filmov

tv

Standard Deviation | Investment Basics #14

Показать описание

In 2017, a standardized methodology for classifying risk was adopted by conventional mutual funds as well as exchange-traded funds. Prior to that, fund managers would assign the fund a risk rating. However, "medium" risk could also mean slightly different things to different fund managers.

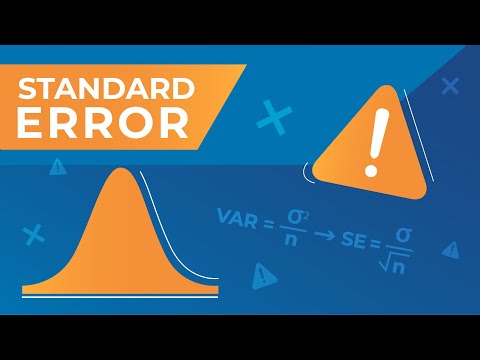

The standardized methodology ranks funds by standard deviation as the sole measure of risk. Under this system, if a fund has a standard deviation of less than 6, it is considered a low-risk fund. On the other hand, if a fund has a standard deviation of 20 more, it's considered a high-risk fund. There is no need to memorize the various ratings as you can always look them up. However, you should know that funds are ranked according to standard deviation. This will be much easier for you to understand and remember if you have an understanding of what standard deviation of returns refers to.

-----------

Follow our social media channels:

-----------

About SeeWhy Learning:

SeeWhy Financial Learning Inc. is a Canadian company based in Milton, Ontario. All of SeeWhy Learning's exam preparation course materials and study tools are created in-house by professional, industry-leading, expert trainers and course writers. Online, email and telephone support are also in-house and staffed by industry and IT experienced team members.

The founders and support management of SeeWhy Financial Learning have over 35 years of combined experience coaching and assisting thousands of students through their financial services education and regulatory exams with tremendous success.

After hearing a topic explained properly by one of our trainers, our students often say,"Why doesn't the textbook just teach it that way?". Frankly, we're not sure, so we started our own company! We have a knack for making concepts seem easy.

The standardized methodology ranks funds by standard deviation as the sole measure of risk. Under this system, if a fund has a standard deviation of less than 6, it is considered a low-risk fund. On the other hand, if a fund has a standard deviation of 20 more, it's considered a high-risk fund. There is no need to memorize the various ratings as you can always look them up. However, you should know that funds are ranked according to standard deviation. This will be much easier for you to understand and remember if you have an understanding of what standard deviation of returns refers to.

-----------

Follow our social media channels:

-----------

About SeeWhy Learning:

SeeWhy Financial Learning Inc. is a Canadian company based in Milton, Ontario. All of SeeWhy Learning's exam preparation course materials and study tools are created in-house by professional, industry-leading, expert trainers and course writers. Online, email and telephone support are also in-house and staffed by industry and IT experienced team members.

The founders and support management of SeeWhy Financial Learning have over 35 years of combined experience coaching and assisting thousands of students through their financial services education and regulatory exams with tremendous success.

After hearing a topic explained properly by one of our trainers, our students often say,"Why doesn't the textbook just teach it that way?". Frankly, we're not sure, so we started our own company! We have a knack for making concepts seem easy.

Комментарии

0:02:42

0:02:42

0:07:49

0:07:49

0:01:47

0:01:47

0:02:57

0:02:57

0:10:45

0:10:45

0:04:37

0:04:37

0:01:32

0:01:32

0:11:21

0:11:21

0:52:14

0:52:14

0:15:16

0:15:16

0:04:41

0:04:41

1:28:38

1:28:38

0:16:48

0:16:48

0:02:55

0:02:55

0:06:35

0:06:35

0:03:23

0:03:23

0:07:20

0:07:20

0:02:03

0:02:03

0:01:23

0:01:23

0:07:06

0:07:06

0:02:17

0:02:17

0:01:11

0:01:11

0:09:59

0:09:59

0:01:04

0:01:04