filmov

tv

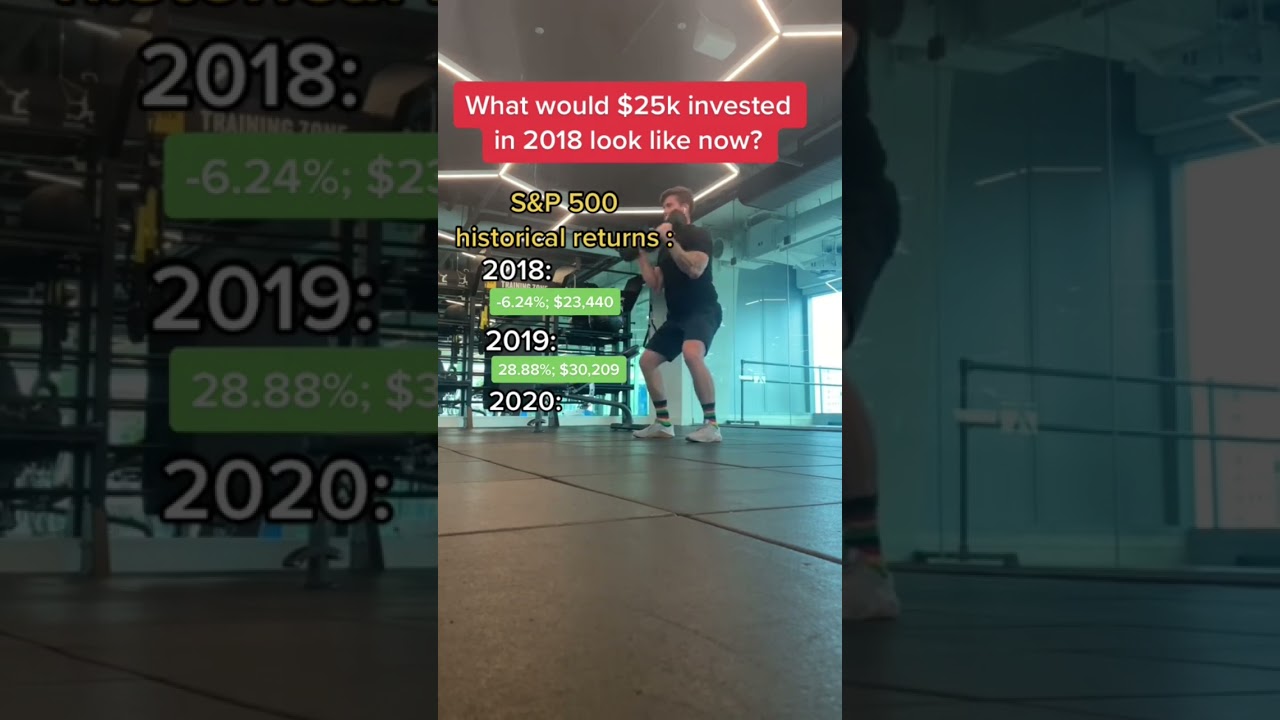

S&P 500 investing during a stock market crash ETF VOO 2022

Показать описание

What would $25,000 invested in 2018 look like now? S&P 500 ETF VOO investing. during a stock market crash! Don't be afraid to invest during a crash or recession, especially in a solid ETF like the Vanguard S&P 500 with low fees!

#indexfunds #voo #etfinvesting

*not financial advice

#indexfunds #voo #etfinvesting

*not financial advice

S&P 500 investing during a stock market crash ETF VOO 2022

Is the S&P 500 All You Really Need to Invest in?

1 Year Review Investing in S&P 500 Index Fund (How Much $ I Made)

How To Invest In The S&P 500 For Beginners In 2024

Investing in the S&P 500 is RISKIER than you think...

What is the S&P 500 -- Should you Invest in the S&P 500

How To Invest In The S&P 500 (EASY Step By Step Guide!)

How to invest in the S&P 500? (Beginners step-by-step guide)

🚨 URGENT! Stock Market CRASH (UPDATE) 🔥 Why The SP500 Is Going HIGHER (SPY, QQQ, BTC, ETH)

Warren Buffet explains how one could've turned $114 into $400,000 by investing in S&P 500 i...

How to become a millionaire by investing in the S&P500

Investing in the S&P 500

Don't Invest in the S&P 500. Especially if you're retired. (108-year backtest results)

Charlie Munger: Why Most People Should Invest In S&P 500 Index | Daily Journal 2023 【C:C.M 298】...

$100,000 in S&P 500 ETF VOO (This WILL change your life)

Is The S&P 500 All You Really Need?

Avoid My Mistake | 1 Year Review Investing into the S&P500

Warren Buffett: Why Most People Should Invest In S&P 500 Index | BRK 2008 【C:W.B Ep.409】

SCHD Vs. The S&P 500: It's Not Only About Total Return

Warren Buffett: Why Most People Should Invest In S&P 500 Index

CONFIRMED: Ranking Best S&P 500 Fund to Invest for LIFE

Is the S&P 500 Too Concentrated?

S&P 500 Index Funds for the COMPLETE BEGINNER

Finance Professor Explains: S&P 500 Price Prediction by 2030

Комментарии

0:00:38

0:00:38

0:11:16

0:11:16

0:08:27

0:08:27

0:21:20

0:21:20

0:06:22

0:06:22

0:08:14

0:08:14

0:11:49

0:11:49

0:06:50

0:06:50

0:09:32

0:09:32

0:00:50

0:00:50

0:00:51

0:00:51

0:10:58

0:10:58

0:15:48

0:15:48

0:02:52

0:02:52

0:10:08

0:10:08

0:11:43

0:11:43

0:08:22

0:08:22

0:03:07

0:03:07

0:25:22

0:25:22

0:04:59

0:04:59

0:13:14

0:13:14

0:16:57

0:16:57

0:12:58

0:12:58

0:08:51

0:08:51