filmov

tv

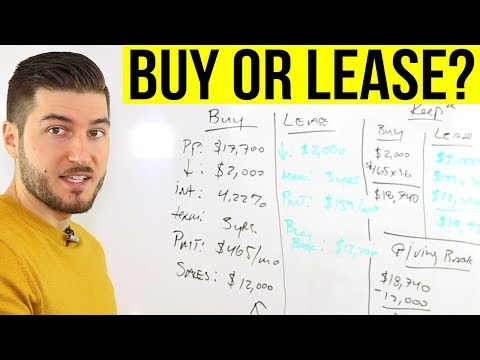

Buying vs Leasing a Car: Which is Cheaper?

Показать описание

FREE STOCKS:

RESOURCES:

MY SOCIALS:

WHO AM I?

Hello 👋 I’m Humphrey, I used to be a financial advisor, worked in gaming/tech, and started my own eCommerce business. I make practical, rational content on investing, personal finance, the news, and much more with a data-backed approach. My goal is to help you with financial literacy and creating wealth.

PS: I am no longer a current Financial Advisor, any investment commentary are my opinions only. Some of the links in this description are affiliate links that I do receive a commission for & they help support the channel!

⏱️ Timestamps:

0:00 - Start Here

RESOURCES:

MY SOCIALS:

WHO AM I?

Hello 👋 I’m Humphrey, I used to be a financial advisor, worked in gaming/tech, and started my own eCommerce business. I make practical, rational content on investing, personal finance, the news, and much more with a data-backed approach. My goal is to help you with financial literacy and creating wealth.

PS: I am no longer a current Financial Advisor, any investment commentary are my opinions only. Some of the links in this description are affiliate links that I do receive a commission for & they help support the channel!

⏱️ Timestamps:

0:00 - Start Here

Leasing vs Buying a Car: Which is ACTUALLY Cheaper in 2024?

ACCOUNTANT EXPLAINS Should You Buy, Finance or Lease a New Car

🚗 Leasing vs. Buying a Car: Which is the Better Option for YOU? 🚗 | Your Rich BFF

Car Finance Explained (UK) - BUY VS LEASE - 5 Ways to SAVE MONEY.

Leasing VS. Financing A Car | Is It Better To Buy Or Lease A New Car?

Leasing Vs Buying A Car - Dave Ramsey

Is Leasing CHEAPER Than Buying? 2023 Data REVEALED!

Buying, Financing or Lease a Car in Germany? Which is worth it?

Cheapest New Cars to Buy in January 2025. Target these 10 Models! 🤔🚘🚙

Buying vs Leasing a Car 101: How to pick the BEST choice

Lease vs Buy a Car (Why I Lease with $0 Down)

EXPERT EXPLAINS! Should You Buy, Finance or Lease Your New Car!

Which is better for you? Leasing vs. buying your vehicle

Buying vs. Leasing a Car (Pros and Cons)

Auto Broker Explains: Should you Lease, Finance, or Buy a New Car?

Buying vs Leasing a Car: Which is Cheaper?

Leasing vs Buying a Car, Which is Worse

Here’s Why Leasing a Car is Stupid

How To Lease A Car In 2025 (Step By Step)

Buying vs Leasing a Car (Pros & Cons)

Leasing vs buying a car in Australia

Should You Pay Cash, Finance or Lease A New Car? Expert Explains Which Is Best

Buying a Car vs. Leasing a Car: Weigh Your Options | Toyota Financial Services | Toyota

🚗 Guide to leasing vs. buying a new car, per consumer experts

Комментарии

0:14:15

0:14:15

0:14:24

0:14:24

0:05:44

0:05:44

0:05:21

0:05:21

0:08:23

0:08:23

0:05:51

0:05:51

0:12:53

0:12:53

0:10:25

0:10:25

0:05:49

0:05:49

0:11:34

0:11:34

0:10:06

0:10:06

0:16:50

0:16:50

0:02:42

0:02:42

0:12:32

0:12:32

0:08:32

0:08:32

0:00:45

0:00:45

0:06:59

0:06:59

0:10:18

0:10:18

0:12:58

0:12:58

0:12:48

0:12:48

0:01:44

0:01:44

0:11:34

0:11:34

0:02:34

0:02:34

0:02:05

0:02:05