filmov

tv

Unit 7.3-1 || Bond Valuation || How to calculate bond price?

Показать описание

Unit 7.3-1 || Bond Valuation || How to calculate bond price?

Bond Valuation - A Quick Review

Unit 7.1-2 || Bond Valuation || Bond example

Chapter 7 : Interest Rates and Bond Valuation

Unit 7.1-1 || Bond Valuation || What is a bond?

Bond Valuation

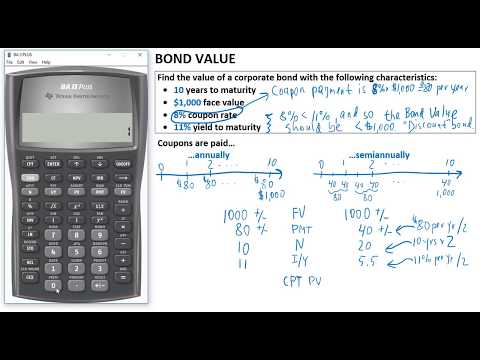

Find Bond Value - annual vs semiannual coupons

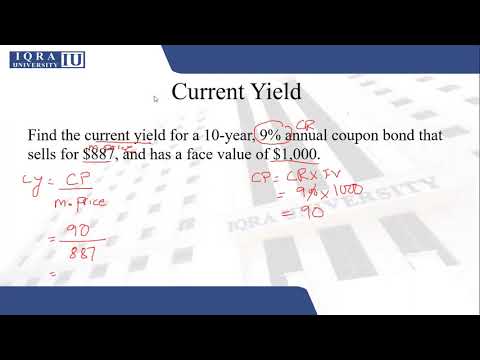

Unit 7.4-1 || Bond Valuation || Bond yields || Current yield

00003 BUYING BONDS AND SHARES 1 PART ONE WITH VOICEOVER 17m 39s

Bond valuation 1 3

Bond Evaluation | 7.3 | Finance Chap 7 | Fundamentals of Financial Management | Question 7.3

How to Calculate the Current Price of a Bond

Bond Valuation Simplified

Session 7: Valuing Bonds

Unit 7.3-2 || Bond Valuation || Bond Price with different frequency

Solving for Bond Price with Semiannual Interest Payments

FINA 301 Chapter 7 Bond Valuation Lecture Professor Watson

Bond Valuation| Financial Mathematics| Unit 7| P 4| CBSE Handbook |Class 12 Applied Maths in English

Corporate Finance Ross | Ch 7 Interest Rate and Bond Valuation

Unit 7.4-2 || Bond Valuation || YTM and YTC

Bond Valuation| Financial Mathematics| Unit 7| P 5| CBSE Handbook |Class 12 Applied Maths in English

Bonds (Corporate Bonds, Municipal Bonds, Government Bonds, etc.) Explained in One Minute

Bond Valuation

(3 of 16) Ch.7 - Calculating bond value (with annual coupons)

Комментарии

0:16:12

0:16:12

0:11:08

0:11:08

0:05:14

0:05:14

1:08:37

1:08:37

0:06:44

0:06:44

0:08:11

0:08:11

0:10:37

0:10:37

0:10:01

0:10:01

0:17:39

0:17:39

0:05:26

0:05:26

0:09:39

0:09:39

0:02:20

0:02:20

0:00:52

0:00:52

0:15:37

0:15:37

0:06:04

0:06:04

0:03:59

0:03:59

0:58:04

0:58:04

0:30:38

0:30:38

1:00:37

1:00:37

0:13:25

0:13:25

0:19:33

0:19:33

0:01:26

0:01:26

0:35:03

0:35:03

0:10:08

0:10:08