filmov

tv

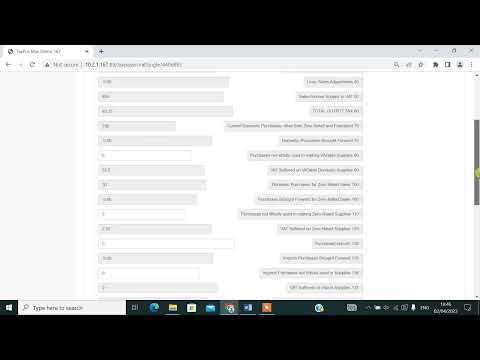

VAT on Purchase, Input VAT in QuickBooks UK

Показать описание

UAE VAT Rules for 5% VAT on Purchase and Reverse charge on Import of Goods and Services in QuickBooks Accounting Software UK Edition.

VAT on Purchase, Input VAT in QuickBooks UK

Input VAT vs Output VAT | Explained

(VAT) Value Added Tax - Whiteboard Animation Explanation

Input VAT vs Output VAT: What's the Difference?

Learn how to compute 12% VAT in 3 minutes. Gross, Net, Inclusive, Exclusive.

VAT - Input Tax

Calculate VAT figures

Input VAT Explained: Actual, Transitional, Presumptive and Standard Input Tax

V.A.T Payable

VAT (Value Added Tax) In Kenya - All you need to know | Joe Gachira

Value Added Tax (VAT) in the Philippines

Input VAT Recovery Conditions & Timeframes | FTA | VAT Explained | Value Added Tax | When to Cla...

Input Vat, Output Vat and WHT TAX or WHT VAT charged by Customer on your invoices

TAXPROMAX UPDATED VAT FILING AND INPUT VAT CLAIM

VAT Inclusive & VAT Exclusive | Calculation Examples

Reverse Charge VAT on Purchases

Save on Taxes Correctly | 5 FAQ Non Recoverable Input VAT | UAE | FTA | Entertainment | Vehicle |

How to Calculate VAT in Excel | Calculate the VAT amount |Calculate Selling Price | value added tax

QUICKBOOKS | How to Enter a 100% VAT Tax Only Purchase Invoice

How to Compute VAT Input Tax if the VAT Inclusive Purchases Amount is Given

Recoverable Input Tax | Can you Claim Input Tax for Missed Invoices? | CA. Manu - CEO, EmiratesCA

VAT Registration Explained By A Real Accountant - Value Added Tax UK

All About VAT & Its Accounting Treatment | Value Added Tax | Accountant Training Series 27 | By ...

How to File KRA VAT Returns, A simplified Step by Step Guide

Комментарии

0:01:11

0:01:11

0:07:46

0:07:46

0:04:35

0:04:35

0:08:10

0:08:10

0:03:31

0:03:31

0:14:37

0:14:37

0:07:41

0:07:41

0:09:47

0:09:47

0:11:09

0:11:09

0:10:01

0:10:01

0:07:21

0:07:21

0:01:43

0:01:43

0:32:42

0:32:42

0:12:24

0:12:24

0:11:09

0:11:09

0:07:24

0:07:24

0:05:12

0:05:12

0:02:06

0:02:06

0:02:53

0:02:53

0:00:47

0:00:47

0:04:10

0:04:10

0:06:56

0:06:56

0:31:04

0:31:04

0:16:39

0:16:39