filmov

tv

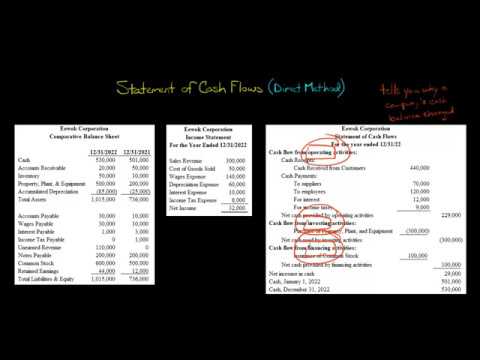

Statement of cash Flow: Direct Method. Intermediate Accounting

Показать описание

In this video, we cover the statement of cash using the direct method.

The cash flow direct method is a way of preparing the cash flow statement, which is one of the key financial statements used by businesses to track their financial health. This method provides a detailed record of cash inflows and outflows from the company's operating activities over a specific period, usually a month, quarter, or year. Unlike the indirect method, which starts with net income and adjusts for non-cash transactions, the direct method lists all the major cash receipts and payments during the period.

Here's a breakdown of how the cash flow direct method works:

Cash Inflows

These typically include:

Cash received from customers: Reflects the cash collected from sales of goods or services.

Cash received from interest and dividends: Represents the cash earned from interest on investments and dividends from equity investments.

Cash Outflows

These usually cover:

Cash paid to suppliers: Reflects the cash paid for inventory or raw materials.

Cash paid to employees: Represents the salaries, wages, and other compensation paid to employees.

Cash paid for operating expenses: Includes cash spent on rent, utilities, and other day-to-day operating expenses.

Cash paid for interest: Reflects the interest payments on loans and borrowings.

Cash paid for taxes: Represents the cash paid for various taxes.

Advantages of the Direct Method

Transparency: Offers a clear view of actual cash transactions, making it easier for stakeholders to understand how cash is generated and spent.

Useful for management: Provides detailed information that can help in managing cash flow more effectively.

Challenges with the Direct Method

Data collection: Requires detailed tracking of all cash transactions, which can be cumbersome and resource-intensive.

Less common: Many businesses prefer the indirect method for its simplicity and because it ties closely to the income statement prepared on an accrual basis.

Although the direct method provides a more transparent view of cash flows, many companies opt for the indirect method due to its practicality, especially since it requires less granular data collection. However, for internal management purposes, the detailed information provided by the direct method can be invaluable for decision-making and financial planning.

#cpaexaminindia #cpaexam #accountingstudent

The cash flow direct method is a way of preparing the cash flow statement, which is one of the key financial statements used by businesses to track their financial health. This method provides a detailed record of cash inflows and outflows from the company's operating activities over a specific period, usually a month, quarter, or year. Unlike the indirect method, which starts with net income and adjusts for non-cash transactions, the direct method lists all the major cash receipts and payments during the period.

Here's a breakdown of how the cash flow direct method works:

Cash Inflows

These typically include:

Cash received from customers: Reflects the cash collected from sales of goods or services.

Cash received from interest and dividends: Represents the cash earned from interest on investments and dividends from equity investments.

Cash Outflows

These usually cover:

Cash paid to suppliers: Reflects the cash paid for inventory or raw materials.

Cash paid to employees: Represents the salaries, wages, and other compensation paid to employees.

Cash paid for operating expenses: Includes cash spent on rent, utilities, and other day-to-day operating expenses.

Cash paid for interest: Reflects the interest payments on loans and borrowings.

Cash paid for taxes: Represents the cash paid for various taxes.

Advantages of the Direct Method

Transparency: Offers a clear view of actual cash transactions, making it easier for stakeholders to understand how cash is generated and spent.

Useful for management: Provides detailed information that can help in managing cash flow more effectively.

Challenges with the Direct Method

Data collection: Requires detailed tracking of all cash transactions, which can be cumbersome and resource-intensive.

Less common: Many businesses prefer the indirect method for its simplicity and because it ties closely to the income statement prepared on an accrual basis.

Although the direct method provides a more transparent view of cash flows, many companies opt for the indirect method due to its practicality, especially since it requires less granular data collection. However, for internal management purposes, the detailed information provided by the direct method can be invaluable for decision-making and financial planning.

#cpaexaminindia #cpaexam #accountingstudent

Комментарии

0:12:12

0:12:12

0:08:09

0:08:09

0:18:13

0:18:13

0:29:38

0:29:38

0:21:21

0:21:21

0:05:57

0:05:57

0:04:47

0:04:47

0:15:10

0:15:10

0:12:02

0:12:02

0:06:50

0:06:50

0:06:00

0:06:00

0:14:44

0:14:44

0:05:43

0:05:43

0:11:15

0:11:15

0:05:17

0:05:17

0:14:39

0:14:39

0:13:26

0:13:26

0:25:12

0:25:12

0:06:58

0:06:58

0:00:44

0:00:44

0:10:21

0:10:21

0:09:16

0:09:16

0:55:56

0:55:56

0:16:57

0:16:57