filmov

tv

Understanding Standard Deviation

Показать описание

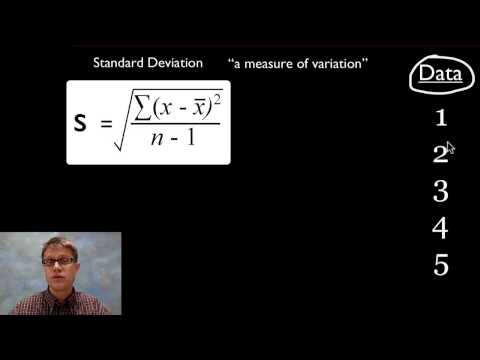

In this video we cover the basics of standard deviation, which is used by investors to quantify their exposure to total risk. It is also used to determine a range of returns around the investment’s average return.

Standard deviation (simply explained)

Standard deviation Simply Explained

The Standard Deviation (and Variance) Explained in One Minute: From Concept to Definition & Form...

Understanding Standard Deviation

Measures of Variability (Range, Standard Deviation, Variance)

How To Calculate The Standard Deviation

Calculating the Mean, Variance and Standard Deviation, Clearly Explained!!!

Standard Deviation and Variance

Basics of statistics #stats#statistics #mean #median#mode #standarddeviation #datascience #machine

Mode, Median, Mean, Range, and Standard Deviation (1.3)

Standard Deviation Formula, Statistics, Variance, Sample and Population Mean

Understanding Standard deviation and other measures of spread in statistics

Standard Deviation

Standard Deviation explained

Variance and Standard Deviation: Why divide by n-1?

Standard Deviation (1 of 2: Introduction to Standard Deviation and what it measures)

Standard Deviation | Investment Basics #14

Standard Deviation Explained | Options Trading Concepts

Sec 3.2: Interpret a standard deviation

Standard Deviation: Definition, Formula & Calculation Examples

What is Standard Deviation and Mean Absolute Deviation | Math, Statistics for data science, ML

How to Find Price Targets - Standard Deviation Projections

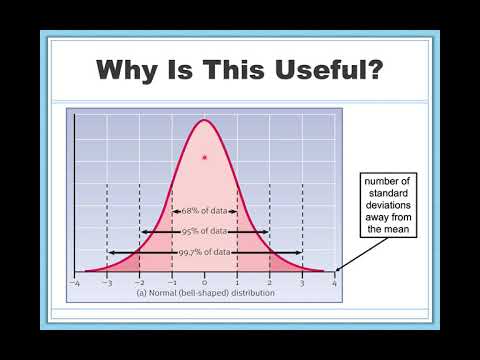

Z-Scores, Standardization, and the Standard Normal Distribution (5.3)

Range, variance and standard deviation as measures of dispersion | Khan Academy

Комментарии

0:07:49

0:07:49

0:04:18

0:04:18

0:01:47

0:01:47

0:02:57

0:02:57

0:09:30

0:09:30

0:07:14

0:07:14

0:14:22

0:14:22

0:05:50

0:05:50

0:01:01

0:01:01

0:07:10

0:07:10

0:10:21

0:10:21

0:05:09

0:05:09

0:07:50

0:07:50

0:05:14

0:05:14

0:13:47

0:13:47

0:09:51

0:09:51

0:02:42

0:02:42

0:11:24

0:11:24

0:04:46

0:04:46

0:15:24

0:15:24

0:08:16

0:08:16

0:20:48

0:20:48

0:06:57

0:06:57

0:12:34

0:12:34