filmov

tv

Solving for Bond Price with Semiannual Interest Payments

Показать описание

How to Calculate the Current Price of a Bond

How to Calculate the Price of a Bond (No Financial Calculator Needed!)

Macro Minute -- Bond Prices and Interest Rates

Solving for Bond Price with Semiannual Interest Payments

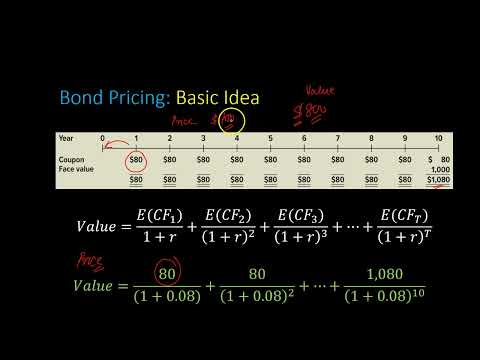

Bond price formula

Bond Valuation - A Quick Review

Relationship between bond prices and interest rates | Finance & Capital Markets | Khan Academy

How to Calculate the Price of a Bond using a Financial Calculator

Formula (USING VBA) II Calculation of Bond [ Price, Rate, Yield to maturity and Duration ] II EXCEL

Treasury bond prices and yields | Stocks and bonds | Finance & Capital Markets | Khan Academy

Calculating Bond Price with Semi Annual Interest Payments using a Financial Calculator

Bond Prices Vs Bond Yield | Inverse Relationship

Pricing a Bond using Excel

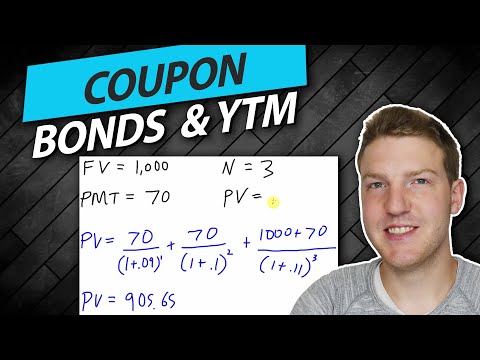

Coupon Bond Price

Unit 7.3-1 || Bond Valuation || How to calculate bond price?

Bond Prices And How They Are Related To Yield to Maturity (YTM)

Calculate Bond Price and Yield to Maturity (YTM) | Annual and Semi Annual Bonds

Bond Valuation Price Function in Excel

ep6: time value of money, bond cashflows and bond price

Calculate Yield to Maturity of a Coupon Bond in 2 Minutes

Bond Pricing

What happens to my bond when interest rates rise? | Financial Fundamentals

Actuarial Exam 2/FM Prep: Compare Makeham's and Basic Formula for Bond Prices

Help with Calculating Change in Bond Price

Комментарии

0:02:20

0:02:20

0:16:06

0:16:06

0:02:48

0:02:48

0:03:59

0:03:59

0:01:34

0:01:34

0:11:08

0:11:08

0:13:16

0:13:16

0:09:37

0:09:37

0:12:36

0:12:36

0:03:47

0:03:47

0:12:57

0:12:57

0:04:45

0:04:45

0:02:39

0:02:39

0:03:39

0:03:39

0:16:12

0:16:12

0:15:37

0:15:37

0:09:05

0:09:05

0:05:06

0:05:06

0:40:22

0:40:22

0:02:05

0:02:05

0:09:49

0:09:49

0:03:07

0:03:07

0:06:38

0:06:38

0:05:09

0:05:09