filmov

tv

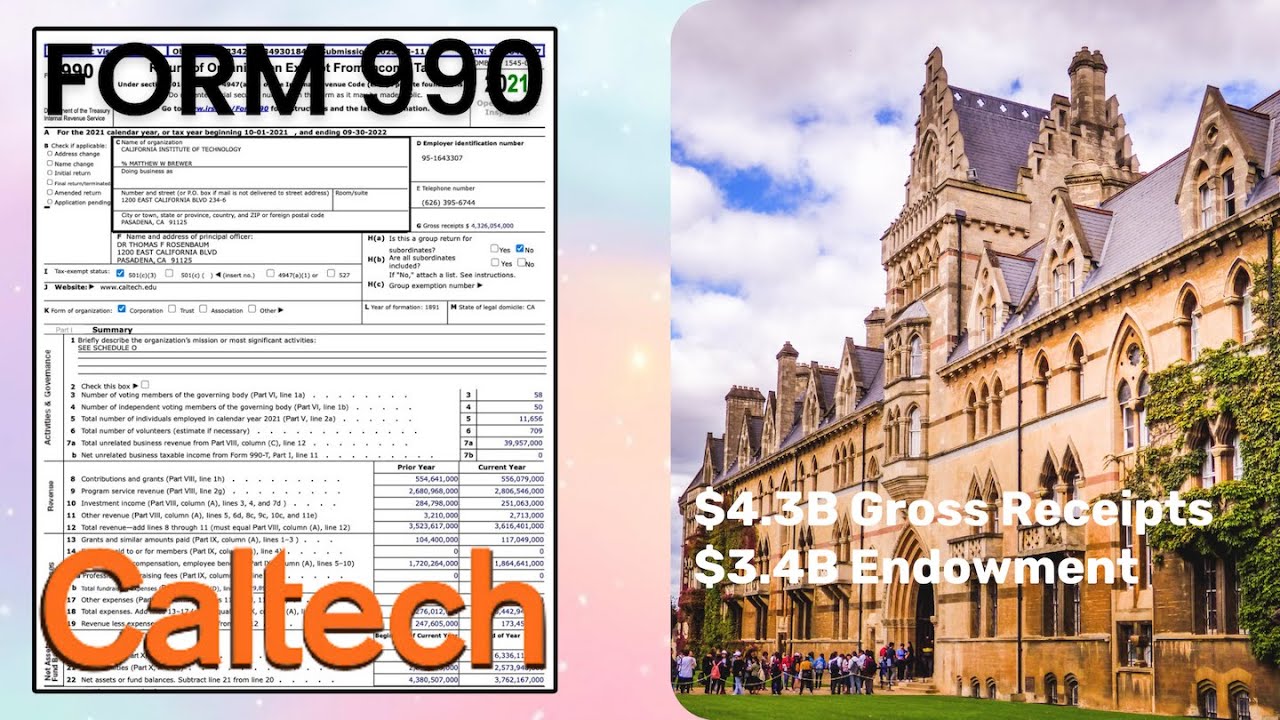

How to Read & Understand Form 990 || CalTech Example

Показать описание

We we go over the Form 990 Informational Return for Exempt Organization, with California Institute of Technology as an Example. Form 990 Tutorial & Walk-Through.

——Chapters——

00:00 - What is Form 990

01:15 - Gross Receipts for CalTech

01:42 - Form 990 Part I Summary

03:04 - Schedule O for Form 990

04:29 - Form 990-T Unrelated Business Income

05:50 - Revenue on Form 990

06:30 - Expenses on Form 990

06:48 - Compensation for Non-Profits

07:19 - Fundraising for Non-Profits

09:21 - Net Revenue for CalTech

09:45 - Net Assets for CalTech

11:46 - Contributors on Form 990

12:00 - Endowment for CalTech

Sources:

Required Filings:

How to Read Forms 990s

List of Schedules:

Exempt Organizations Forms & Instructions

Intangible Assets for Educational Institutions:

——————————DISCLOSURE———————————

The information presented in this video is for informational and educational purposes only. It is not intended to render tax advice for any specific situation. Those needing assistance with a specific situation should consult with a qualified Tax Professional.

The information in this video is based on current tax law and IRS regulations as of date of publication and is subject to change.

#akistepinska #taxguide101

——Chapters——

00:00 - What is Form 990

01:15 - Gross Receipts for CalTech

01:42 - Form 990 Part I Summary

03:04 - Schedule O for Form 990

04:29 - Form 990-T Unrelated Business Income

05:50 - Revenue on Form 990

06:30 - Expenses on Form 990

06:48 - Compensation for Non-Profits

07:19 - Fundraising for Non-Profits

09:21 - Net Revenue for CalTech

09:45 - Net Assets for CalTech

11:46 - Contributors on Form 990

12:00 - Endowment for CalTech

Sources:

Required Filings:

How to Read Forms 990s

List of Schedules:

Exempt Organizations Forms & Instructions

Intangible Assets for Educational Institutions:

——————————DISCLOSURE———————————

The information presented in this video is for informational and educational purposes only. It is not intended to render tax advice for any specific situation. Those needing assistance with a specific situation should consult with a qualified Tax Professional.

The information in this video is based on current tax law and IRS regulations as of date of publication and is subject to change.

#akistepinska #taxguide101

0:13:00

0:13:00

0:11:54

0:11:54

0:00:27

0:00:27

0:02:21

0:02:21

0:00:34

0:00:34

0:00:27

0:00:27

0:00:34

0:00:34

0:15:16

0:15:16

0:00:05

0:00:05

0:03:34

0:03:34

0:05:32

0:05:32

0:00:17

0:00:17

0:05:32

0:05:32

0:00:25

0:00:25

0:06:51

0:06:51

0:00:38

0:00:38

0:06:39

0:06:39

0:10:50

0:10:50

0:05:10

0:05:10

0:23:20

0:23:20

0:10:05

0:10:05

0:07:47

0:07:47

0:06:09

0:06:09

0:08:17

0:08:17