filmov

tv

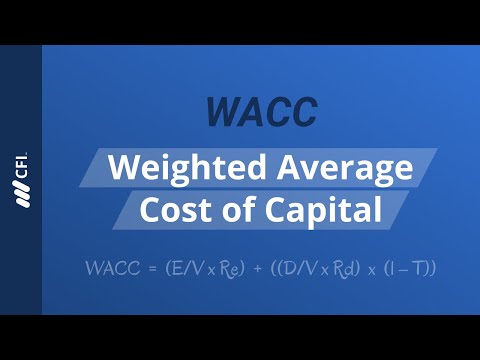

WACC - Weighted Average Cost of Capital, WACC formula and Cost of Capital explained in detail

Показать описание

WACC - Weighted Average Cost of Capital, WACC formula and Cost of Capital explained in detail

WACC.

Goal for this Video: 1 Like and 1 subscribe click from you. Please can you help me in this goal?

Topics to learn in sequence after this video.

1. Learn Capital Budgeting Techniques)

Skip it: WACC (You already learnt it here, so you can skip it).

2. Learn CAPM (Capital Assest Pricing Model)

3. Learn Beta Analysis

4. Learn Sharpe Raito

5. Learn Financial Accounting

6. Learn DCF (Discounted Cash flow)

7. Learn MIRR (Modified Internal Rate of Return)

8. Learn Company Valuations

Disclaimer:

=====================================================

Disclaimer: Some contents are used for educational purposes under fair use.

Copyright Disclaimer under Section 107 of the Copyright Act 1976, allowance is made for "Fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship, and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use.

=====================================================

Keywords:

корпоративные финансы

средневзвешенная стоимость капитала

wacc berechnen

wacc

capm

wacc tax shield

cost of equity share capital

cost of capital

cost of equity

wacc erklärung deutsch

cost of preference

cost of preference share capital

cost of preference shares

wacc erklart

wacc finance

wacc and capm

capm in wacc

wacc capm

weighted average cost of capital

wacc explained simply

wacc weighted average cost of capital

cost of debt

what is cost of debt

dcf valuation

how to calculate wacc

wacc calculation

wacc definition

wacc dcf

calculation of weighted average cost of capital

wacc explained

corporate finance wacc

what is wacc in corporate finance

weighted average cost of capital explained

wacc cost of capital

how to calculate weighted average cost of capital

weighted average cost of capital explained simply

weighted average cost of capital example

weighted average cost of capital calculation

cost of debt.

wacc formula

wacc example

how to use weighted average cost of capital

what is cost of capital

what is wacc

how to use wacc

how to find wacc

wacc rate

how to calculate wacc in excel

como wacc finbox

how wacc is calculated nepali

que montos se considera para el wacc de una empresa

how to edit wacc calculation meroshare

how to calculate wacc and edis and my purchase sourse from edis

how to calculate wacc in share sansar

what is wacc hindi

how calculation of wacc

how to calculate wacc no debt

como descobrir o wacc

how to do wacc payment nepse

como sacar el wacc en excel

how to calculate wacc for bonus share

what are the projects npv assuming the wacc will change

how to find the ratio of wacc math

how to know wacc

what is cost of capital and wacc

how to find wacc of private company

how to do wacc of a company

how to count wacc from financial statements

how to determine cost of debt for wacc

what is wacc calculation

como calcular wacc en excel

como calcular wacc

how to calculate wacc from annual report

which company should choose wacc excel

how to do wacc calculation

WACC.

Goal for this Video: 1 Like and 1 subscribe click from you. Please can you help me in this goal?

Topics to learn in sequence after this video.

1. Learn Capital Budgeting Techniques)

Skip it: WACC (You already learnt it here, so you can skip it).

2. Learn CAPM (Capital Assest Pricing Model)

3. Learn Beta Analysis

4. Learn Sharpe Raito

5. Learn Financial Accounting

6. Learn DCF (Discounted Cash flow)

7. Learn MIRR (Modified Internal Rate of Return)

8. Learn Company Valuations

Disclaimer:

=====================================================

Disclaimer: Some contents are used for educational purposes under fair use.

Copyright Disclaimer under Section 107 of the Copyright Act 1976, allowance is made for "Fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship, and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use.

=====================================================

Keywords:

корпоративные финансы

средневзвешенная стоимость капитала

wacc berechnen

wacc

capm

wacc tax shield

cost of equity share capital

cost of capital

cost of equity

wacc erklärung deutsch

cost of preference

cost of preference share capital

cost of preference shares

wacc erklart

wacc finance

wacc and capm

capm in wacc

wacc capm

weighted average cost of capital

wacc explained simply

wacc weighted average cost of capital

cost of debt

what is cost of debt

dcf valuation

how to calculate wacc

wacc calculation

wacc definition

wacc dcf

calculation of weighted average cost of capital

wacc explained

corporate finance wacc

what is wacc in corporate finance

weighted average cost of capital explained

wacc cost of capital

how to calculate weighted average cost of capital

weighted average cost of capital explained simply

weighted average cost of capital example

weighted average cost of capital calculation

cost of debt.

wacc formula

wacc example

how to use weighted average cost of capital

what is cost of capital

what is wacc

how to use wacc

how to find wacc

wacc rate

how to calculate wacc in excel

como wacc finbox

how wacc is calculated nepali

que montos se considera para el wacc de una empresa

how to edit wacc calculation meroshare

how to calculate wacc and edis and my purchase sourse from edis

how to calculate wacc in share sansar

what is wacc hindi

how calculation of wacc

how to calculate wacc no debt

como descobrir o wacc

how to do wacc payment nepse

como sacar el wacc en excel

how to calculate wacc for bonus share

what are the projects npv assuming the wacc will change

how to find the ratio of wacc math

how to know wacc

what is cost of capital and wacc

how to find wacc of private company

how to do wacc of a company

how to count wacc from financial statements

how to determine cost of debt for wacc

what is wacc calculation

como calcular wacc en excel

como calcular wacc

how to calculate wacc from annual report

which company should choose wacc excel

how to do wacc calculation

Комментарии

0:06:40

0:06:40

0:06:28

0:06:28

0:02:16

0:02:16

0:03:43

0:03:43

0:17:01

0:17:01

0:03:10

0:03:10

0:05:11

0:05:11

0:13:57

0:13:57

0:02:00

0:02:00

0:08:26

0:08:26

0:29:35

0:29:35

0:18:23

0:18:23

0:22:03

0:22:03

0:07:17

0:07:17

0:03:24

0:03:24

0:10:52

0:10:52

0:23:59

0:23:59

0:27:29

0:27:29

0:10:59

0:10:59

0:13:10

0:13:10

0:28:23

0:28:23

0:09:50

0:09:50

0:29:17

0:29:17

0:03:51

0:03:51