filmov

tv

A Beginner's Guide to Long-Term Care (LTC) Insurance

Показать описание

If you end up needing skilled nursing care, assisted living, or in-home assistance later in life, the cost can be tremendous. Here's why you may want to look in to LTC insurance to lower your risk.

Please subscribe to my channel to keep up with all of my investing and personal finance content and join this channel to get access to perks:

A portion of this video is sponsored by The Motley Fool.

Please subscribe to my channel to keep up with all of my investing and personal finance content and join this channel to get access to perks:

A portion of this video is sponsored by The Motley Fool.

How I Pick My Stocks: Investing For Beginners

Stock Market for Beginners | Step by Step Guide (2024)

Bond Investing 101--A Beginner's Guide to Bonds

The Difference Between Trading and Investing

How To Invest in ETFs | Ultimate Guide

Bonds 101 (DETAILED EXPLANATION FOR BEGINNERS)

The Only Technical Analysis Video You Will Ever Need... (Full Course: Beginner To Advanced)

Project Zomboid And Preparing For The Long Term! Project Zomboid Tips For Long Survival Times!

My BIGGEST Project EVER, with NO TIME LEFT! | Beginners Guide | E24 | Satisfactory Update 8

Best 3 Mutual Funds to Start Investing as Beginner | Investing in Mutual Funds for Beginners

Beginner's Guide to the Gym | DO's and DON'Ts

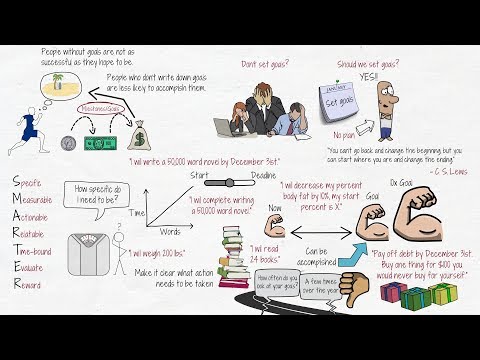

A Complete Guide to Goal Setting

Long Term Investment VS Short Term Investment | Real Estate Guide for Beginners

BEGINNERS GUIDE TO HEALTHY EATING | 15 healthy eating tips

Short Term vs Long Term Investing Explained - A Beginners Guide to Investing | Capital Gains Taxes

Top ETF for Long Term Investment in 2024 | Best ETF: A Beginner's Guide

11 Beginner Run Tips | How To Start Running!

Best Beginner Camera - 2024 - What you need to know

Beginners Guide to Video Editing (Start to Finish)

Options Trading Explained - COMPLETE BEGINNERS GUIDE (Part 1)

🤑Mutual Funds for BEGINNERS 🤑How to EARN MONEY using Mutual Funds

The ONLY Candlestick Pattern Guide You'll EVER NEED

Don’t Starve Together Beginner’s Guide: Things I Wish I Knew When Starting Out

Wild Camping For Beginners | A Real Life Walk-through

Комментарии

0:13:33

0:13:33

0:24:04

0:24:04

0:45:01

0:45:01

0:10:29

0:10:29

0:26:27

0:26:27

0:12:26

0:12:26

1:17:35

1:17:35

0:13:33

0:13:33

0:50:13

0:50:13

0:09:50

0:09:50

0:11:25

0:11:25

0:06:12

0:06:12

0:09:19

0:09:19

0:18:25

0:18:25

0:13:48

0:13:48

0:12:26

0:12:26

0:06:30

0:06:30

0:21:07

0:21:07

0:10:43

0:10:43

0:13:24

0:13:24

0:07:30

0:07:30

0:11:45

0:11:45

0:09:02

0:09:02

0:07:44

0:07:44