filmov

tv

Bond Prices And How They Are Related To Yield to Maturity (YTM)

Показать описание

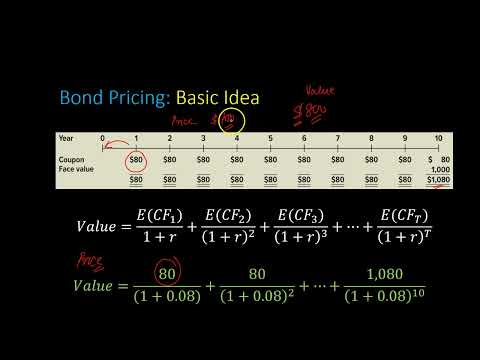

In this video, you will learn how to calculate the price of a bond. In the process, you will also learn what is meant by a bond's Yield to Maturity (YTM), and why bond prices and yields are negatively related to each other.

This video will also help you understand why/when some bonds trade at a discount (i.e. at a price LESS than their face value), why some trade at a premium (i.e. at a price that is GREATER than their face value), and why some trade AT PAR (i.e. at a price EQUAL to their face value).

Finally, and perhaps more importantly, after watching this video you will clearly understand the distinvtion between a bond's coupon rate and its YTM.

Students will particularly find this video useful in understanding parts of Chapter 8 (Interest Rates and Bond Valuation) of Corporate Finance by Ross, Westerfield, Jaffe and Jordan.

This video will also help you understand why/when some bonds trade at a discount (i.e. at a price LESS than their face value), why some trade at a premium (i.e. at a price that is GREATER than their face value), and why some trade AT PAR (i.e. at a price EQUAL to their face value).

Finally, and perhaps more importantly, after watching this video you will clearly understand the distinvtion between a bond's coupon rate and its YTM.

Students will particularly find this video useful in understanding parts of Chapter 8 (Interest Rates and Bond Valuation) of Corporate Finance by Ross, Westerfield, Jaffe and Jordan.

Macro Minute -- Bond Prices and Interest Rates

Bond Prices Vs Bond Yield | Inverse Relationship

Why Bond Yields Are a Key Economic Barometer | WSJ

Relationship between bond prices and interest rates | Finance & Capital Markets | Khan Academy

Bond Prices And How They Are Related To Yield to Maturity (YTM)

🔴 Bond Valuation Explained and How to Value a Bond

Treasury bond prices and yields | Stocks and bonds | Finance & Capital Markets | Khan Academy

THE GREAT BOND SELLOFF, Explained in 6 Minutes

Is the Bond Market Broken? | LPL Street View

Relationship Between Interest Rates & Bond Prices | (Part 1)

How are bond prices determined? #LLAShorts 77

What happens to my bond when interest rates rise?

What Moves Bond Prices?

Bond Prices and Bond Yields Explained | Economics

Bond Yields Moving Higher; What It Means | Treasury Bond Prices And Interest Rates

Bond Investing 101--A Beginner's Guide to Bonds

Bonds and Bond Yields

Why a bond price goes down when an interest rate goes up? #svb #accounting #accounting101

Bond Fundamentals - Definition, Prices And Determining Factors

Bond Investing For Beginners 2023 | Complete Guide

How Bond Investing Can Still (Sometimes) Fail | WSJ

Intro to Investing In Bonds - Current Yield, Yield to Maturity, Bond Prices & Interest Rates

Macro 4.1 - Financial Assets - How are bond prices and interest rates related?

Bond price and yield relationship (for the @CFA Level 1 exam)

Комментарии

0:02:48

0:02:48

0:04:45

0:04:45

0:05:17

0:05:17

0:13:16

0:13:16

0:15:37

0:15:37

0:03:01

0:03:01

0:03:47

0:03:47

0:07:10

0:07:10

0:04:30

0:04:30

0:01:00

0:01:00

0:01:00

0:01:00

0:03:07

0:03:07

0:07:26

0:07:26

0:06:44

0:06:44

0:03:55

0:03:55

0:45:01

0:45:01

0:10:49

0:10:49

0:00:47

0:00:47

0:03:41

0:03:41

0:54:28

0:54:28

0:06:29

0:06:29

0:36:20

0:36:20

0:06:14

0:06:14

0:09:56

0:09:56