filmov

tv

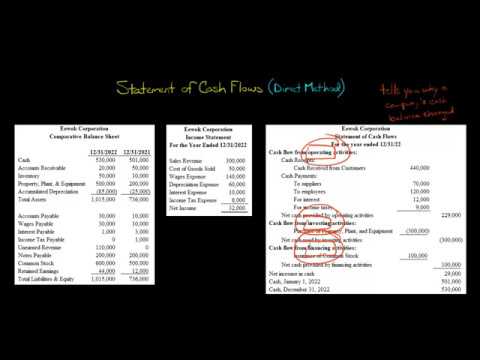

Statement of Cash Flows: Direct Method - Lesson 1

Показать описание

In this video, 25.03 – Statement of Cash Flows: Direct Method – Lesson 1, Roger Philipp, CPA, CGMA, first compares and contrasts the two methods for calculating operating activities cash flows.

The direct method requires directly analyzing each item on the income statement and converting it from accrual to cash. The indirect method involves starting with net income and indirectly reconciling back to the ending balance on the statement of cash flows via a series of analysis and adjustments.

Roger then moves from theory to application by setting up a statement of cash flows example for teaching the direct method.

Video Transcript Sneak Peek:

Ok, let's move on to operating activity section. Now remember we talked about the statement and cash flows, we said three main areas. Which are what? It's called operating, investing, and financing, then we have our net change, and so on. The thing is, there are two ways to do the operating activity section. So when we talked about net cash provided by operating activities, we ended up with this number here, which was $135.

The direct method requires directly analyzing each item on the income statement and converting it from accrual to cash. The indirect method involves starting with net income and indirectly reconciling back to the ending balance on the statement of cash flows via a series of analysis and adjustments.

Roger then moves from theory to application by setting up a statement of cash flows example for teaching the direct method.

Video Transcript Sneak Peek:

Ok, let's move on to operating activity section. Now remember we talked about the statement and cash flows, we said three main areas. Which are what? It's called operating, investing, and financing, then we have our net change, and so on. The thing is, there are two ways to do the operating activity section. So when we talked about net cash provided by operating activities, we ended up with this number here, which was $135.

Комментарии

0:12:12

0:12:12

0:18:13

0:18:13

0:08:09

0:08:09

0:29:38

0:29:38

0:21:21

0:21:21

0:05:57

0:05:57

0:06:50

0:06:50

0:04:47

0:04:47

0:27:10

0:27:10

0:05:17

0:05:17

0:05:43

0:05:43

0:21:15

0:21:15

0:06:00

0:06:00

0:15:10

0:15:10

0:14:44

0:14:44

0:55:56

0:55:56

0:13:26

0:13:26

0:14:39

0:14:39

0:11:15

0:11:15

0:06:58

0:06:58

0:25:12

0:25:12

0:09:16

0:09:16

0:05:02

0:05:02

0:16:57

0:16:57