filmov

tv

Bond Prices Vs Bond Yield | Inverse Relationship

Показать описание

In this video we will be looking at the inverse relationship between bond price and bond yield.

When the price of a bond goes up, its yield goes down, and when its price goes down, its yield goes up. Why is that? Watch to find out.

#bondyield #investing #bondprice

When the price of a bond goes up, its yield goes down, and when its price goes down, its yield goes up. Why is that? Watch to find out.

#bondyield #investing #bondprice

Bond Prices Vs Bond Yield | Inverse Relationship

Macro Minute -- Bond Prices and Interest Rates

Why Bond Yields Are a Key Economic Barometer | WSJ

Treasury bond prices and yields | Stocks and bonds | Finance & Capital Markets | Khan Academy

Relationship between bond prices and interest rates | Finance & Capital Markets | Khan Academy

What happens to my bond when interest rates rise? | Financial Fundamentals

Bond Yields Moving Higher; What It Means | Treasury Bond Prices And Interest Rates

Bonds and Bond Yields

FOMC Rate Decision: What Traders Need to Know This Week!

Bond Prices and Bond Yields Explained | Economics

What Are Bond Yields And Interest Rates

Interest Rates, Bond Prices & Bond Yield | Economy | By Sivakumar Sir | UPSC | Rau's IAS

Coupon Rate vs Yield To Maturity

Treasury Bonds SIMPLY Explained

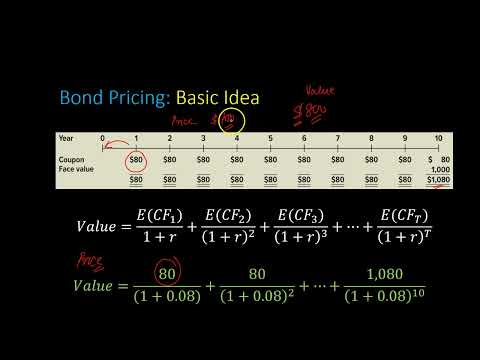

Treasury Bond Pricing Calculation Explained | Bond Coupon Rate vs Yield | Prices vs Interest Rates

THE GREAT BOND SELLOFF, Explained in 6 Minutes

Bond Prices And How They Are Related To Yield to Maturity (YTM)

Why stock investors need to keep an eye on the bond market? How bond yields affect stock market?

How Bond Prices Work | Bond Yield vs Interest, Impact on Stock Market.

Investing Basics: Bonds

Why buy negative yielding bonds? | FT

How interest rate hikes impact bonds and stock prices

Dave Explains Why He Doesn't Recommend Bonds

What are BOND YIELDS? Why US Government's Treasury Bills are falling down? Current Affairs 2019...

Комментарии

0:04:45

0:04:45

0:02:48

0:02:48

0:05:17

0:05:17

0:03:47

0:03:47

0:13:16

0:13:16

0:03:07

0:03:07

0:03:55

0:03:55

0:10:49

0:10:49

1:31:35

1:31:35

0:06:44

0:06:44

0:02:47

0:02:47

0:18:56

0:18:56

0:00:29

0:00:29

0:15:28

0:15:28

1:12:59

1:12:59

0:07:10

0:07:10

0:15:37

0:15:37

0:09:12

0:09:12

0:12:19

0:12:19

0:04:47

0:04:47

0:06:24

0:06:24

0:07:18

0:07:18

0:07:58

0:07:58

0:15:40

0:15:40