filmov

tv

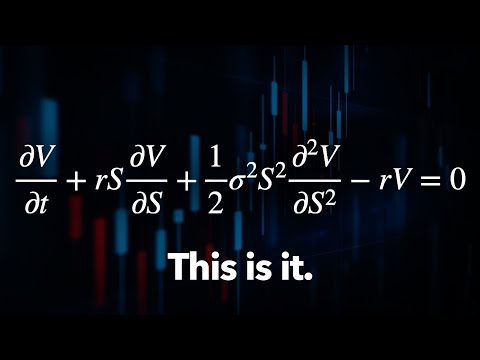

Black Scholes Formula I

Показать описание

Introduction to the Black-Scholes formula | Finance & Capital Markets | Khan Academy

19. Black-Scholes Formula, Risk-neutral Valuation

Black Scholes Formula explained simply

Black Scholes Explained - A Mathematical Breakdown

Warren Buffett: Black-Scholes Formula Is Total Nonsense

Black Scholes Formula I

Black Scholes Option Pricing Model Explained In Excel

The Trillion Dollar Equation

The Easiest Way to Derive the Black-Scholes Model

The Black-Scholes Model EXPLAINED

An intuitive explanation the Black Scholes' formula

Mastering the Black-Scholes Model: Essential Knowledge for Options Traders

Did you ever use the Black-Scholes model, aka the Black-Scholes-Merton (BSM) model? #shorts

Is the Black Scholes Actually Used in the Real World

Charlie Munger on Black–Scholes

How to interpret N(d1) and N(d2) in Black Scholes Merton (FRM T4-12)

La formule qui a radicalement transformé la finance mondiale [Black-Scholes]

Pricing Options using Black Scholes Merton

Black Scholes Formel | Was ist das Black Scholes Modell? | einfach erklärt

Black-Scholes Model

Black Scholes Model | Was ist die Black Scholes Formel? (Ausführlich) | einfach erklärt

How the Black-Scholes Options Pricing Model 💲🎯 Works

Black Scholes Model INTUITIVELY Explained for Option Traders

How to Trade with the Black-Scholes Model

Комментарии

0:10:24

0:10:24

0:49:52

0:49:52

0:03:40

0:03:40

0:14:03

0:14:03

0:15:54

0:15:54

0:32:33

0:32:33

0:09:23

0:09:23

0:31:22

0:31:22

0:09:53

0:09:53

0:10:40

0:10:40

0:05:48

0:05:48

0:00:59

0:00:59

0:00:34

0:00:34

0:08:29

0:08:29

0:00:39

0:00:39

0:14:12

0:14:12

0:26:08

0:26:08

0:20:59

0:20:59

0:06:37

0:06:37

0:00:10

0:00:10

0:13:41

0:13:41

0:04:55

0:04:55

0:09:44

0:09:44

0:16:49

0:16:49