filmov

tv

Dividend yield calculation example

Показать описание

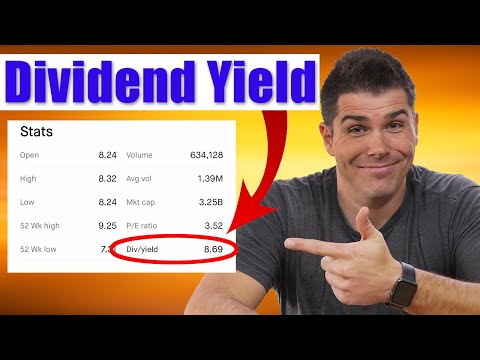

How to calculate dividend yield? In this video, we go through the dividend yield formula and a dividend yield example.

Let’s start with looking up the dividend yield for one of the biggest companies in the world in terms of market capitalization: Microsoft. In the middle of December 2018, the dividend yield on shares of Microsoft is shown as 1.79%. How is that dividend yield calculated?

The formula for dividend yield is annual dividend divided by the current share price. You could look up the latest full year dividend in the annual report, but it is even better to take the latest quarterly dividend announced, multiply that by four to get to an annual number, and divide that by the share price. In the case of Microsoft, the latest quarterly dividend was $0.46 per share, an increase versus the previous dividend levels.

We fill in that quarterly dividend in the formula, and check the latest share price. Share prices tend to fluctuate on a daily basis, so by the time you watch this video the share price might be higher or lower. Share price is the denominator in our dividend yield calculation. If the share price goes up, then dividend yield decreases. If the share price goes down, then dividend yield increases. Always check the latest dividend announcement or forecast, and the latest share price!

Four times $0.46 quarterly dividend equals an annual dividend of $1.84. Divide this by the current share price of $102.89, and you get to a dividend yield of 1.79%.

Let’s check that outcome with the dividend yield in the share price graph. Same outcome! 1.79% dividend yield on shares of Microsoft in mid-December 2018.

Philip de Vroe (The Finance Storyteller) aims to make strategy, finance and leadership enjoyable and easier to understand. Learn the business and accounting vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better #stockmarket #investing decisions. Philip delivers #financetraining in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In!

Let’s start with looking up the dividend yield for one of the biggest companies in the world in terms of market capitalization: Microsoft. In the middle of December 2018, the dividend yield on shares of Microsoft is shown as 1.79%. How is that dividend yield calculated?

The formula for dividend yield is annual dividend divided by the current share price. You could look up the latest full year dividend in the annual report, but it is even better to take the latest quarterly dividend announced, multiply that by four to get to an annual number, and divide that by the share price. In the case of Microsoft, the latest quarterly dividend was $0.46 per share, an increase versus the previous dividend levels.

We fill in that quarterly dividend in the formula, and check the latest share price. Share prices tend to fluctuate on a daily basis, so by the time you watch this video the share price might be higher or lower. Share price is the denominator in our dividend yield calculation. If the share price goes up, then dividend yield decreases. If the share price goes down, then dividend yield increases. Always check the latest dividend announcement or forecast, and the latest share price!

Four times $0.46 quarterly dividend equals an annual dividend of $1.84. Divide this by the current share price of $102.89, and you get to a dividend yield of 1.79%.

Let’s check that outcome with the dividend yield in the share price graph. Same outcome! 1.79% dividend yield on shares of Microsoft in mid-December 2018.

Philip de Vroe (The Finance Storyteller) aims to make strategy, finance and leadership enjoyable and easier to understand. Learn the business and accounting vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better #stockmarket #investing decisions. Philip delivers #financetraining in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In!

Комментарии

0:04:42

0:04:42

0:02:05

0:02:05

0:02:04

0:02:04

0:11:47

0:11:47

0:02:23

0:02:23

0:01:00

0:01:00

0:00:58

0:00:58

0:03:31

0:03:31

0:24:10

0:24:10

0:01:23

0:01:23

0:00:58

0:00:58

0:06:48

0:06:48

0:00:06

0:00:06

0:04:05

0:04:05

0:07:59

0:07:59

0:00:39

0:00:39

0:00:31

0:00:31

0:04:54

0:04:54

0:00:28

0:00:28

0:08:18

0:08:18

0:10:19

0:10:19

0:00:55

0:00:55

0:00:28

0:00:28

0:00:25

0:00:25