filmov

tv

Statement of Cash Flows: Direct Method - Lesson 2

Показать описание

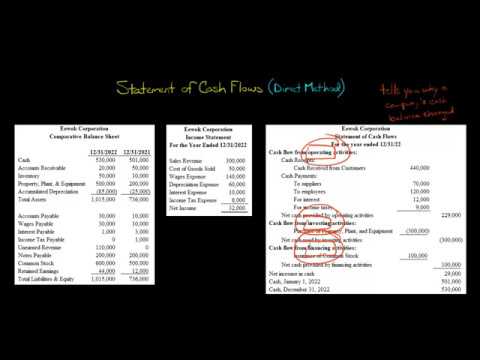

In this video, 25.03 – Statement of Cash Flows: Direct Method – Lesson 2, ever wonder what effect an increase in accounts receivable has on the statement of cash flows? Or how about an increase in accounts payable and an increase in inventory and how do those affect the statement of cash flows? Find out in this thrilling video! Continuing from the statement of cash flows example set up in Lesson 1, Roger Philipp, CPA, CGMA, provides several changes to balance sheet accounts during the year and shows us how to analyze these changes for their effects on operating activities cash flows.

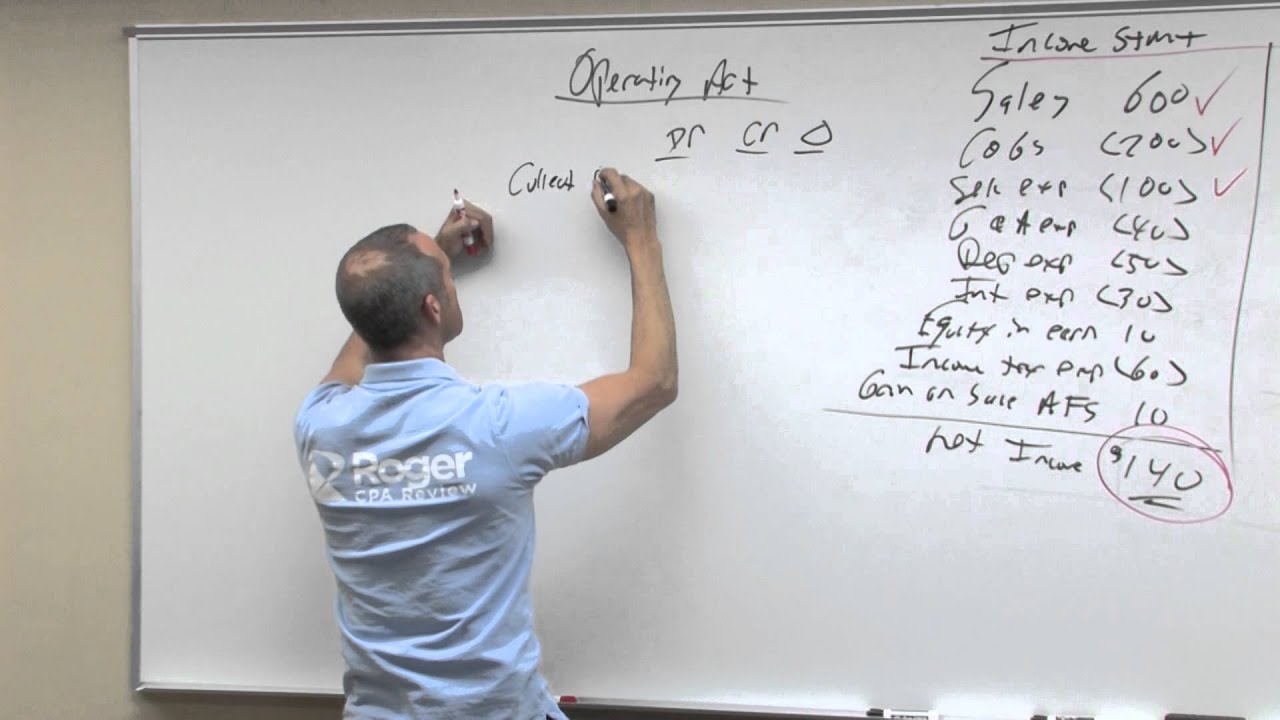

He sets up the T-accounts for these balance sheet accounts on the whiteboard, continually reinforcing basic accounting concepts such as debits increasing assets and credits increasing liabilities. Next, he applies the direct method for calculating cash flows to the increase in accounts receivable, using Sales from the income statement to set up the journal entry to solve for operating cash flows resulting from cash collections from customers.

Finally, the direct method is applied to the increases in accounts payable and inventory, which are set up in a summarizing journal entry with Cost of Goods Sold from the income statement to solve for cash flows from payments for purchases. Stay tuned for more direct method magic in the next lesson!

Connect with us:

Video Transcript Sneak Peek:

Now, it mentions here selected balance sheet account changes. And you'll see here, for example, accounts receivable. Now, it's important to know, it says increase or decrease. If it's an asset, it goes up, then that would be a debit. So, what this means is during the year, this account changed by $80. Now, I'm going to put it here as a debit to 80 cause, that's an increase. We're going to have to figure out what goes here to cause the change.

Now receivables would go up because you had sales that weren't collected in cash. Hmm, so that would mean some of the sales may not have been cash. They may have been an IOU called a receivable. We have increase in investment under equity method. So that would be your investment under the equity method. So that would go up by 10 that went up by 10. We've got an increase in inventory of 30. So, we have inventory, 30. And again, this isn't the balance it's the change. We have accounts payable, which went up by 20.

He sets up the T-accounts for these balance sheet accounts on the whiteboard, continually reinforcing basic accounting concepts such as debits increasing assets and credits increasing liabilities. Next, he applies the direct method for calculating cash flows to the increase in accounts receivable, using Sales from the income statement to set up the journal entry to solve for operating cash flows resulting from cash collections from customers.

Finally, the direct method is applied to the increases in accounts payable and inventory, which are set up in a summarizing journal entry with Cost of Goods Sold from the income statement to solve for cash flows from payments for purchases. Stay tuned for more direct method magic in the next lesson!

Connect with us:

Video Transcript Sneak Peek:

Now, it mentions here selected balance sheet account changes. And you'll see here, for example, accounts receivable. Now, it's important to know, it says increase or decrease. If it's an asset, it goes up, then that would be a debit. So, what this means is during the year, this account changed by $80. Now, I'm going to put it here as a debit to 80 cause, that's an increase. We're going to have to figure out what goes here to cause the change.

Now receivables would go up because you had sales that weren't collected in cash. Hmm, so that would mean some of the sales may not have been cash. They may have been an IOU called a receivable. We have increase in investment under equity method. So that would be your investment under the equity method. So that would go up by 10 that went up by 10. We've got an increase in inventory of 30. So, we have inventory, 30. And again, this isn't the balance it's the change. We have accounts payable, which went up by 20.

Комментарии

0:12:12

0:12:12

0:08:09

0:08:09

0:18:13

0:18:13

0:21:21

0:21:21

0:29:38

0:29:38

0:05:57

0:05:57

0:04:47

0:04:47

0:05:17

0:05:17

1:14:05

1:14:05

0:05:43

0:05:43

0:14:39

0:14:39

0:06:50

0:06:50

0:14:44

0:14:44

0:15:10

0:15:10

0:09:16

0:09:16

0:05:02

0:05:02

0:04:11

0:04:11

0:11:15

0:11:15

0:55:56

0:55:56

0:03:56

0:03:56

0:21:09

0:21:09

0:21:15

0:21:15

0:20:29

0:20:29

0:25:12

0:25:12