filmov

tv

Calculating the Efficient Frontier for more than 2 Assets in Excel

Показать описание

This series on Institutional-Grade Risk Management has so far shown how to calculate the Efficient Frontier for 2 Assets. This episode looks at 3 assets and the process that is required. This approach will take us a step closer to real-world portfolio optimization techniques which we will build on in future episodes.

#EfficientFrontier, #MultipleAssets, #ExcelTutorial, #MultipleStocks, #3Assets, #ManagingRisk, #StandardDeviation, #ExpectedReturn, #EfficientFrontierFor3Assets, #EfficientFrontierCalculation, #EfficientFrontierInExcel, #HowToCalculateTheEfficientFrontier, #Darwinex

Video Contents:

00:00 Efficient Frontier with 3 Assets

00:23 Why Darwinex?

01:12 Constructing the Efficient Frontier in Excel with 3 Stocks

06:15 Summary and Next Episodes

Content Disclaimer: Past performance is not a reliable indicator of future results. The contents of this video (and all other videos by the presenter) are for educational purposes only and are not to be construed as financial and/or investment advice.

#EfficientFrontier, #MultipleAssets, #ExcelTutorial, #MultipleStocks, #3Assets, #ManagingRisk, #StandardDeviation, #ExpectedReturn, #EfficientFrontierFor3Assets, #EfficientFrontierCalculation, #EfficientFrontierInExcel, #HowToCalculateTheEfficientFrontier, #Darwinex

Video Contents:

00:00 Efficient Frontier with 3 Assets

00:23 Why Darwinex?

01:12 Constructing the Efficient Frontier in Excel with 3 Stocks

06:15 Summary and Next Episodes

Content Disclaimer: Past performance is not a reliable indicator of future results. The contents of this video (and all other videos by the presenter) are for educational purposes only and are not to be construed as financial and/or investment advice.

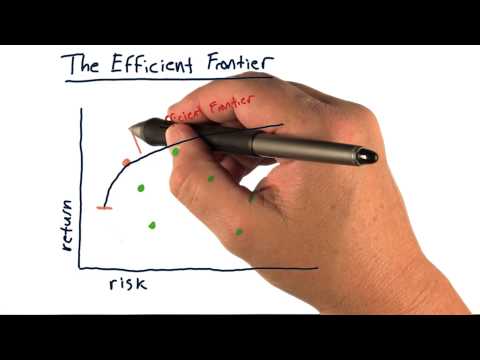

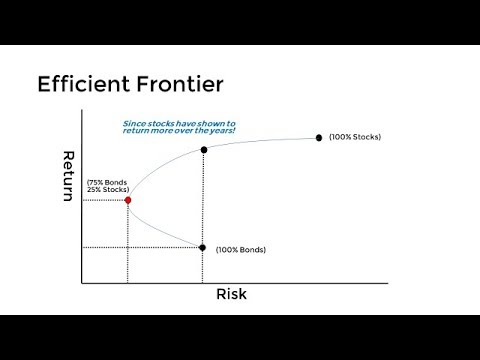

The efficient frontier

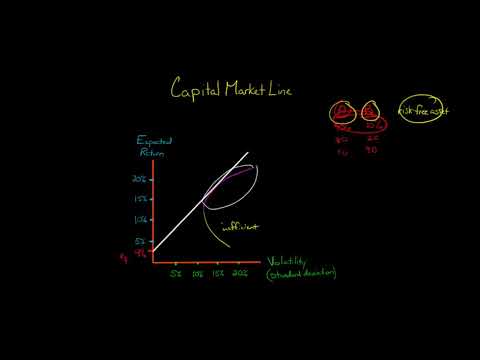

Graph The Efficient Frontier And Capital Allocation Line In Excel

The Efficient Frontier - Explained in 3 Minutes

Calculating the Efficient Frontier for more than 2 Assets in Excel

Efficient Frontier Explained in Excel: Plotting a 3-Security Portfolio

The efficient compute frontier.

Efficient Frontier and Portfolio Optimization Explained | The Ultimate Guide

The Math of Drawing the Efficient Frontier

Calculating The Efficient Frontier Step-by-Step in Excel

The Capital Market Line

GFM29 - Calculating the efficient frontier of investments.

Calculation Exercise - Efficient Portfolios

Modern Portfolio Theory and the Efficient Frontier Explained

How To Graph The Efficient Frontier For A Two-Stock Portfolio In Excel

Plotting Efficient Frontier for Four Securities in Excel

13. Graphing the efficient frontier for Multiple Stock portfolio in Excel #Finance

FRM : How to Build Efficient Frontier in Excel - Part 1 (of 2)

markowitz portfolio theory efficient frontier cfa-course.com

Graph the efficient frontier and capital allocation line for a three stock portfolio using Excel.

Concavity of the Efficient Frontier

Four Stock Portfolio and Graphing Efficient Portfolio Frontier

Portfolio Optimization Seven Security Example with Excel Solver

Use Excel to graph the efficient frontier of a three security portfolio

CFA/FRM : How to Build Efficient Frontier in Excel- CAL and Use of Sharpe Ratio [Part 2 of 2]

Комментарии

0:02:54

0:02:54

0:08:47

0:08:47

0:03:05

0:03:05

0:07:26

0:07:26

0:14:43

0:14:43

0:00:55

0:00:55

0:13:05

0:13:05

0:07:00

0:07:00

0:12:02

0:12:02

0:05:45

0:05:45

0:10:37

0:10:37

0:09:34

0:09:34

0:03:49

0:03:49

0:04:27

0:04:27

0:15:38

0:15:38

0:15:32

0:15:32

0:20:07

0:20:07

0:03:26

0:03:26

0:34:57

0:34:57

0:10:31

0:10:31

0:35:01

0:35:01

0:17:10

0:17:10

0:32:47

0:32:47

0:20:08

0:20:08