filmov

tv

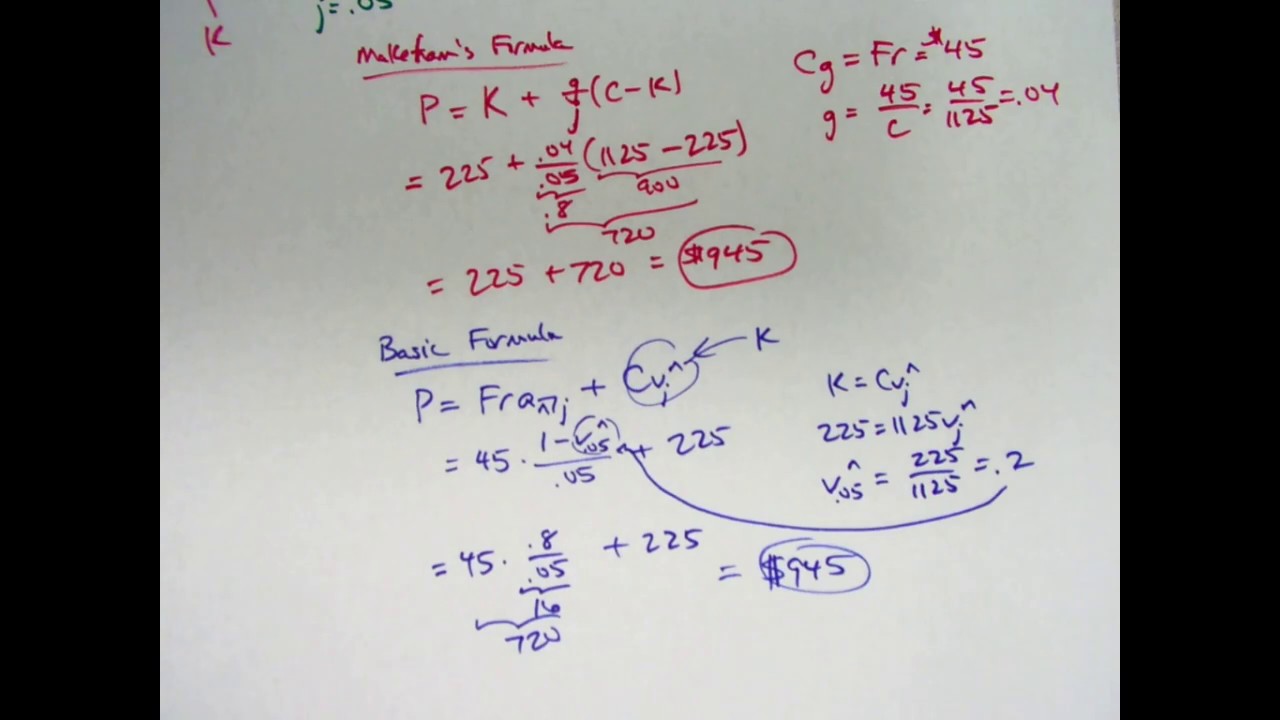

Actuarial Exam 2/FM Prep: Compare Makeham's and Basic Formula for Bond Prices

Показать описание

Financial Math for Actuarial Exam 2 (FM), Video #104. Exercise 7.9 (modified) from "The Theory of Interest", 2nd Edition, by Stephen G. Kellison.

Present value of redemption value known. Number of coupon payments unknown.

Exercise 7.9 (modified): A $1000 bond with a coupon rate of 9% payable semian- nually is redeemable after an unspecified number of years at $1125. The bond is bought to yield 10% convertible semiannually. If the present value of the redemption value is $225 at this yield rate, find the purchase price.

AMAZON ASSOCIATE

As an Amazon Associate I earn from qualifying purchases.

0:06:38

0:06:38

0:11:27

0:11:27

0:07:46

0:07:46

0:16:57

0:16:57

0:22:39

0:22:39

0:07:48

0:07:48

0:15:19

0:15:19

0:16:43

0:16:43

0:11:41

0:11:41

0:21:32

0:21:32

0:12:51

0:12:51

0:06:20

0:06:20

0:08:28

0:08:28

0:20:59

0:20:59

0:17:31

0:17:31

0:11:05

0:11:05

0:09:55

0:09:55

0:05:47

0:05:47

0:11:08

0:11:08

0:22:10

0:22:10

0:09:26

0:09:26

0:06:53

0:06:53

0:06:59

0:06:59

0:08:18

0:08:18