filmov

tv

Calculating VAR and CVAR in Excel in Under 9 Minutes

Показать описание

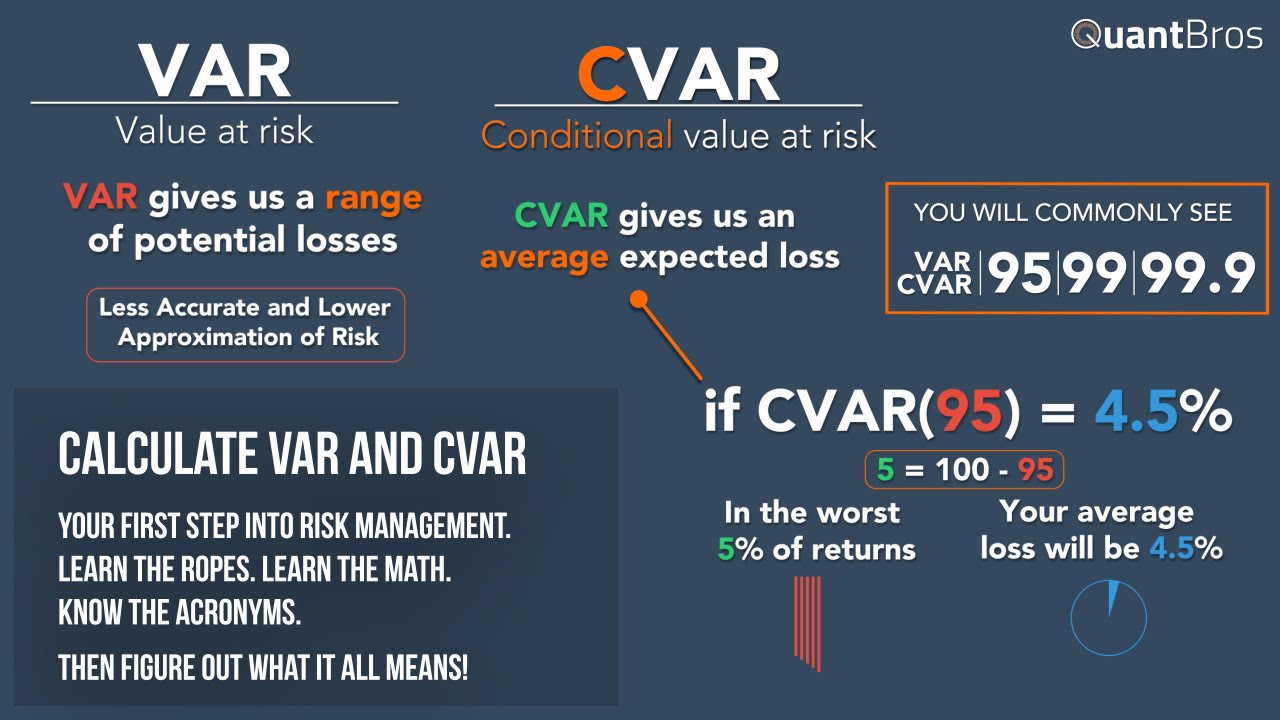

Learn how to calculate VAR and CVAR in Excel. We'll also teach you the difference between VAR and CVAR.

Not enough for you? Want to learn more R? Our friends over at DataCamp will whip you into shape real quick if you need help:

Or if you're more of a Python guy, we have an intro to finance for Python course live on DataCamp right now:

Not enough for you? Want to learn more R? Our friends over at DataCamp will whip you into shape real quick if you need help:

Or if you're more of a Python guy, we have an intro to finance for Python course live on DataCamp right now:

Calculating VAR and CVAR in Excel in Under 9 Minutes

Expected Shortfall & Conditional Value at Risk (CVaR) Explained

Value at Risk Explained in 5 Minutes

Value at Risk (VaR) Explained!

Historical Value-at-Risk (VaR) and Conditional VaR (CVaR) in Excel

Conditional Value-at-Risk (Expected shortfall) - measuring expected extreme loss (Excel) (SUB)

Parametric VaR and CVaR (Gaussian/Normal Distribution) in Excel

Monte Carlo Simulation with value at risk (VaR) and conditional value at risk (CVaR) in Python

1000% Back Test Return On a Trading Bot ... Should I Quit My Job?

VaR (Value at Risk) and CVaR (Conditional Value at Risk) Explained in Graphics

Historical VAR Calculation in Excel | FRM & CFA Preparation

Parametric VaR and CVaR with Python

Monte Carlo Method: Value at Risk (VaR) In Excel

Conditional Value at Risk (CVaR) Portfolio Optimization

Cornish-Fisher VaR and CVaR in Excel

Value at Risk (VaR) Explained in 5 minutes

How do you calculate value at risk? Two ways of calculating VaR

What Is Conditional Value at Risk (CVaR)?

Historical Method: Value at Risk (VaR) In Excel

Value at Risk (VAR) | Risk Management | CA Final SFM

VaR for a multi-asset portfolio using variance covariance matrix

Portfolio & Single Stock VAR and CVAR in R

Conditional Value at Risk and Stress Testing in Financial Risk Management

What is Value at Risk? VaR and Risk Management

Комментарии

0:09:02

0:09:02

0:11:52

0:11:52

0:05:09

0:05:09

0:14:53

0:14:53

0:11:04

0:11:04

0:09:36

0:09:36

0:05:03

0:05:03

0:10:26

0:10:26

0:18:37

0:18:37

0:07:54

0:07:54

0:13:09

0:13:09

0:15:04

0:15:04

0:10:13

0:10:13

0:05:38

0:05:38

0:08:11

0:08:11

0:05:55

0:05:55

0:08:43

0:08:43

0:02:26

0:02:26

0:05:01

0:05:01

0:12:53

0:12:53

0:08:09

0:08:09

0:25:36

0:25:36

0:06:43

0:06:43

0:06:25

0:06:25