filmov

tv

The Right Way to do a Monthly Budget

Показать описание

The Right Way to do a Monthly Budget

Sponsors pay the producer of this show, The Lampo Group, LLC, advertising fees for mentioning their services or products during programming. Advertising fees are not based upon or otherwise tied to any product sale or business transacted between any consumer or sponsor. The following sponsors have paid for the programming you are viewing: Christian Healthcare Ministries

Ramsey Solutions Privacy Policy

The RIGHT Way to Do Work-Life Balance | Simon Sinek

HIIT vs HIRT | How to Do a Sprint Workout the RIGHT Way

How To Do A Glute Bridge | The Right Way | Well+Good

THERE IS ONE WAY TO DO THINGS RIGHT - Jordan Peterson | Powerful Life Advice

Do YOU know the right way to use a can opener?

How To Do A Push-Up | The Right Way | Well+Good

The RIGHT Way To Do Push-Ups (PERFECT FORM)

How To Do A Burpee | The Right Way | Well+Good

The RIGHT Way To Do Push Ups

How to Plank | The Right Way | Well+Good

How To Do Surya Namaskar (The Right Way)

How to do a Superman | The Right Way | Well+Good

How to do ab wheel rollouts the right way

How to do a Reverse Plank | The Right Way | Well+Good

The Right Way to Do a Glute Bridge

How To Do A Sun Salutation | The Right Way | Well+Good

How To Do A Kettlebell Swing | The Right Way | Well+Good

How to Do Mountain Climbers | The Right Way | Well+Good

HOW TO DO SUBPLOTS - THE RIGHT WAY

How To Do Pigeon Pose | The Right Way | Well+Good

The RIGHT Way To Do Facebook Targeting For Local Businesses

The RIGHT Way to Make an Essay Longer #shorts

The Right Way

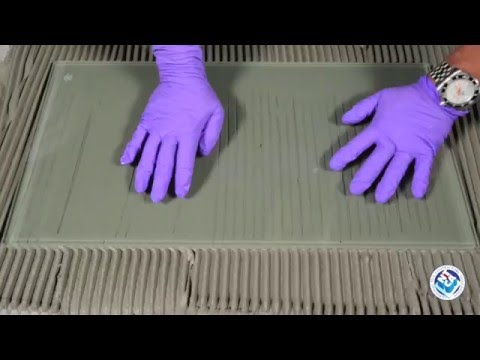

Trowel and Error - How to Set Tile the Right Way

Комментарии

0:02:50

0:02:50

0:05:31

0:05:31

0:02:09

0:02:09

0:03:37

0:03:37

0:00:24

0:00:24

0:02:40

0:02:40

0:04:54

0:04:54

0:03:24

0:03:24

0:03:31

0:03:31

0:01:03

0:01:03

0:01:00

0:01:00

0:01:47

0:01:47

0:03:18

0:03:18

0:01:32

0:01:32

0:00:29

0:00:29

0:03:54

0:03:54

0:02:33

0:02:33

0:01:17

0:01:17

0:08:55

0:08:55

0:03:32

0:03:32

0:15:07

0:15:07

0:00:30

0:00:30

0:03:27

0:03:27

0:06:36

0:06:36