filmov

tv

Value-at-Risk Explained

Показать описание

The 2008 financial crisis showed banks that a liquidity crisis could have catastrophic results, possibly resulting in the bank’s failure. Not surprisingly, banks now take great interest in assessing liquidity risk. One way to measure liquidity risk is value-at-risk (VaR).

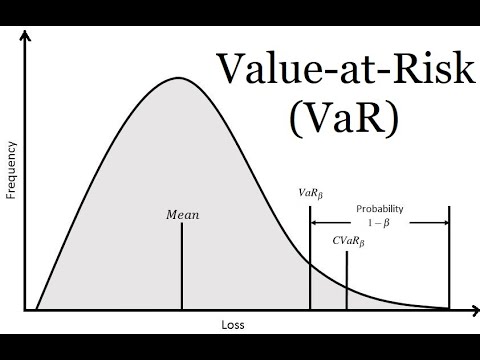

VaR measures the maximum potential loss in the value of a financial instrument over a period of time (called the “VaR time horizon”) for a certain confidence level.

For example, let’s say a bank paid $940 for a corporate bond with a face value of $1,000. The value of this bond will fluctuate on a daily basis as interest rates change.

But what if you want to know the maximum loss the bank could expect to have on the bond in the next 6 months, with a 90% confidence level?

Let’s say you perform an analysis and find that the VaR for the next 6 months at a 90% confidence level is $200. This means the maximum expected loss is $200 in the next 6 months, but there is a 10% chance that the maximum loss will turn out to be higher than $200.

You can estimate the VaR using historical returns or Monte Carlo simulation.

We can apply the same concepts behind VaR to examine the effects of risk factors, such as changes in interest rates or currency exchange rates, on the bank’s economic value of equity (EVE) and net interest income (NII).

• Equity-at-risk is the maximum decrease in the bank’s EVE for a given time period and confidence interval

• Earnings-at-risk is the maximum decrease in the bank’s NII for a given time period and confidence interval

—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

VaR measures the maximum potential loss in the value of a financial instrument over a period of time (called the “VaR time horizon”) for a certain confidence level.

For example, let’s say a bank paid $940 for a corporate bond with a face value of $1,000. The value of this bond will fluctuate on a daily basis as interest rates change.

But what if you want to know the maximum loss the bank could expect to have on the bond in the next 6 months, with a 90% confidence level?

Let’s say you perform an analysis and find that the VaR for the next 6 months at a 90% confidence level is $200. This means the maximum expected loss is $200 in the next 6 months, but there is a 10% chance that the maximum loss will turn out to be higher than $200.

You can estimate the VaR using historical returns or Monte Carlo simulation.

We can apply the same concepts behind VaR to examine the effects of risk factors, such as changes in interest rates or currency exchange rates, on the bank’s economic value of equity (EVE) and net interest income (NII).

• Equity-at-risk is the maximum decrease in the bank’s EVE for a given time period and confidence interval

• Earnings-at-risk is the maximum decrease in the bank’s NII for a given time period and confidence interval

—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

Комментарии

0:05:09

0:05:09

0:06:30

0:06:30

0:06:54

0:06:54

0:05:55

0:05:55

0:03:06

0:03:06

0:14:53

0:14:53

0:12:53

0:12:53

0:06:25

0:06:25

0:25:14

0:25:14

1:21:15

1:21:15

0:11:52

0:11:52

0:48:01

0:48:01

0:23:42

0:23:42

0:09:36

0:09:36

0:04:41

0:04:41

0:05:01

0:05:01

0:07:23

0:07:23

0:13:00

0:13:00

0:22:59

0:22:59

0:11:55

0:11:55

0:17:03

0:17:03

0:25:57

0:25:57

0:01:31

0:01:31

0:09:02

0:09:02