filmov

tv

What is WACC?

Показать описание

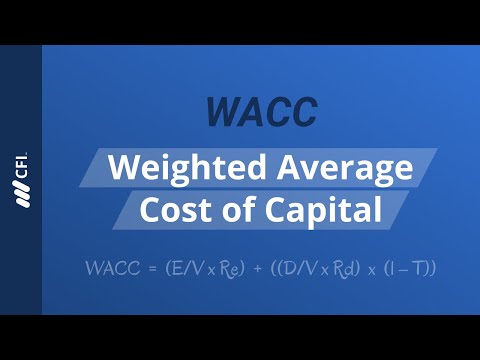

WACC (‘Weighted Average Cost of Capital’).

This Weighted Average reflects the blended average return for all providers of capital to the company. We call this blended average return the Weighted Average Cost of Capital.

Weighted Average Cost of Capital (WACC) Components:

✅Debt / (Debt + Equity) – the value of Debt (typically Book Value) relative to the total value of Debt + Equity.

✅Cost of Debt (Kd) – the current blended return expected by Lenders to the Company. Typically calculated as the weighted average Yield to Maturity for all components of the Company’s Debt. Note that we look at the Cost of Debt on an after-tax basis because Interest is tax-deductible, which lowers the true Cost of Debt.

✅Debt / (Debt + Equity) – the value of Equity (always Market Value) relative to the total value of Debt + Equity.

✅Cost of Equity (Ke) – the level of Return expected by Investors in the Business which is calculated using the Capital Asset Pricing Model (or ‘CAPM’) formula.

𝗙𝗼𝗹𝗹𝗼𝘄 @FinanceableTraining for more investment banking interview prep.

💡𝗥𝗲𝗮𝗱𝘆 𝘁𝗼 𝗯𝗿𝗲𝗮𝗸 𝗶𝗻𝘁𝗼 𝗙𝗶𝗻𝗮𝗻𝗰𝗲? 𝗪𝗲 𝗼𝗳𝗳𝗲𝗿 𝗮 𝗯𝘂𝗻𝗰𝗵 𝗼𝗳 𝗳𝗿𝗲𝗲 𝗿𝗲𝘀𝗼𝘂𝗿𝗰𝗲𝘀 𝘁𝗵𝗮𝘁 𝗰𝗮𝗻 𝗵𝗲𝗹𝗽 𝘆𝗼𝘂 𝗴𝗲𝘁 𝗼𝗻 𝘁𝗵𝗲 𝗽𝗮𝘁𝗵.

🔗𝗦𝗲𝗲 𝗹𝗶𝗻𝗸 𝗶𝗻 𝗯𝗶𝗼

#investmentbanking #privateequity #financecareers #financejobs #interviewprep #wacc

This Weighted Average reflects the blended average return for all providers of capital to the company. We call this blended average return the Weighted Average Cost of Capital.

Weighted Average Cost of Capital (WACC) Components:

✅Debt / (Debt + Equity) – the value of Debt (typically Book Value) relative to the total value of Debt + Equity.

✅Cost of Debt (Kd) – the current blended return expected by Lenders to the Company. Typically calculated as the weighted average Yield to Maturity for all components of the Company’s Debt. Note that we look at the Cost of Debt on an after-tax basis because Interest is tax-deductible, which lowers the true Cost of Debt.

✅Debt / (Debt + Equity) – the value of Equity (always Market Value) relative to the total value of Debt + Equity.

✅Cost of Equity (Ke) – the level of Return expected by Investors in the Business which is calculated using the Capital Asset Pricing Model (or ‘CAPM’) formula.

𝗙𝗼𝗹𝗹𝗼𝘄 @FinanceableTraining for more investment banking interview prep.

💡𝗥𝗲𝗮𝗱𝘆 𝘁𝗼 𝗯𝗿𝗲𝗮𝗸 𝗶𝗻𝘁𝗼 𝗙𝗶𝗻𝗮𝗻𝗰𝗲? 𝗪𝗲 𝗼𝗳𝗳𝗲𝗿 𝗮 𝗯𝘂𝗻𝗰𝗵 𝗼𝗳 𝗳𝗿𝗲𝗲 𝗿𝗲𝘀𝗼𝘂𝗿𝗰𝗲𝘀 𝘁𝗵𝗮𝘁 𝗰𝗮𝗻 𝗵𝗲𝗹𝗽 𝘆𝗼𝘂 𝗴𝗲𝘁 𝗼𝗻 𝘁𝗵𝗲 𝗽𝗮𝘁𝗵.

🔗𝗦𝗲𝗲 𝗹𝗶𝗻𝗸 𝗶𝗻 𝗯𝗶𝗼

#investmentbanking #privateequity #financecareers #financejobs #interviewprep #wacc

What is WACC - Weighted Average Cost of Capital

🔴 Weighted Average Cost of Capital or WACC Explained (Quickest Overview)

WACC explained

WACC - Weighted Average Cost of Capital

What is WACC?

What is WACC?

Weighted Average Cost of Capital (WACC) Explained

WACC Weighted Average Cost of Capital | Explained with Example

Know more about #WACC

WACC (Weighted Average Cost of Capital) Formula and Definition | Learn With Finance Strategists

WACC-explained in short.

WACC Explained in Plain English

WACC (Weighted Average Cost of Capital) - Explained in Hindi |# 41 Master Investor

What is WACC | Weighted Average Cost of Capital | Finance |

Understanding Cost of Debt and Calculating WACC with an example

Weighted Average Cost of Capital | WACC | CFA, MBA in Finance | Cost of capital formulas | (Hindi)

What is WACC

What is WACC?

WACC | Was sind die Weighted Average Cost of Capital | einfach erklärt

Weighted Average Cost of Capital | WACC | How to Calculate WACC | ACCA | CMA | Commerce Specialist

WACC, Cost of Equity, and Cost of Debt in a DCF

What is WACC? #personalfinance #investments #finance #business

What is WACC ( Weighted Average Cost of Capital) | How to Calculate | Concept of Wacc

Cost of Capital (WACC)

Комментарии

0:06:40

0:06:40

0:02:16

0:02:16

0:13:57

0:13:57

0:06:28

0:06:28

0:06:41

0:06:41

0:00:06

0:00:06

0:03:43

0:03:43

0:17:01

0:17:01

0:00:50

0:00:50

0:03:10

0:03:10

0:00:47

0:00:47

0:00:52

0:00:52

0:17:13

0:17:13

0:05:08

0:05:08

0:05:55

0:05:55

0:09:06

0:09:06

0:17:32

0:17:32

0:00:12

0:00:12

0:05:11

0:05:11

0:15:54

0:15:54

0:17:56

0:17:56

0:00:54

0:00:54

0:12:29

0:12:29

0:29:17

0:29:17