filmov

tv

Direct vs. Indirect Method Statement of Cash Flows

Показать описание

This video compares and contrasts the direct method for preparing the Statement of Cash Flows to the indirect method for preparing the Statement of Cash Flows.

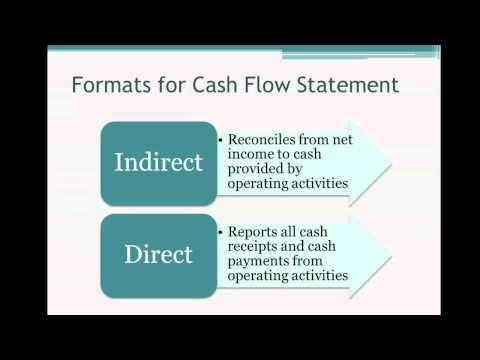

Regardless of whether the indirect method or direct method is used, the Statement of Cash Flows has three sections: operating, investing, and financing. The investing section and financing section are prepared in the exact same way for the indirect method and direct method. Thus, it is the way in which the operating section is prepared that makes the indirect method and direct method different.

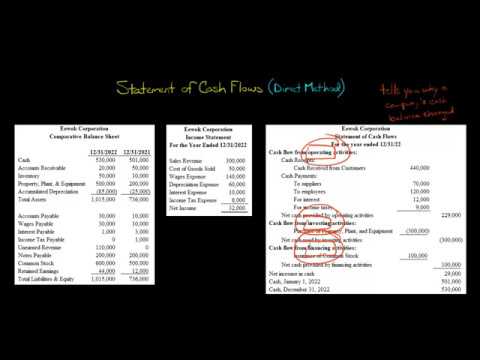

With the direct method, the operating section of the Statement of Cash Flows is simply a cash-basis Income Statement. Thus, the operating section is prepared by going line-by-line through the company's Income Statement and converting each line item to its cash-basis (sales revenue is converted to cash received from customers, cost of goods sold is converted to cash paid to suppliers, etc.). Non-cash charges such as depreciation expense are not included in the operating section because they do not affect cash and would not appear in a cash-basis Income Statement.

In contrast, the indirect method calls for the operating section to be prepared by starting with Net Income (from the Income Statement) and making adjustments to Net Income. The adjustments are based on changes in the company's current assets and current liabilities. Also, non-cash charges such as depreciation expense or impairment charges are added back to Net Income as an adjustment (also, any gains are subtracted from Net Income as an adjustment).

You obtain the same Net Cash Flow from Operating Activities whether the direct method or indirect method is used. The direct method's operating section is easier to understand because all cash receipts and cash payments are clearly listed, but the indirect method is much more frequently used by companies.—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

Regardless of whether the indirect method or direct method is used, the Statement of Cash Flows has three sections: operating, investing, and financing. The investing section and financing section are prepared in the exact same way for the indirect method and direct method. Thus, it is the way in which the operating section is prepared that makes the indirect method and direct method different.

With the direct method, the operating section of the Statement of Cash Flows is simply a cash-basis Income Statement. Thus, the operating section is prepared by going line-by-line through the company's Income Statement and converting each line item to its cash-basis (sales revenue is converted to cash received from customers, cost of goods sold is converted to cash paid to suppliers, etc.). Non-cash charges such as depreciation expense are not included in the operating section because they do not affect cash and would not appear in a cash-basis Income Statement.

In contrast, the indirect method calls for the operating section to be prepared by starting with Net Income (from the Income Statement) and making adjustments to Net Income. The adjustments are based on changes in the company's current assets and current liabilities. Also, non-cash charges such as depreciation expense or impairment charges are added back to Net Income as an adjustment (also, any gains are subtracted from Net Income as an adjustment).

You obtain the same Net Cash Flow from Operating Activities whether the direct method or indirect method is used. The direct method's operating section is easier to understand because all cash receipts and cash payments are clearly listed, but the indirect method is much more frequently used by companies.—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

Комментарии

0:05:57

0:05:57

0:04:47

0:04:47

0:09:29

0:09:29

0:12:12

0:12:12

0:11:15

0:11:15

0:04:48

0:04:48

0:09:16

0:09:16

0:07:37

0:07:37

0:12:32

0:12:32

0:14:25

0:14:25

0:08:11

0:08:11

0:15:10

0:15:10

0:21:21

0:21:21

0:29:15

0:29:15

0:08:09

0:08:09

0:06:34

0:06:34

0:08:05

0:08:05

0:18:13

0:18:13

0:14:44

0:14:44

0:08:15

0:08:15

0:04:41

0:04:41

0:21:15

0:21:15

0:04:50

0:04:50

0:13:26

0:13:26