filmov

tv

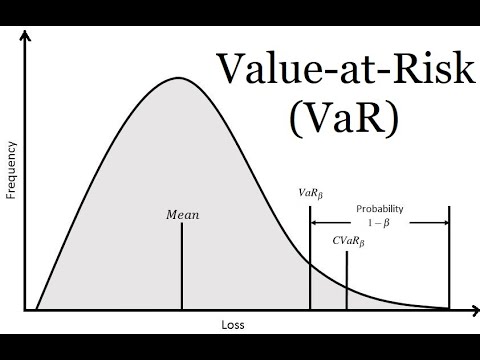

Value at Risk or VaR, a tool to master market risk, explained in clear terms with Excel model.

Показать описание

Value at Risk or VaR is a risk management tool banks use to manage their exposure to market risk. In the video we explain what VaR is and how you can calculate VaR yourself using historical price data. We show how to calculate Value at Risk with the help of a clear Excel example. The example follows the historical method using Yahoo finance data.

Good luck! André Koch

Stachanov Solutions & Services

Excel,Model,VaR,Value at Risk,André Koch,Stachanov,market risk,Basel Accord,Mercursim,Bank capital,stock market,Risk management,Risk analysis,bank capital,Capital buffer;Bank regulation;Basel treaty;Basel accord;regulatory capital, economic capital,ECAP,stock price, historical method, Yahoo, bank regulation,percentile,simulation

Good luck! André Koch

Stachanov Solutions & Services

Excel,Model,VaR,Value at Risk,André Koch,Stachanov,market risk,Basel Accord,Mercursim,Bank capital,stock market,Risk management,Risk analysis,bank capital,Capital buffer;Bank regulation;Basel treaty;Basel accord;regulatory capital, economic capital,ECAP,stock price, historical method, Yahoo, bank regulation,percentile,simulation

Value at Risk Explained in 5 Minutes

7. Value At Risk (VAR) Models

Value at Risk (VaR) Explained in 5 minutes

Value at Risk (VaR) Explained!

VaR (Value at Risk), explained

Value at Risk (VaR) Explained: A Comprehensive Overview

What is Value at Risk? VaR and Risk Management

Value-at-Risk Explained

Log Normal Var - CFA Level 2 and FRM Part 2

How to Calculate Value at Risk (VaR) Using Excel || Value at Risk Explained

Value at Risk - VaR (deutsch) - Berechnung und Formel für dein BWL-Studium

What is VaR (Value at Risk)? #frm #frmexam #VaR

Value-at-risk (VaR) - variance-covariance and historical simulation methods (Excel) (SUB)

How to Calculate Value at Risk (VaR) to Measure Asset and Portfolio Risk

Historical Method: Value at Risk (VaR) In Excel

Paul Wilmott on Quantitative Finance, Chapter 19, Value at Risk (VaR)

Value at Risk (VAR) | Risk Management | CA Final SFM

Value at Risk or VaR, a tool to master market risk, explained in clear terms with Excel model.

Value at Risk (VaR): Historical Method Explained

Termos em Inglês: Gestão de Risco - VAR | Passar na CPA

Evaluating Value-at-Risk (VaR)

Value at Risk (VaR) | Risk Management | Calculation of VaR for an Investor and Portfolio| SFM

Il VaR - Value at Risk

Parametric Method: Value at Risk (VaR) In Excel

Комментарии

0:05:09

0:05:09

1:21:15

1:21:15

0:05:55

0:05:55

0:14:53

0:14:53

0:06:30

0:06:30

0:09:12

0:09:12

0:06:25

0:06:25

0:03:06

0:03:06

0:16:41

0:16:41

0:09:36

0:09:36

0:06:54

0:06:54

0:00:36

0:00:36

0:22:24

0:22:24

0:12:23

0:12:23

0:05:01

0:05:01

0:10:55

0:10:55

0:12:53

0:12:53

0:11:55

0:11:55

0:02:23

0:02:23

0:04:56

0:04:56

0:03:16

0:03:16

0:21:27

0:21:27

0:02:30

0:02:30

0:07:23

0:07:23