filmov

tv

Mortgage Calculator: A Simple Tutorial (template included)!

Показать описание

💸 Who knew a 1.5% change in interest rates can result in an additional US$ 100,000 of interest payments?

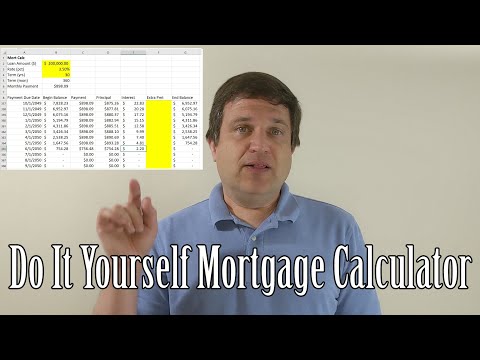

In this video I go through a step-by-step tutorial on how to calculate your monthly mortgage payments given 3 things: the initial amount you borrowed, the interest rate you agreed to, and the loan repayment period

By playing around with the numbers, you will be able to clearly see how each factor affects the total interest you pay back the bank (or to whoever loaned you the principal)

TIMESTAMPS

00:00 How to Calculate Monthly Payments

00:33 Intro to Mortgage Calculator Template

00:58 Monthly Payment for Fixed-Rate Loan

02:33 Calculate Monthly Interest Payments

04:55 Double Check Your Calculations

05:49 How Interest Rate affects Total Interest

06:17 How Extra Payments affect Total Interest

07:05 Pro Tips for this Mortgage Calculator

RESOURCES I MENTION IN THE VIDEO

MY FAVORITE GEAR

MY FAVORITE SOFTWARE

BE MY FRIEND:

👨🏻💻 WHO AM I:

I'm Jeff, a tech professional trying to figure life out. What I do end up figuring out, I share!

PS: Some of the links in this description are affiliate links I get a kickback from and my opinions are my own and may not reflect that of my employer 😇

#mortgage #adulting #amortization

Комментарии

0:07:47

0:07:47

0:05:10

0:05:10

0:03:47

0:03:47

0:01:10

0:01:10

0:07:17

0:07:17

0:05:30

0:05:30

0:12:39

0:12:39

0:04:27

0:04:27

0:01:04

0:01:04

0:01:26

0:01:26

0:03:14

0:03:14

0:35:09

0:35:09

0:15:10

0:15:10

0:10:46

0:10:46

0:25:18

0:25:18

0:18:07

0:18:07

0:11:01

0:11:01

0:04:06

0:04:06

0:00:47

0:00:47

0:01:00

0:01:00

0:00:59

0:00:59

0:12:00

0:12:00

0:15:35

0:15:35

0:13:32

0:13:32