

0:29:35

0:29:35

0:27:55

0:27:55

0:03:10

0:03:10

0:07:17

0:07:17

0:22:03

0:22:03

0:20:04

0:20:04

0:15:54

0:15:54

0:10:59

0:10:59

0:50:38

0:50:38

0:16:14

0:16:14

0:28:23

0:28:23

![[11/12] WACC |](https://i.ytimg.com/vi/A00WooVsZ3s/hqdefault.jpg) 0:03:32

0:03:32

0:06:16

0:06:16