filmov

tv

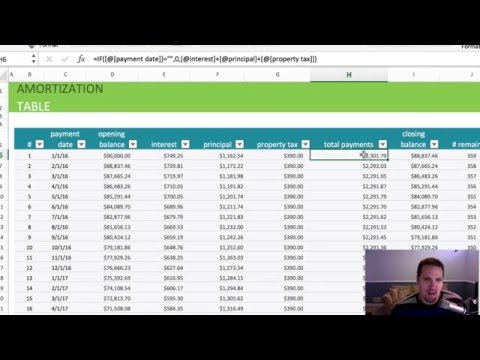

Loan amortization schedule in MS Excel | Effective Interest rate | Transaction cost | IFRS | PMT

Показать описание

Want to calculate house finance installment amount based on annuity? Got confused about the effective interest rate concept? Learn the easiest way to make the loan repayment schedules.

Also if you work at company that follows IFRS, I have included journal entries.

Download the Excel file here:

For small leasing business with multiple customers:

#IFRS #Amortization #Transactioncost # Loan #ICAP #ICAI #ICAEW #FINANCE

Also if you work at company that follows IFRS, I have included journal entries.

Download the Excel file here:

For small leasing business with multiple customers:

#IFRS #Amortization #Transactioncost # Loan #ICAP #ICAI #ICAEW #FINANCE

How To Create an Amortization Table In Excel

Loan amortization schedule in MS Excel | Effective Interest rate | Transaction cost | IFRS | PMT

How to make a Loan Amortization Table with Extra Payments in Excel

Basic 30 Year Mortgage Early Payoff Analysis - [Microsoft Excel Amortization Template] Included -

How to Create a Loan Amortization Table in Excel

Create automatic loan amortization schedule table with PMT, IPMT, PPMT formulas in Microsoft Excel

How To Make a Loan Amortization Table for a Car Loan

Modelling loan amortization schedule in Excel spreadsheet

ADVANCED EXCEL

Very Simple Amortization Table in Excel

Mortgages - Calculate monthly payment & Construct a loan amortization table on MS Excel

Loan Amortization Schedule with additional payments | For Excel Microsoft 365

Loan Amortization Schedule in Excel

How to Make Loan Amortization Table in Excel

How to Create a Loan Amortization Schedule in Google Sheets/ MS Excel

How to create a loan amortization table in Excel - Microsoft Excel Tutorial

Automate Loan Amortization Schedule

LOAN AMORTIZATION USING MICROSOFT ACCESS | Nhior IT Solutions

Microsoft Access Loan Amortization Template 2.0 - Introduction for New Users. Welcome!

Using Microsoft Excel as a Loan Amortization Calculator

Loan Amortization Calculator (Installed Excel Template)

Building a Mortgage Calculator in Excel with Amortization Table

How to Build a Loan Amortization Table in MS Excel

Loan Amortization Schedule | with Variable (Changing) Interest Rate | Excel

Комментарии

0:11:01

0:11:01

0:05:45

0:05:45

0:09:29

0:09:29

0:08:57

0:08:57

0:05:47

0:05:47

0:13:27

0:13:27

0:09:12

0:09:12

0:13:12

0:13:12

0:48:23

0:48:23

0:03:12

0:03:12

0:07:02

0:07:02

0:02:32

0:02:32

0:07:22

0:07:22

0:06:06

0:06:06

0:12:38

0:12:38

0:17:03

0:17:03

0:20:13

0:20:13

0:03:29

0:03:29

0:12:29

0:12:29

0:07:18

0:07:18

0:05:22

0:05:22

0:25:18

0:25:18

0:11:13

0:11:13

0:14:36

0:14:36