filmov

tv

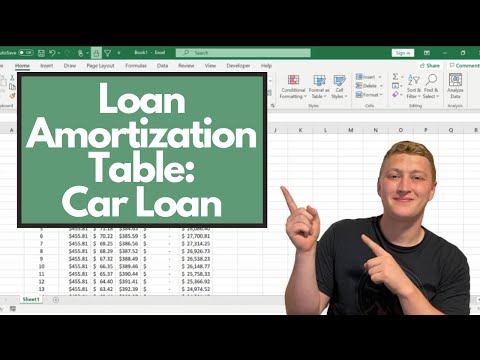

The Easiest Loan Amortization Schedule With Extra Payments

Показать описание

In this video I provide a clear guide on how to create a loan amortization schedule in Google Sheets and Microsoft Excel. This can be useful to break down each installment on a mortgage, a car loan, a student loan, or even a personal loan - any loan as long as it has a fixed term and interest rate. We can then make smarter financial decisions by structuring our loan better, and making strategic lump sum repayments to pay it off quicker, and, pay less interest. The overall interest paid will reduce in the case you reduce the loan term, increase the installments per term (more compounding), and making additional repayments.

The loan schedule I create has a few columns, namely the loan balance, the installment amount, the P&I (principal and interest) split of each installment, and the option to add additional payments.

// SOCIAL

🌏 Follow Me On Instagram @brentcolemaninvesting

// USEFUL LINKS

// TIMESTAMPS

► 0:00 Intro

► 0:38 Create the schedule

► 6:36 Add the extra payment

► 8:43 Adapt the model to accept different variables

► 9:35 Outro

Disclaimer:

I am not a financial adviser. This video is for education and entertainment purposes only. Seek professional help before making any investment decision.

Song: Skylines - Anno Domini Beats

YouTube Studio Copyright Free Music

The loan schedule I create has a few columns, namely the loan balance, the installment amount, the P&I (principal and interest) split of each installment, and the option to add additional payments.

// SOCIAL

🌏 Follow Me On Instagram @brentcolemaninvesting

// USEFUL LINKS

// TIMESTAMPS

► 0:00 Intro

► 0:38 Create the schedule

► 6:36 Add the extra payment

► 8:43 Adapt the model to accept different variables

► 9:35 Outro

Disclaimer:

I am not a financial adviser. This video is for education and entertainment purposes only. Seek professional help before making any investment decision.

Song: Skylines - Anno Domini Beats

YouTube Studio Copyright Free Music

Комментарии

0:10:00

0:10:00

0:11:01

0:11:01

0:03:12

0:03:12

0:05:47

0:05:47

0:09:29

0:09:29

0:05:19

0:05:19

0:03:35

0:03:35

0:09:12

0:09:12

0:07:33

0:07:33

0:12:28

0:12:28

0:07:14

0:07:14

0:08:15

0:08:15

0:01:00

0:01:00

0:07:22

0:07:22

0:13:52

0:13:52

0:21:56

0:21:56

0:05:22

0:05:22

0:14:36

0:14:36

0:07:47

0:07:47

0:06:00

0:06:00

0:22:11

0:22:11

0:22:20

0:22:20

0:05:45

0:05:45

0:14:27

0:14:27