filmov

tv

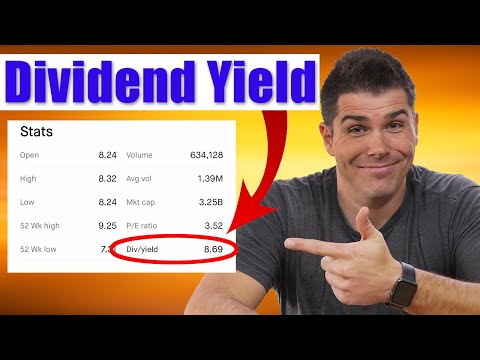

Dividend Yield Explained

Показать описание

This video will teach you what dividend yield is, how to calculate it and why it's important. Dividend yield is the dividend, relative to the price of the investment.

Didn't hear me properly? This is what I was saying:

Today we're going to be learning what dividend yield is. We already know what a dividend is from the previous video, now we just need to know the yield part. If you don't know what a dividend is, just click on the word dividend to watch the previous video, and then come back to this video.

Let's use the hypothetical company from the last video, Soni's Shawarma. Soni's Shawarma is a restaurant chain that has thousands of restaurants across the country, and obviously, sells shawarmas.

Soni's Shawarma pays a quarterly dividend of $0.25. Which means in a year, it pays a total dividend of a dollar, since 25 cents every 3 months adds up to a dollar every year.

So we know how much Soni's Shawarma pays in dividends for every share that we own, but we don't know how much it costs to buy one share of Soni's Shawarma. What if I told you that one share of Soni's Shawarma costs $1000. Yes, $1000 to buy 1 share of Soni's Shawarma, and it only pays us one dollar in dividends every year. What if I told you that one share of Soni's Shawarma costs only $20. $20 for one share, and it pays us one dollar in dividends every year.

Which one would you rather pick? I would pick the $20 share that pays me $1, instead of the $1000 dollar share that pays me $1. Why, because it has a greater yield! Yield is simply the dividends we get, relative to the price of the share. That's not a dictionary definition, it's my definition for this case. So now let's calculate the yield of these two options, let's start with the $1000 share.

If one share of Soni's Shawarma costs $1000 and In one year, it gives us one dollar, the annual dividend is one dollar. So to calculate the yield, we need to take the dividend, and divide it by the price. So the dividend of one dollar, divided by the price of $1000, equals 0.001, which can also be expressed as 0.1%. So the dividend yield in this case is 0.1%. Now let's move on to the next case.

If one share of Soni's Shawarma costs $20 and in one year, it gives us one dollar, the annual dividend is one dollar. Just like before, to calculate the yield, we take the dividend and divide it by the price. So the dividend which is one dollar, divided by the price, which is $20, equals 0.05, which is another way of saying 5%.

So that's dividend yield, the dividend relative to the price. The $20 share has a yield of 5%, that means I'll be getting 5% of the money I paid every year. It means 5% of the price, will be paid to me in dividends. With the $1000 share which has a yield of 0.1%, it means I'll be getting 0.1% of the money I paid, every year. It means 0.1% of the price, will be paid to me in dividends.

So which one would you rather pick? Would you rather have your dividends equal 5% of the price you paid, or would you rather have them equal only 0.1% of the price you paid. I would rather have them equal 5% of the price I paid, because I get more money relative to the price I paid. If we're only looking at dividends, paying $20 to get an annual dividend of $1, is better than paying $1000 to get that same annual dividend of $1.

Remember, stock prices change every day, so that means, dividend yield will also change every day. If its $20 to buy a share that has an annual dividend of $1, it has a yield of 5%. If tomorrow, the price of that same share goes up to $21, then we divide 1 by 21 to get a yield of 4.76%. So as prices change, so does the yield, as dividends change, so does the yield.

So now you know what dividend yield is, how to calculate it, and why it's important. If you liked this video, please make sure to hit that subscribe button. Thank you.

Didn't hear me properly? This is what I was saying:

Today we're going to be learning what dividend yield is. We already know what a dividend is from the previous video, now we just need to know the yield part. If you don't know what a dividend is, just click on the word dividend to watch the previous video, and then come back to this video.

Let's use the hypothetical company from the last video, Soni's Shawarma. Soni's Shawarma is a restaurant chain that has thousands of restaurants across the country, and obviously, sells shawarmas.

Soni's Shawarma pays a quarterly dividend of $0.25. Which means in a year, it pays a total dividend of a dollar, since 25 cents every 3 months adds up to a dollar every year.

So we know how much Soni's Shawarma pays in dividends for every share that we own, but we don't know how much it costs to buy one share of Soni's Shawarma. What if I told you that one share of Soni's Shawarma costs $1000. Yes, $1000 to buy 1 share of Soni's Shawarma, and it only pays us one dollar in dividends every year. What if I told you that one share of Soni's Shawarma costs only $20. $20 for one share, and it pays us one dollar in dividends every year.

Which one would you rather pick? I would pick the $20 share that pays me $1, instead of the $1000 dollar share that pays me $1. Why, because it has a greater yield! Yield is simply the dividends we get, relative to the price of the share. That's not a dictionary definition, it's my definition for this case. So now let's calculate the yield of these two options, let's start with the $1000 share.

If one share of Soni's Shawarma costs $1000 and In one year, it gives us one dollar, the annual dividend is one dollar. So to calculate the yield, we need to take the dividend, and divide it by the price. So the dividend of one dollar, divided by the price of $1000, equals 0.001, which can also be expressed as 0.1%. So the dividend yield in this case is 0.1%. Now let's move on to the next case.

If one share of Soni's Shawarma costs $20 and in one year, it gives us one dollar, the annual dividend is one dollar. Just like before, to calculate the yield, we take the dividend and divide it by the price. So the dividend which is one dollar, divided by the price, which is $20, equals 0.05, which is another way of saying 5%.

So that's dividend yield, the dividend relative to the price. The $20 share has a yield of 5%, that means I'll be getting 5% of the money I paid every year. It means 5% of the price, will be paid to me in dividends. With the $1000 share which has a yield of 0.1%, it means I'll be getting 0.1% of the money I paid, every year. It means 0.1% of the price, will be paid to me in dividends.

So which one would you rather pick? Would you rather have your dividends equal 5% of the price you paid, or would you rather have them equal only 0.1% of the price you paid. I would rather have them equal 5% of the price I paid, because I get more money relative to the price I paid. If we're only looking at dividends, paying $20 to get an annual dividend of $1, is better than paying $1000 to get that same annual dividend of $1.

Remember, stock prices change every day, so that means, dividend yield will also change every day. If its $20 to buy a share that has an annual dividend of $1, it has a yield of 5%. If tomorrow, the price of that same share goes up to $21, then we divide 1 by 21 to get a yield of 4.76%. So as prices change, so does the yield, as dividends change, so does the yield.

So now you know what dividend yield is, how to calculate it, and why it's important. If you liked this video, please make sure to hit that subscribe button. Thank you.

Комментарии

0:04:42

0:04:42

0:01:23

0:01:23

0:11:47

0:11:47

0:06:38

0:06:38

0:06:40

0:06:40

0:11:57

0:11:57

0:10:19

0:10:19

0:04:54

0:04:54

0:13:00

0:13:00

0:08:11

0:08:11

0:04:05

0:04:05

0:00:30

0:00:30

0:01:00

0:01:00

0:00:31

0:00:31

0:03:38

0:03:38

0:00:58

0:00:58

0:12:01

0:12:01

0:06:48

0:06:48

0:03:30

0:03:30

0:02:45

0:02:45

0:07:59

0:07:59

0:05:54

0:05:54

0:11:34

0:11:34

0:04:15

0:04:15