filmov

tv

The Beginner’s Checklist For Mastering Your Money | The 3-Minute Guide

Показать описание

Download your own checklist!

Target date funds:

Learn how to negotiate:

Best budget for your personality:

Two easiest ways to pay off debt:

Emergency savings fund:

The Financial Diet site:

The Beginner’s Checklist For Mastering Your Money | The 3-Minute Guide

Mixing vs Mastering (with FREE pre-mastering checklist)

A Checklist For Mastering Driving Skills

Boost Your Productivity: The Ultimate Guide to Mastering Checklists with Canva

Mastering On-Page SEO: Your Complete Checklist for Better Rankings! 🔍

The Perfect Mindmap: 6 Step Checklist

How to Prepare Your Mixes For Mastering | The Pre Master Checklist

Unleash Your Productivity Superpowers: The Ultimate Guide to Mastering Checklists!

Mastering Candle Pricing - Know Your Profit Margins! #candlemaker #candlebusiness #diycandle

Mastering Engineer Reveals the Secret to Making Your Mix Translate

MASTERING STEPS #masteringtips #audioengineering #soundengineering #mixingandmastering #audio

How to Setup a MASTERING SESSION in Logic Pro

Mixing vs Mastering | Do You Need To Master Your Music?

This Is Crucial In Mastering | FL Studio Tutorial #shorts

What Is The Process Of Mastering Music? A To Z Mastering.

Master your Golf Takeaway with this Proper Golf Swing Checklist

Headroom before starting a mix / mastering session

Audio Production , Dealing with Clipping / Distortion / Pre Mastering Checklist

The Perfect Push Up | Do it right!

This YouTube SEO Secret will SKYROCKET your views!

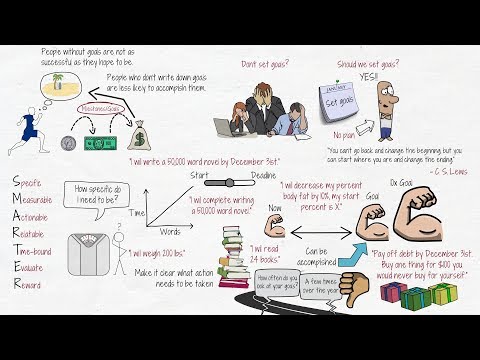

A Complete Guide to Goal Setting

Mastering The Deadlift: How To Increase Your Weight With Perfect Form

MIXING and MASTERING in Logic Pro (Start to Finish)

The Perfect Pull Up - Do it right!

Комментарии

0:04:49

0:04:49

0:08:31

0:08:31

0:04:18

0:04:18

0:08:26

0:08:26

0:00:09

0:00:09

0:18:33

0:18:33

0:20:39

0:20:39

0:00:41

0:00:41

0:00:13

0:00:13

0:25:56

0:25:56

0:00:42

0:00:42

0:13:27

0:13:27

0:03:53

0:03:53

0:00:38

0:00:38

0:07:02

0:07:02

0:03:39

0:03:39

0:05:13

0:05:13

0:10:12

0:10:12

0:03:38

0:03:38

0:03:47

0:03:47

0:06:12

0:06:12

0:05:49

0:05:49

3:15:49

3:15:49

0:04:32

0:04:32