filmov

tv

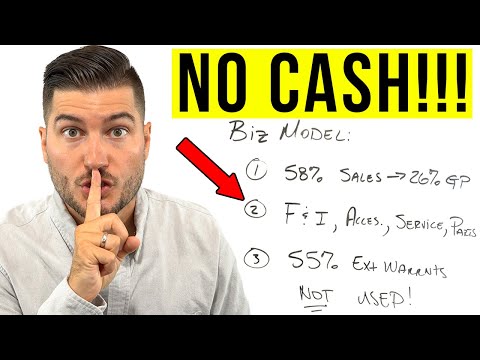

Never Pay For A Car Again (Car Hacking Strategy) - Fire Movement

Показать описание

The worst part about buying a used car is that you have to spend money on it. If you're paying cash for that car then that means you'll need to save money every single month.

I don't like this and I'm sick of having to set money aside every single month so that I can responsibly buy my next car. I figured there has to be a better way to buy a car where I come out winning in the end.

That's when I came up with what I like to call Car Hacking. I especially like this method for anyone in the FIRE movement. If you're working towards Financial Independence, Early Retirement, Regular Retirement, or just don't want to set money aside every month then this is for you.

Check Out My Recommendations (It helps support the channel):

YOU'LL FIND THESE PLAYLISTS HELPFUL:

Affiliate Disclaimer: Some of the above may affiliate links. Support the channel by signing up or purchasing through those links at no additional cost to you. I appreciate you for helping me keep this channel running

Disclaimer: This video is for entertainment purposes only. Everyone's situation is different so do your own research before making any decisions with your money. If you need help then contact a Certified Financial Fiduciary before trying anything that is mentioned in this video. I prefer a Fiduciary financial advisor that charges an hourly fee as opposed to an ongoing fee based on a % of your portfolio. Always remember that incentives determine the type of advice they give you so one that charges an hourly fee is less likely to be problematic.

#freecars #carbuying #financialindependence

I don't like this and I'm sick of having to set money aside every single month so that I can responsibly buy my next car. I figured there has to be a better way to buy a car where I come out winning in the end.

That's when I came up with what I like to call Car Hacking. I especially like this method for anyone in the FIRE movement. If you're working towards Financial Independence, Early Retirement, Regular Retirement, or just don't want to set money aside every month then this is for you.

Check Out My Recommendations (It helps support the channel):

YOU'LL FIND THESE PLAYLISTS HELPFUL:

Affiliate Disclaimer: Some of the above may affiliate links. Support the channel by signing up or purchasing through those links at no additional cost to you. I appreciate you for helping me keep this channel running

Disclaimer: This video is for entertainment purposes only. Everyone's situation is different so do your own research before making any decisions with your money. If you need help then contact a Certified Financial Fiduciary before trying anything that is mentioned in this video. I prefer a Fiduciary financial advisor that charges an hourly fee as opposed to an ongoing fee based on a % of your portfolio. Always remember that incentives determine the type of advice they give you so one that charges an hourly fee is less likely to be problematic.

#freecars #carbuying #financialindependence

Комментарии

0:18:25

0:18:25

0:04:35

0:04:35

0:05:53

0:05:53

0:15:33

0:15:33

0:12:27

0:12:27

0:09:33

0:09:33

0:00:40

0:00:40

0:05:22

0:05:22

0:36:00

0:36:00

0:11:07

0:11:07

0:14:49

0:14:49

0:09:40

0:09:40

0:09:42

0:09:42

0:03:21

0:03:21

0:13:44

0:13:44

0:16:54

0:16:54

0:00:34

0:00:34

0:11:31

0:11:31

0:17:34

0:17:34

0:04:05

0:04:05

0:12:00

0:12:00

0:19:39

0:19:39

0:15:15

0:15:15

0:08:46

0:08:46