filmov

tv

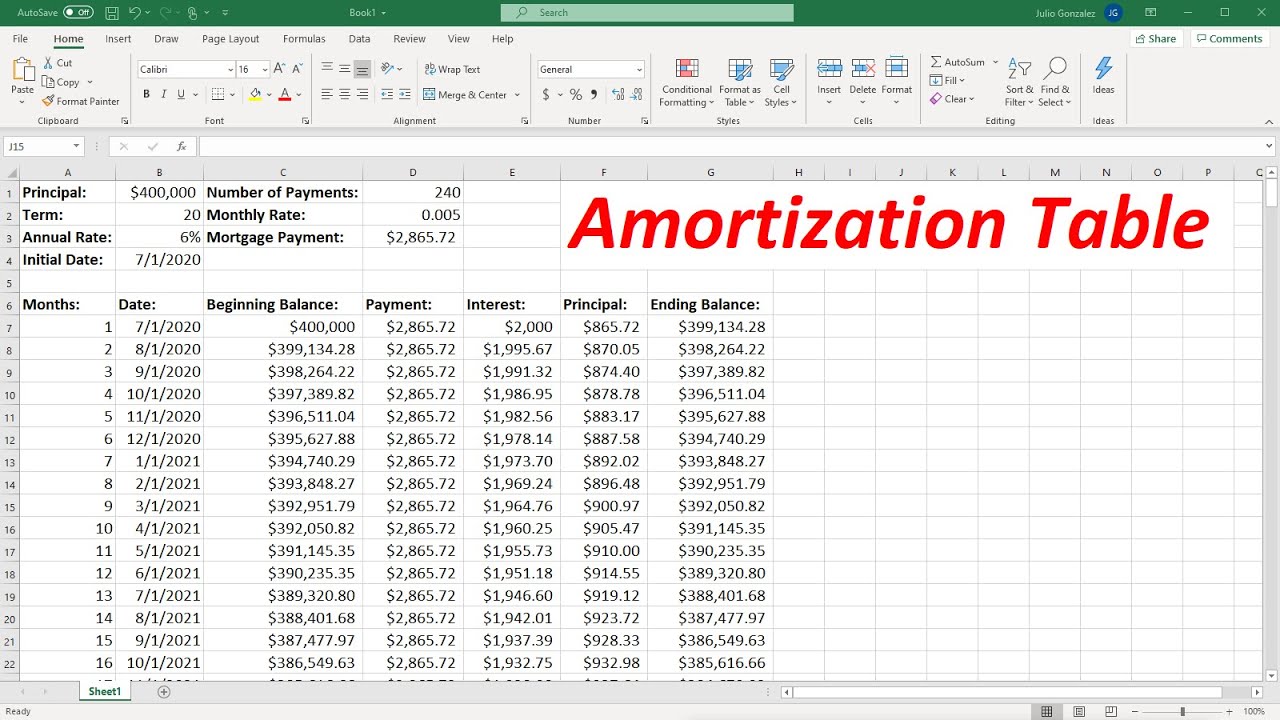

How To Create an Amortization Table In Excel

Показать описание

This finance video tutorial explains how to create an amortization table in excel. This schedule shows the beginning balance, monthly payment, monthly interest, and ending balance of a mortgage with a specified principal, loan term, and annual interest rate.

Excel Tutorial For Beginners:

Top 30 Excel Tips & Shortcuts:

_________________________________________

How To Calculate The Total Hours Worked:

How To Make a Time-Sheet In Excel:

How To Calculate Loan Payments In Excel:

How To Create an Amortization Table:

Excel - Business Account Ledger:

______________________________________

Relative & Absolute Cell References:

Lock Cells and Protect Sheets In Excel:

Excel Interactive Checklist:

Excel Pivot Tables:

______________________________________

YouTube Channel Growth Accelerator:

Algebra For Beginners:

Final Exams and Video Playlists:

Full-Length Math & Science Videos:

Excel Tutorial For Beginners:

Top 30 Excel Tips & Shortcuts:

_________________________________________

How To Calculate The Total Hours Worked:

How To Make a Time-Sheet In Excel:

How To Calculate Loan Payments In Excel:

How To Create an Amortization Table:

Excel - Business Account Ledger:

______________________________________

Relative & Absolute Cell References:

Lock Cells and Protect Sheets In Excel:

Excel Interactive Checklist:

Excel Pivot Tables:

______________________________________

YouTube Channel Growth Accelerator:

Algebra For Beginners:

Final Exams and Video Playlists:

Full-Length Math & Science Videos:

Комментарии

0:11:01

0:11:01

0:05:47

0:05:47

0:02:34

0:02:34

0:07:14

0:07:14

0:09:12

0:09:12

0:09:29

0:09:29

0:08:08

0:08:08

0:04:46

0:04:46

0:05:19

0:05:19

0:13:27

0:13:27

0:05:58

0:05:58

0:06:00

0:06:00

0:03:12

0:03:12

0:12:28

0:12:28

0:05:46

0:05:46

0:25:18

0:25:18

0:05:23

0:05:23

0:09:27

0:09:27

0:09:17

0:09:17

0:09:57

0:09:57

0:04:06

0:04:06

0:08:07

0:08:07

0:10:42

0:10:42

0:03:35

0:03:35