filmov

tv

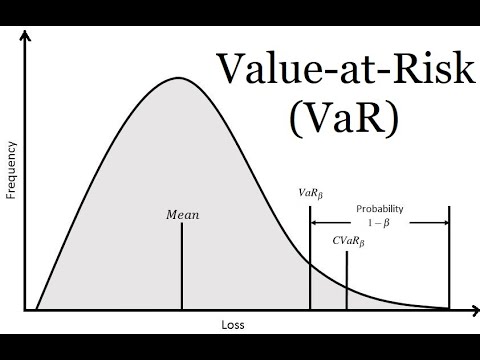

All About Value at Risk(VaR) | FRM Part 1 2023| Historical Simulation, Delta Normal, Monte Carlo VaR

Показать описание

Hello candidates,

Welcome in All About Value at Risk(VaR) | FRM Part 1 2023| Historical Simulation, Delta Normal, Monte Carlo VaR.

In this video we are talking about all about value at risk which is important in FRM Part 1, 2023 curriculum. FRM is a difficult exam and here in this video, we will taking one concept of FRM Part 1 Exam, which is Value at Risk (VaR).

We have talked about the limitations and interpretations of value at risk. We are also talking about the historical simulation method. Delta normal method, and Monte Carlo approach to calculate the value at risk.

Please make sure to watch our other videos as well, and subscribe to our YouTube channel if you haven't subscribed yet.

Join our telegram channel as well.

Welcome in All About Value at Risk(VaR) | FRM Part 1 2023| Historical Simulation, Delta Normal, Monte Carlo VaR.

In this video we are talking about all about value at risk which is important in FRM Part 1, 2023 curriculum. FRM is a difficult exam and here in this video, we will taking one concept of FRM Part 1 Exam, which is Value at Risk (VaR).

We have talked about the limitations and interpretations of value at risk. We are also talking about the historical simulation method. Delta normal method, and Monte Carlo approach to calculate the value at risk.

Please make sure to watch our other videos as well, and subscribe to our YouTube channel if you haven't subscribed yet.

Join our telegram channel as well.

Value at Risk Explained in 5 Minutes

7. Value At Risk (VAR) Models

Value at Risk (VaR) Explained in 5 minutes

Value at Risk (VaR) Explained: A Comprehensive Overview

Value at Risk (VaR) Explained!

Value-at-Risk Explained

VaR (Value at Risk), explained

What is Value at Risk? VaR and Risk Management

How to Calculate Value at Risk VaR for an Investment Using Python

What is VaR (Value at Risk)? #frm #frmexam #VaR

Value at Risk (VaR): Monte Carlo Method Explained

Historical Method: Value at Risk (VaR) In Excel

Value at Risk (VAR) | Risk Management | CA Final SFM

Value at Risk - VaR (deutsch) - Berechnung und Formel für dein BWL-Studium

All About Value at Risk(VaR) | FRM Part 1 2023| Historical Simulation, Delta Normal, Monte Carlo VaR

Value at Risk (VaR) Demo

Value at Risk (VaR)

Evaluating Value-at-Risk (VaR)

How to Calculate Value at Risk (VaR) Using Excel || Value at Risk Explained

Value-at-risk (VaR) - variance-covariance and historical simulation methods (Excel) (SUB)

Monte Carlo Method: Value at Risk (VaR) In Excel

Value at Risk (VaR), Explanation and VaR Calculation Methods with Examples

Var - Value at Risk #var #marketrisk #riskmanagement #frm #frtb #creditrisk #ima #basel #finance

Il VaR - Value at Risk

Комментарии

0:05:09

0:05:09

1:21:15

1:21:15

0:05:55

0:05:55

0:09:12

0:09:12

0:14:53

0:14:53

0:03:06

0:03:06

0:06:30

0:06:30

0:06:25

0:06:25

0:25:51

0:25:51

0:00:36

0:00:36

0:02:53

0:02:53

0:05:01

0:05:01

0:12:53

0:12:53

0:06:54

0:06:54

0:23:42

0:23:42

0:03:12

0:03:12

0:41:16

0:41:16

0:03:16

0:03:16

0:09:36

0:09:36

0:22:24

0:22:24

0:10:13

0:10:13

0:17:03

0:17:03

0:00:24

0:00:24

0:02:30

0:02:30